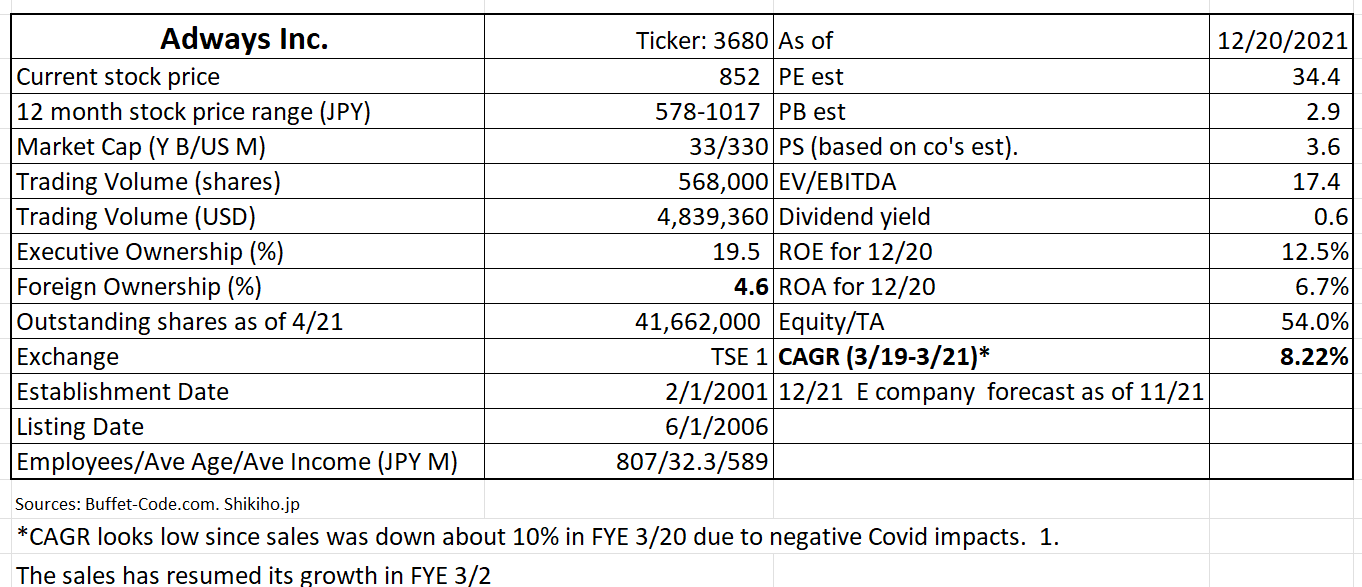

Adways Inc. (Ticker: 2489): Japan’s First Apple Certified Ad Partner.

Adways is an AI driven advertising agency.

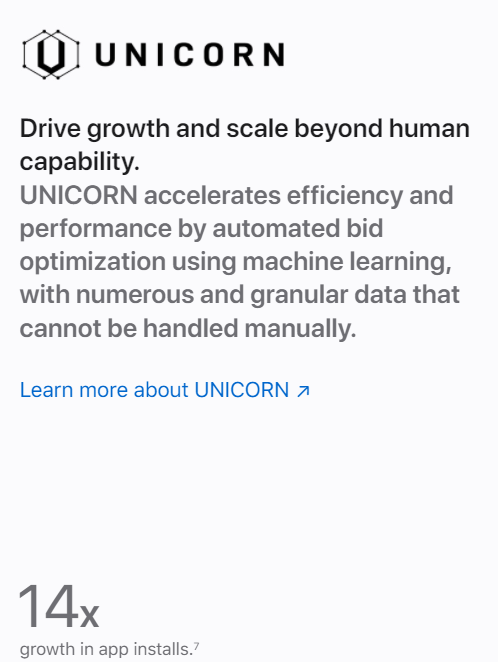

It runs the largest mobile affiliate network* in Japan as well as the largest smartphone app distribution network. The next leg of growth will come from “UNICORN”. UNICORN is Japan’s largest fully automatic marketing platform with monthly purchasable traffic exceeding 600 billion impressions per second. It is the AI which can analyze a huge amount of past distribution data and automate appropriate biddings to optimize the advertisement to achieve the desired results.

