(Note 1: Please make sure to read Note 2 and Note 3 at the end of this report).

2023: A Pivotal Year for Japanese Stock Markets

This year witnessed several notable events that revitalized interest in Japan’s long-neglected equity markets:

- Focus on Capital Efficiency: On March 31st, the Tokyo Stock Exchange took a rare step, urging companies trading below book value to disclose long-term plans for improving capital efficiency. This move aimed to encourage better use of resources and potentially boost share prices.

- Warren Buffett’s Vote of Confidence: In April, legendary investor Warren Buffett visited Japan for the first time in over a decade. He announced Berkshire Hathaway’s plans to increase investments in the five major Japanese trading houses (Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo). By June, their holdings had already surpassed an average of 8.5%, demonstrating his strong commitment to the market.

- Enhancing Corporate Governance: In a recent update, the Tokyo Stock Exchange began requesting listed companies with subsidiaries or affiliates which are also listed to provide detailed explanations of their corporate governance practices. This push aims to protect minority shareholder rights, attract investors, and prevent conflicts of interest. Over 1,000 companies are expected to comply, fostering greater transparency and accountability.

- Governmental Support: While this may not be as significant as the previous three events, it’s worth noting that Tokyo has initiated a program to support small, publicly traded companies. This program covers the costs associated with publishing communications in English, thereby enhancing the appeal of these Small and Medium-sized Enterprises (SMEs) to non-Japanese investors.

These developments sparked a surge in investor interest, leading to the Nikkei recording its best annual performance since 2013 with a 28% increase this year, the highest return in Asia.

Intrigued by the revitalized Japanese market, you might now ask: are there still potential diamonds in the rough? While discounted, low P/B stocks have seen price increases due to improvement plans, opportunities likely still exist. So, how do we unearth them?

Hacking the Japanese Stock Market:

With 3,935 companies listed on the Tokyo Stock Exchange, spending a week per research would take a grueling 76 years! It’s clear we need some strategic shortcuts. Enter Warren Buffett’s playbook: the Japan Company Handbook.

As Mohnish Pabrai revealed in his insightful YouTube talk (more on his talk later), Buffett relied (on and off) on this resource to discover the five major trading companies he invested in. So, what makes this handbook such a valuable screening tool?

What is the Japan Company Handbook

The Japan Company Handbook (JCH) is a widely-acclaimed quarterly publication, providing comprehensive information on all publicly listed companies in Japan. Here’s a breakdown of its key aspects:

What it is:

- A detailed resource for investors, corporate analysts, business executives, and anyone needing in-depth information on Japanese companies.

- Published by Toyo Keizai, a leading Japanese financial publisher.

- Updated four times a year, offering the latest financial data and company information.

Unique Features:

- Comprehensive coverage: Covers over 3,900 companies listed on all Japanese stock exchanges, including the Tokyo Stock Exchange and local exchanges.

- Detailed information: For each company, you’ll find:

- Brief history and background information

- Financial data including income statements, balance sheets, and cash flow statements

- Performance outlook and analyst estimates

- Stock price charts

- Key business segments and products/services

- Management information and ownership structure

- Contact details and website address

- Original earnings estimates: Toyo Keizai’s analysts provide their own independent earnings forecasts, considered highly accurate by many investors.

- Data accessibility: Available in both print and digital versions, including PDF downloads and database access for corporations and academics.

Page Organization:

- Each company gets a dedicated half page, making it easy to find specific information.

- Information is organized into sections like company profile, financials, business segments, management, and contact details.

- Financial tables are clearly presented with key metrics highlighted.

- Stock price charts provide a visual overview of performance.

My personal take: If you can read Japanese, I recommend using the Japanese version of JCH. Japanese, as a language, allows for conveying more information in a compact space. For instance, the four-letter term ‘増収増益Zoushu Zoeki’ translates to ‘the company achieved a rise in sales and profits.

Additional Resource:

