The Tokyo Stock Exchange (the “TSE”) on 3/31/23 urged companies with low price-to-book (PB) ratios to start focusing on using capital more efficiently and to increase their PB ratios to be higher than 1. Low than 1 PB ratio indicates that investors’ view that a company is worth less than its book value, which is to say, in an extreme term, that a company and its assets are worth more liquidated than being a public company.

Note: You may be thinking that low capital efficiency and low PB ratios are not quite the same concept. However, I am using these terms interchangeably, since improvement of both concepts require management’s focus on overall internal operations, i.e, on increasing profitability by using capital more efficiently.

According to Nikkei Asia article, “Tokyo bourse tells Toyota, Softbank and others to lift capital efficiency”, issued on 4/1/23:

The TSE, stepping up its push to better attract overseas investment (not for the first time), told the roughly 3,300 companies listed on the Prime and Standard segments to pay more attention to capital costs and stock prices.

Those with P/B ratios below 1 should publish detailed plans “as soon as possible” toward lifting their stock prices and continue updating the plans at least once a year, the exchange said.

I was aware that many Japanese companies are trading at below 1 PB ratio, however, it was shocking to learn that Toyota, which arguably symbolizes Japanese “monozukuri (manufacturing excellence)” culture, is one of 1,800 companies.

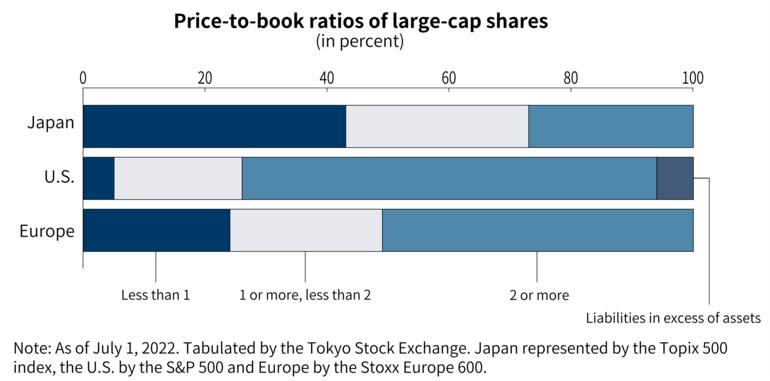

How low are PB ratios actually?

(Source: Nikkei Asia)

The above chart highlights that more than 40% of Japanese blue chips have ratios below 1, compared with around 20% in Europe and less than 10% in the U.S. This is a result of many years in which Japan has struggled to appeal to foreign investors.

There are many reasons why global investment manager are underweight Japan, reflecting their view that Japanese companies are slow growing, less profitable and saddled with poor governance. Furthermore, their balance sheets are bloated with low yielding and less productive assets. However, things are changing and changing for better. According to GMO’s 12/22 dated white paper “Japan Equities: Entrenched Perceptions Ignore Improving Realty”

Over the last decade “operational and profit improvements have led to better fundamental outcomes for shareholders. While the U.S. has increased earnings per share (EPS) by 66% since late 2012, Japan has done even better. Surprisingly to many, Japanese EPS has grown more than 160% since Abe’s re-election in late 2012”

Then why has Japan still being ignored?

Japanese leaders themselves may be responsible for the lack of global interests. They tend to believe that the stock prices are at a mercy of markets and are beyond their control. However, if they can increase investor confidence, by providing transparency and positive news about the company, investors may be willing to pay a higher price for each unit of book value, leading to a higher PB ratio. To this end, I have been and will keep introducing under-the-radar yet steadily growling Japanese companies at LinkedIn and at JapaneseIPO.com.

The TSE’s new warning on capital efficiency intends to encourage companies to better monitor capital costs and returns on capital to achieve sustained growth which will lead to higher share prices.

The exchange estimates that the total market capitalization for its top-tier Prime market will rise to around 850 trillion yen ($6.4 trillion) from the current 700 trillion yen or so if all components achieve a PB ratio of at least 1. That is a 20% price appreciation!

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.