*Affiliate marketing is a marketing arrangement in which an online retailer pays commission to an external website for traffic or sales generated from its referrals (per Oxford English Dictionary)

1. Investment thesis

1) UNICORN has become Japan’s First Apple Certified Ad Partner in 9/2021. Only 9 companies, along with UNICORN, have been certified as Apple’s “Campaign Management Partner” in the world.

The below comments are based on Apple’s “Apple Search Ad” page:

Apple Search Ad is an ad space displayed at the top of search results on App Store. Millions of users visit the App Store every day to find and download their next app.

By being 9 of Apple’s Campaign Management Partner, UNICORN’s name is shown in “Partner” tab of Apple’s Apple Search Ad” page. The tag line of this tab is “Save time and improve performance by working with one of our partners”.

Advantages of being Apple Certified Ad Partner (which are listed on Adways’ financial result presentation for 2Q 2021).

======

The Apple Ad Space is the only ad space available in App Store, which all users downloading apps must go through.

The Ad Space directly reaches users who are looking for an app.

The Ad Space can target and measure performance, based on Apple ID (no impact of IDFA/Identifiers For Advertisers).

The Ad Space does act as receptable for various app marketing strategies.

=======

The below is the screen shot of UNICORN introduction page on Apple’s Campain Management Partner site. Growth in app installs is impressively at 14x

Why is UNICORN chosen as a partner?

UNICORN can fully automate Apple Search Ads.

It can automatically acquire keywords of apps and games that are advertising on the App Store from related content. For example, if there are 1,000 keywords, there are about 100,000 patterns that can be created depending on the keywords x age x gender x where or not the app is installed. UNICORN makes value forecasts from this 100,000 pattern and keeps changing bids 24 hours a day, 365 days a year. This is impossible tasks for humans.

The reason why UNICORN can continue high performance is various fraud countermeasures and value prediction every 0.01 seconds derived from more than 100 data labels by machine learning.

UNICORN detects delivery patterns that result in unusual delivery and exclude them from the purchase target and realize distributions only with patterns that have advertising effects. It also eliminates inventory with high mistap rates. For both still images and videos, clicks are measured excluding erroneous clicks, so it is possible to evaluate the essential advertising value. Furthermore, UNICORN uses a unique fraud detection algorithm to automatically determine if an ad space is valuable. It blocks non human access at once, such as bots and crawlers.

ARPU is often higher than organic acquisition. As a result of achieving high-precision and hassle-free advertisement distribution in this way, It is used in about half of the game apps in the top sales ranking of each IOS/Android app store.

2) Business and Capital relationships with Hakuhodo DY Holdings.

“Apps marketing industry” has rapidly grown to $25.9 Bn in 2020 from $16 Bn in 2016, according to Japanese Ministry of Finance (as reported in the company’s website). This rapid growth is driven by the marketers’ needs to diversify their contact points with consumers who are expanding their purchase information sources.

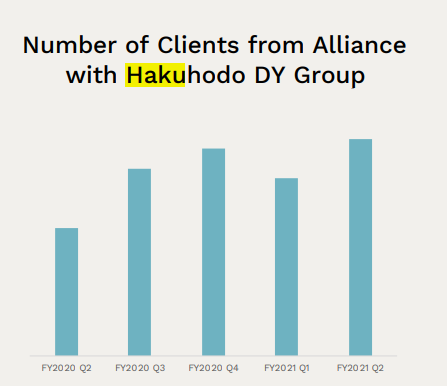

To take advantage of this supportive industry backdrop, the company has teamed up with Hakuhodo DY Group in 11/2019. Hakuhodo DY is a 100 % owned subsidiary of Hakuhodo. Founded in 1895, Hakuhodo is a global top 10 integrated ad agency. It had a huge network with 150 offices in 20 countries. The relationship with Hakuhodo is both financial and operational. Hakuhodo has increased its ownership of Adways to 15.42% this year (through its subsidiaries).

On an operational front, the relationship with Hakuhodo has exposed the company to the large client base which was not otherwise accessible to Adways. The below chart does not have Y axis legend but shows that Hakuhodo related clients are steadily increasing.