- Official website: https://str.toyokeizai.net/magazine/jch/

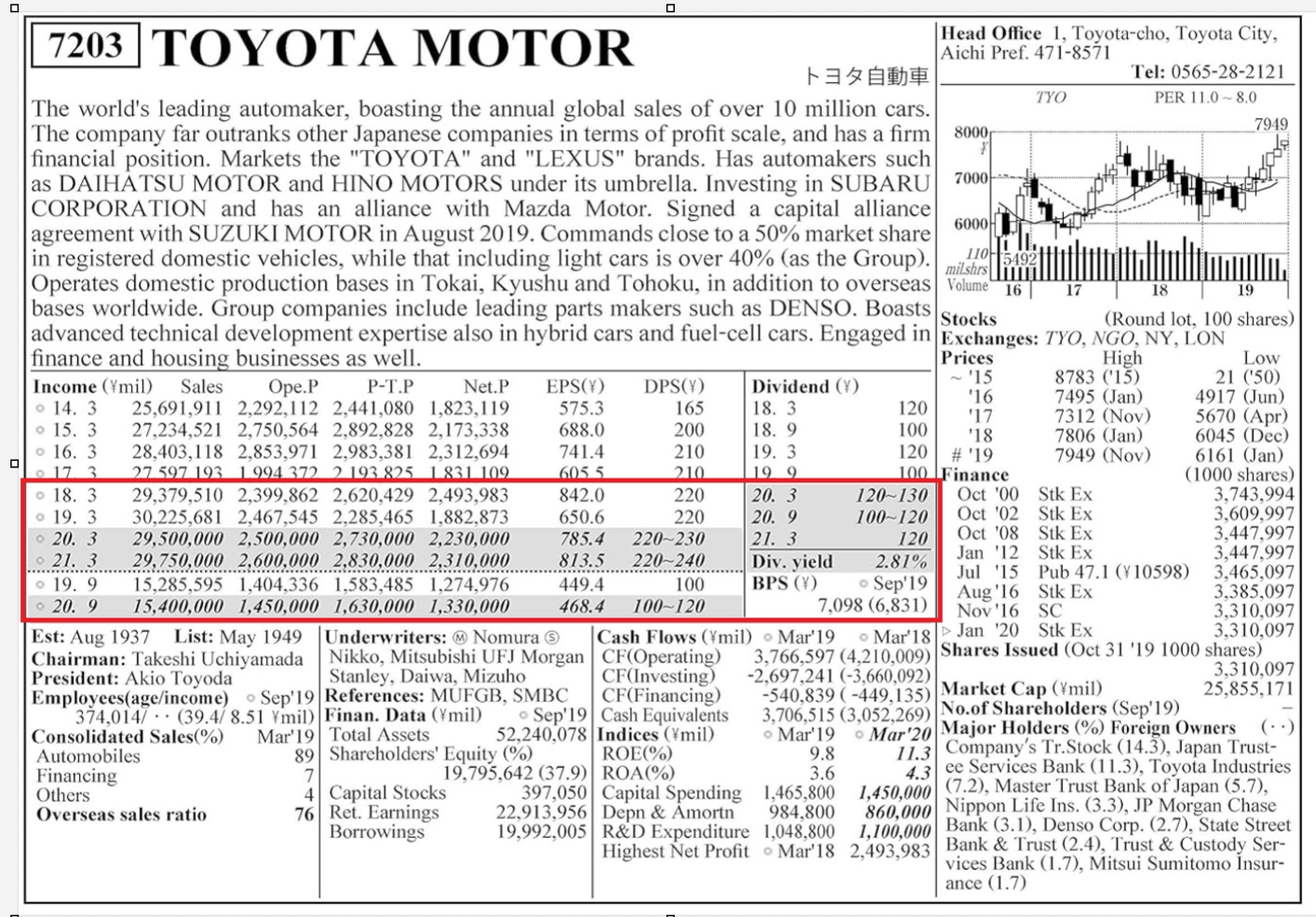

The below is an example page from JCH (Toyota). The aforementioned original estimate of JCH is in the red box. Some short term focused traders only look at this section and compare these numbers with the companies’ guidance. They believe if JCH’s numbers are higher than management’s, there might be a possibility of guidance hike which tends to lead to stock price movements.

(Source: Japan Company Handbook: 2020 Winter)

Example use of JCH 1

For Long term value investors

In the recent YouTube video “Mohnish Pabrai’s Q&A Session at Boston College, Carroll School of Management on 10/12/23” , the esteemed value investor, Mohnish Pabrai has discussed his investment philosophy.

He is recognized for his anomaly investing style, which seeks ‘low risk, high uncertainty’ opportunities, essentially mispriced stocks. One such investment was Stewart Enterprises, which doubled his money. However, discussing this case would divert from the focus on Japan. You can read about his success with Stewart in the linked article.

Source:https://www.morningstar.in/posts/38503/2/mohnish-pabrai-how-to-profit-from-uncertainty.aspx

In one of his lectures, Mohnish Pabrai expressed that he doesn’t find Japan to be an attractive investment destination due to its declining demographics and management’s prioritization of employee welfare over shareholders. However, he continues to read JCH and ‘Value Line’, which could potentially validate the value of JCH.

Mohnish Pabrai is renowned for his admiration of Warren Buffet and Charlie Munger. Berkshire Hathaway’s investment in 5 Japanese trading companies exemplifies the concept of low risk, high uncertainty.”

Buffett and JCH

Did Buffett merely stumble upon the five trading companies by chance? No. Mohnish Pabrai mentioned in the earlier part of the referenced YouTube video that Buffett was reviewing JCH and eventually decided on trading companies, likely after an extended period of his own research and patience.

The stability of the entrenched trading companies, combined with their possession of valuable assets like copper mines and rubber plantations, made them attractive investment prospects. Berkshire Hathaway leveraged its excellent credit rating to secure favorable borrowing terms, a privilege unavailable to other companies*.

(*Berkshire Hathaway borrowed money at an incredibly low interest rate of 0.5% in Japan, and subsequently invested in stocks with a solid 5% dividend yield. This strategic move allowed Berkshire Hathaway to capitalize on a constant flow of cash).

For long term retail investors

In Youtube, there are amazing number of tutorial videos on how to locate 10 baggers using JCH (in Japanese).

One of these videos, hosted by a former Nomura professional, revealed that a historical backtest of past ‘10-baggers’ shared the following common traits:

- 20% annual earnings growth (rough estimate – if earnings double in 4 years).

- Operating profits growth average +10%

- Within 5 years of IPO (the Small Firm Effect)

- High ownership of founders, i.e., quick decision making

While there is no guarantee a stock with the above characteristics will become a future multi-bagger stock, JCH makes it fairly easy to screen for them if you so desire.

Example use of JCH 2

For short term traders

Some fund managers are known to go through JCH three times each quarter.

- First, place post-it notes on the pages of companies with promising financial performance write-ups.

- Then, add post-it notes to companies with rising estimates.

- Finally, place a post-it note on a promising chart (i.e., prior to stock prices taking off).

If the companies receive three post its, they will be automatic buy.

Note 1: I am not affliated with Toyo Keizai which publishs The Japan Company Handbook They don’t’ know my existense.

Note 2: The above examples of using JCH are just that, examples. These approaches do not guarantee future investment returns.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.