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

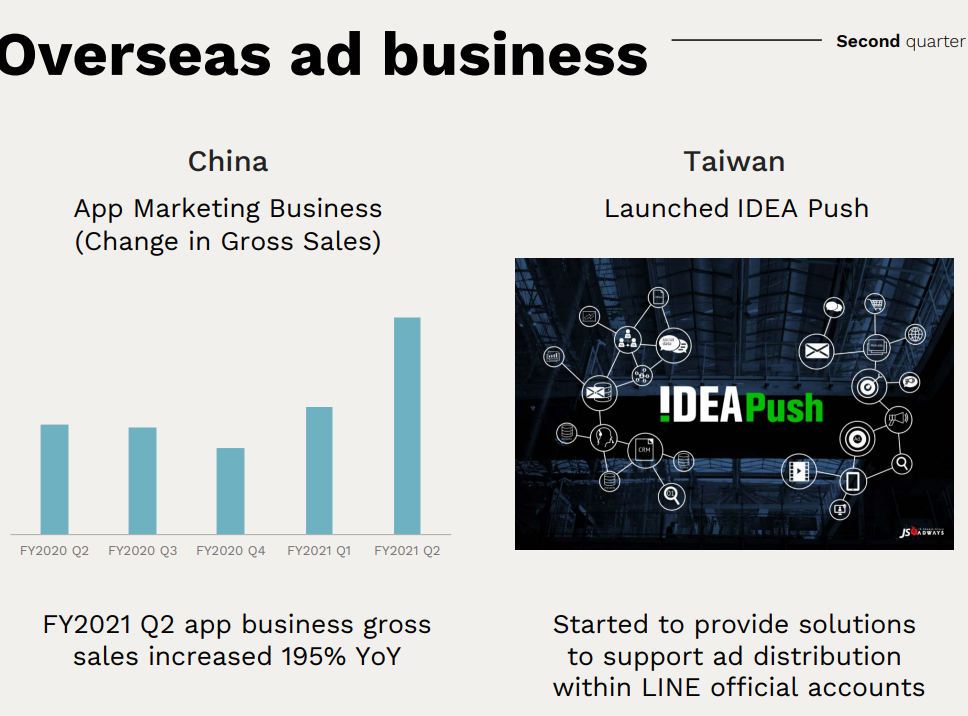

3) Overseas Expansion

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

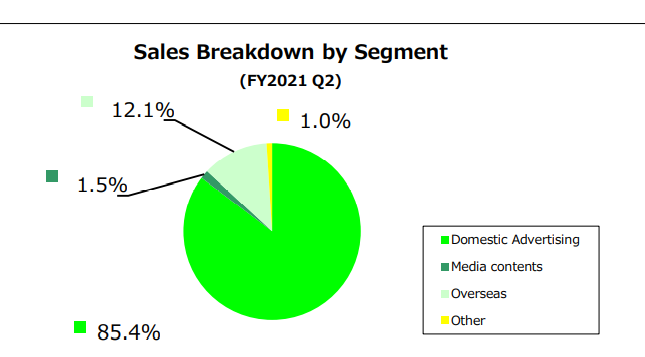

Overseas operations which are still small (12% of total Q2/2021 sales) grew as Chinese clients expanded aggressively overseas. App advertising (IDEAPush) in Taiwan increased as well.

4) Steady growth in sales and profits in the first half of 2021.

As discussed in Financial Highlights section, sales and all the profit lines grew close to 20% in 1H (half) of 2021 vs. 1H of 2020.

2. Technically Speaking

With the stock markets on an Omicron-induced downward trend, Adways has also come down but seems to have bounced back from the immediate support level of JPY 846. The next critical level is JPY 940, which is the volume cluster. When the stock pushes through this level, the upside move will come with less selling pressure.

(Source: buffet-code.com)

3. Who is Adways?

Adways (Adways or the “company”) started in 2001 as an affiliate advertisement agency* mainly for feature phones. The advertising business for PCs is conducted under the brand name of “JANet” (Japan Affiliate Network). Entered China in 2007, and had been expanding business in Southeast Asia, with focus on China, Taiwan and South Korea. The company was first listed in Mothers section in 2006 and upgraded to TSE 1st in 2020.

4. Business Model

(Source: company’s website)

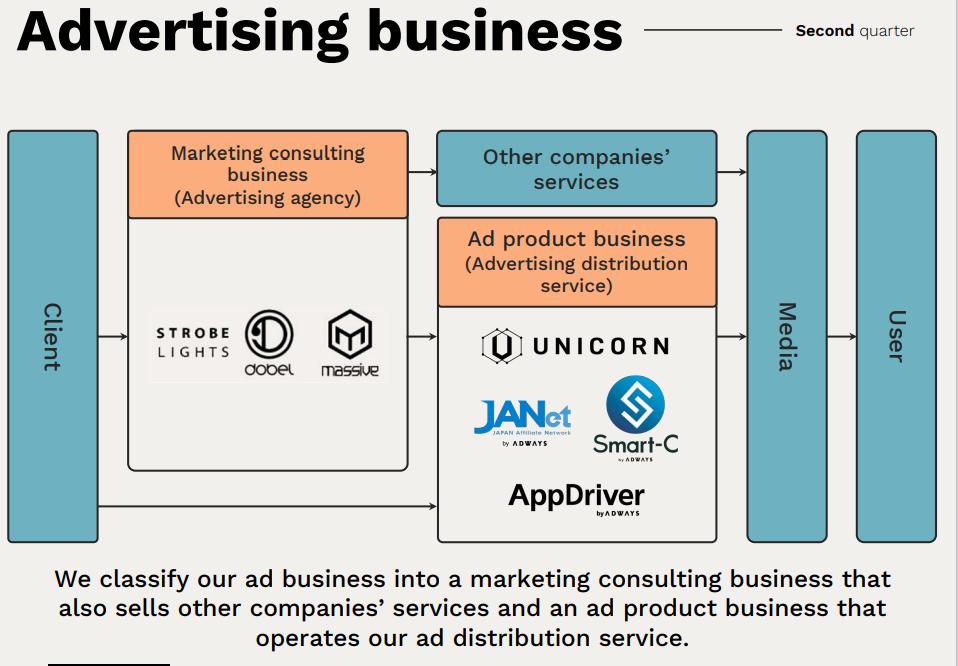

Domestic advertising segment operates advertising business for both PC and Smartphones. Smartphones include UNICORN. This group comprises of two sub groups: marketing consulting (ad agency) and ad distribution businesses.

Media content segment is the portable web media supports, run by Samurai Adways for professionals.

Other segment includes the company’s new initiatives.

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

1. Marketing Consulting Business (Ad Agency)

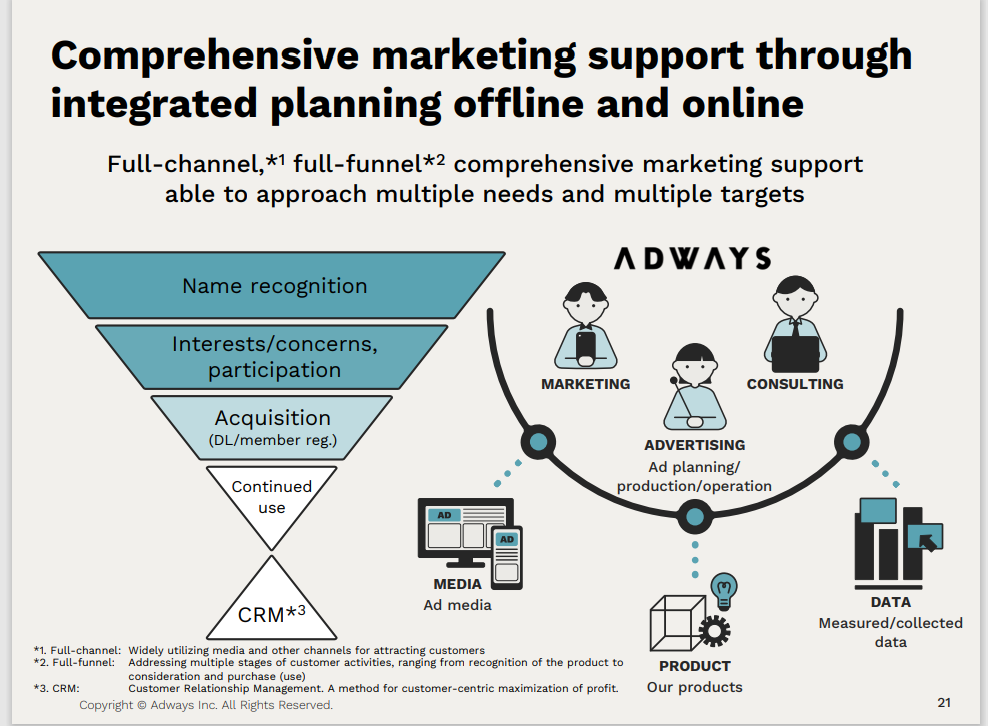

The below diagram highlights strengths of Adways:

1) The company can help the clients in wide range of media platforms (full channel). Adways can maximize ad effect by analyzing main mega-platforms’ algorithms to optimize operations.

2) It can help the clients in all stages of consumer buying behavior (from product recognition to the purchase decision)

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

Hakuhodo related operations are reported in this segment.

2. Ad product business (ad distribution service of Adways).

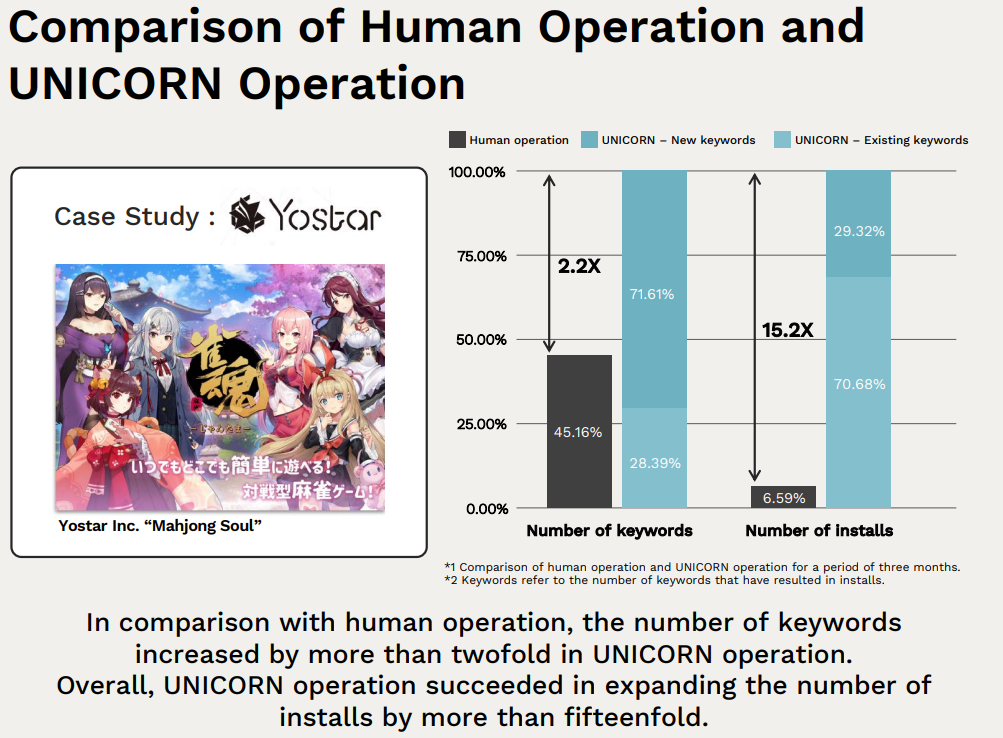

The below diagram explains that UNICORN, through its fully automated operations and optimization, can expand the number of app installs by more than 15-fold

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

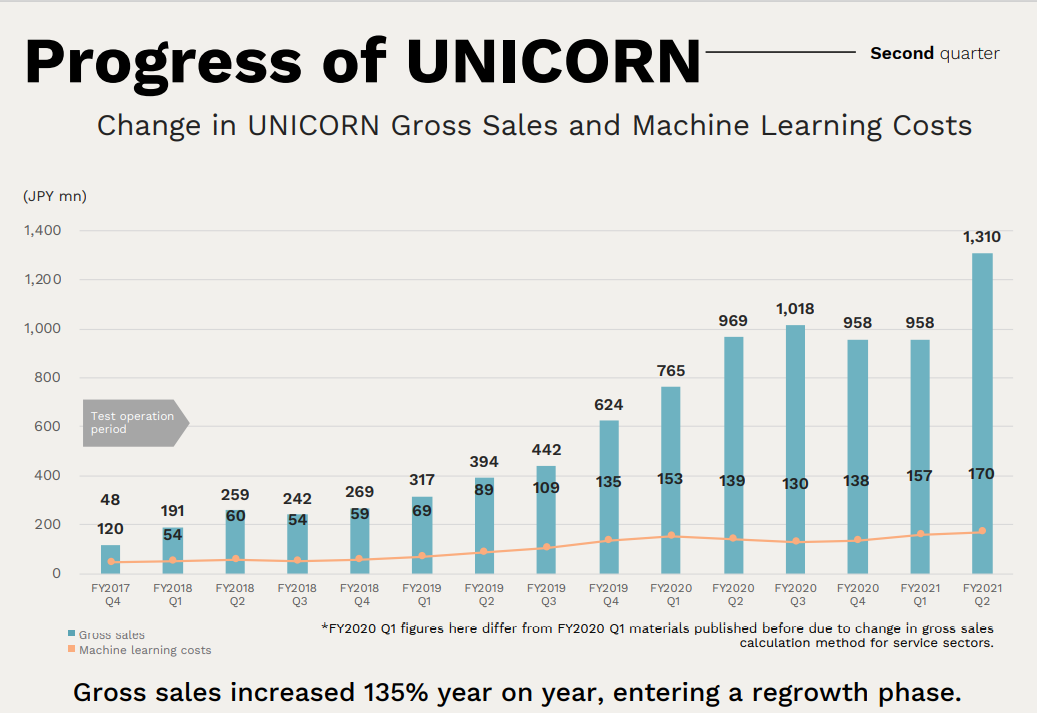

Supported by high success rate, UNICORN sales grew 135% in Q2/21 vs. Q2/20

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

5. Financial Highlights

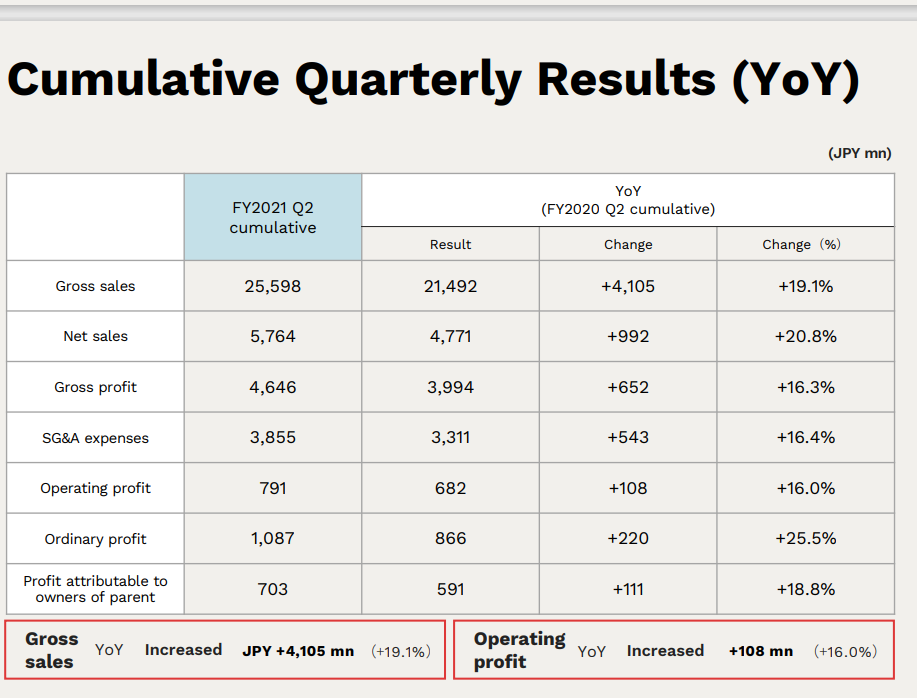

Both transaction and sales amounts of the first 6 month of 2021 increased 20% year over year, thanks to

1) market recognition and adoption of UNICORN improved, leading to higher sales of domestic smartphone ad business,

2) Domestic game app producers increased their ad budgets in association with their major game title launches,

3) Chinese segment enjoyed steady growth supported by Chinese game application creators aggressively expanded overseas,

4) Digital marketing (mainly in LINE platform) in Taiwan solidly increased.

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

Note: Gross sales amounts above indicate the transaction amounts.

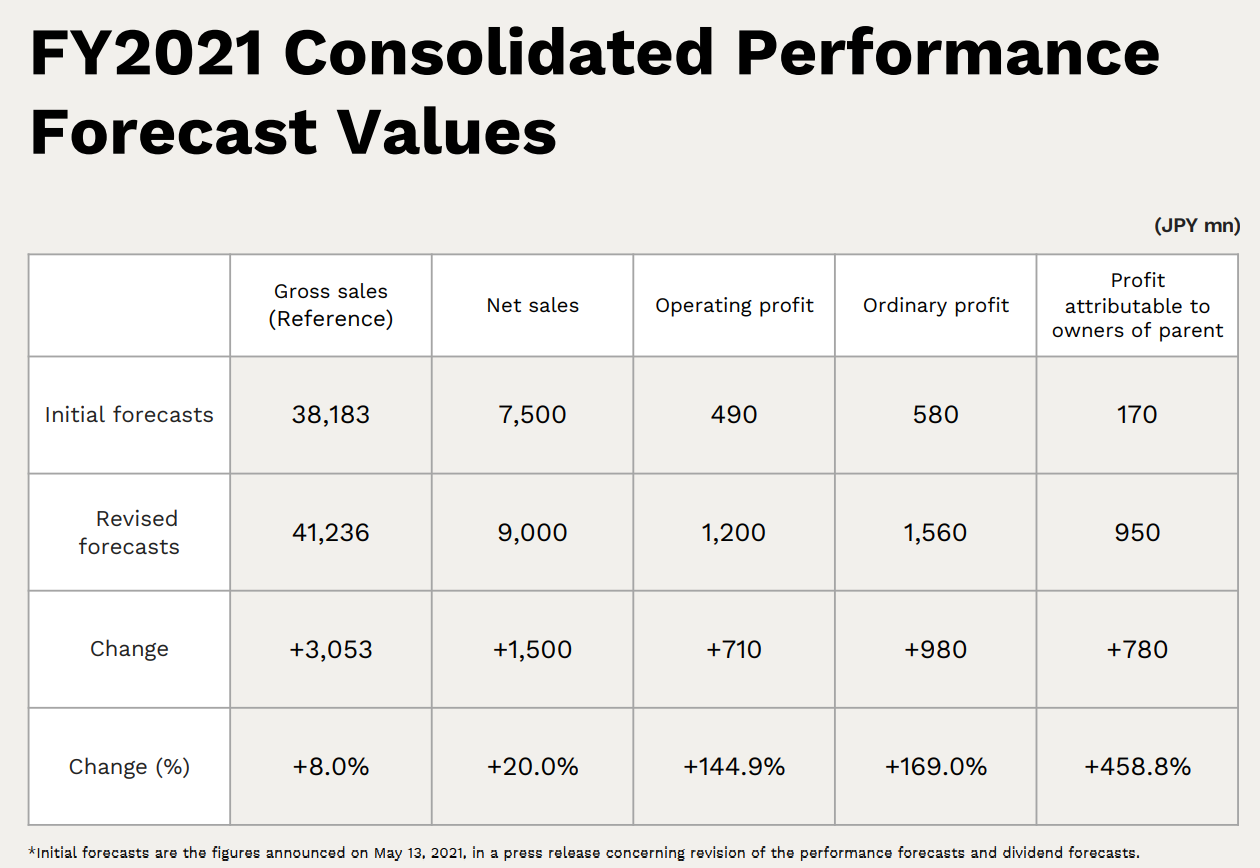

To reflect the strong 1H 21 showings, the company upward-revised their full year guidance for 2021 by 20% for sales and 140% for operating profits.

(Source: Presentation Material for financial results of Q2 of FYE 12/21)

6. TAM (Total accessible markets)

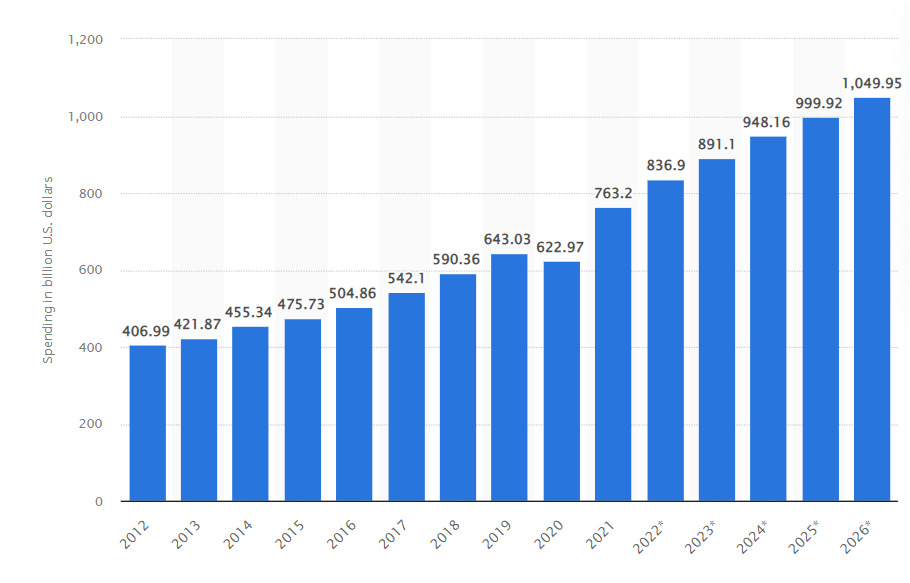

(Source: Global advertising revenue 2012-2026, published by Statisca on 12/7/21)

Statisca estimates that media owners and revenue worldwide fell to $622 Bn in 2022, representing a decline of about 3.1% due to the negative impact of Covid. However, in 2021, the figures grew by 22.5%. North America is expected to remain the largest regional market, followed by Asia Pacific and Western Europe.

In 2022, internet ad spend will grow by 13.5% and outdoor and cinema advertising are projected to also experience a significant growth in 2022. However, magazines and newspapers will both see negative growth.

Adways should be able to benefit from the growth of digital advertisement markets.

7. Strengths and Weaknesses

Strengths

1. Industry Tailwinds

As we just witnessed in the preceding section, the business environment surrounding the company is very favorable with 2021-2026 growth of 38% to $1,050 Bn.

2. Competition well controlled

There are many peers in AI/machine learning segments which can take shares away from Adways. However, at this point, the company, equipped with UNCORN, has upper hand over its competitors, evidenced by its status as one of 9 Apple’s Certified Ad Partner.

Weaknesses:

Entry of New Technology/AI

It is possible that a competing AI will make UNICORN obsolute. Thus, the Company is continuously investing in improvement of its AI capabilities.

8. Near-term Selling Pressure

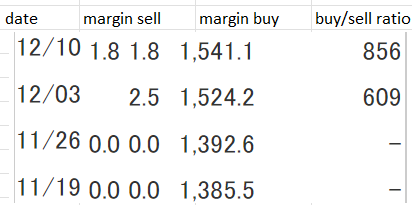

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Adways, outstanding margin sell volume is almost non-existent. Many margin buy holders are willing to hold the stock till their 6 month holding period even after the stock has come under the pressure. These investors will sell the shares as soon as their holdings general small gain. Therefore, we can assume that some near-term selling pressure exists at this point. We will need to watch the volume at which the stock will absorb margin buy volume.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance