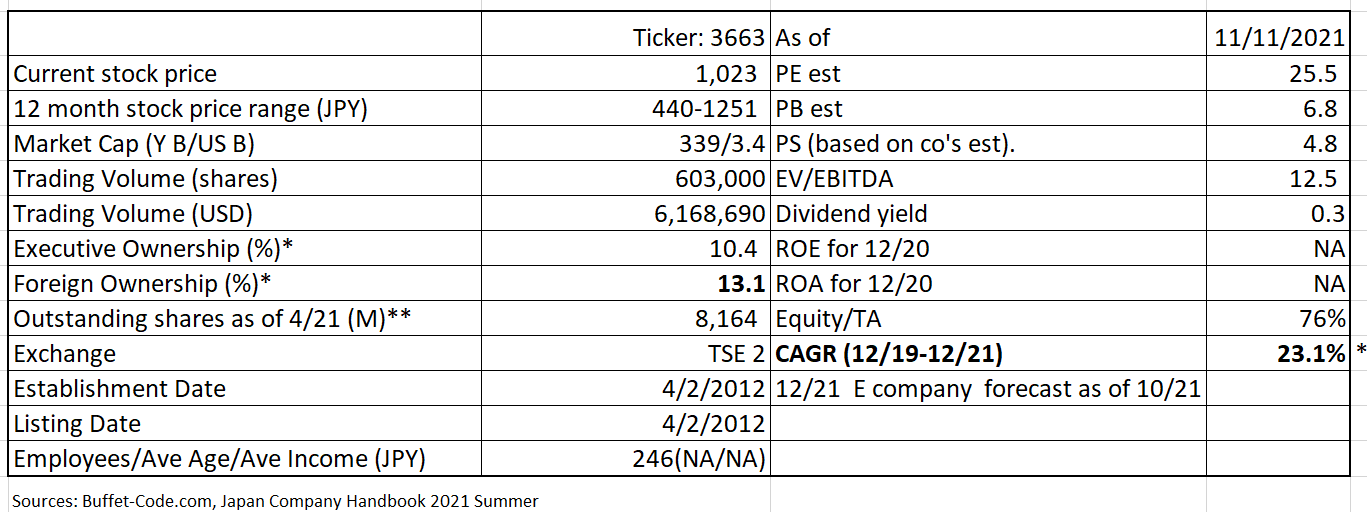

ArtSpark Holdings (Ticker: 3663) – a anime/manga company which is agnostic to a specific title hit!

Warning: I am the first one to admit that the following narrative on ArtSpark may be laced with my emotions which is a serious offense when we are looking for a good stock to buy.

1. Who is ArtSpark?

ArtSpark Holdings (“ArtSpark” or the “Company”) was created in 4/12 via the integration of Celsys, Inc (a developer of software for producing anime and manga) and HI Corp. (a supplier of 3D engines for feature phones and UI/UX custom development).

The current mainline of ArtSpark is Celsys which sells “Clip Studio Paint” – illustration software for manga and anime creation. Celsys differentiates itself by its product which are high quality yet is easy to use. This product superiority roots back to HI’s 3D software and image distribution solutions for feature phones. ArtSpark enjoys a 90%-plus market share in animation creator market (per Shared Research).

ArtSpark acquired Candera of Austria, a competitor in in-vehicle products, in 4/19 and established Candera Japan to strengthen the business and put HI under it. However, HI was sold to Micwave Co., Ltd. In 3/21 since HI’s custom development focus was not in line with ArtSpark’s new focus on its proprietary IP in both Celsys and UI/UX business at Candera.

Furthermore, in Q3/21 earnings release, the company announced that it would absorb the operations of Celsys, Inc. and change its company name from ArtSpark to Celsys as of 4/22. After this reorganization, Candera and Candera Japan will be owned by Celsys, not ArtSpark. We believe this is a good move since Celsys has much wider brand recognition than ArtSpark and it is a growth driver for the entire company.

Business Segments post reorganization:

The company’s business segments are (1) Creator Support (Celsys) and (2) UI/UX operated by Candera and Candera Japan.

2. Why buy ArtSpark?

I got goosebumps when I saw that many Olympians marched on the themes of Iconic video games during the opening ceremony of Summer Olympics 2020/2021. Mind you, I have never played video games but know the names such as “Final Fantasy”, “Dragon Quest” and “Monster Hunter”. This event made me realize that the importance of video games, anime and manga for Japan as an industry and I looked up some related statistics. Anime industry is large and growing. Industry size is discussed in TAM section of this blog.

Which stocks can be beneficiaries of this growth?

Video game stocks are very hard to trade. They tend to gyrate very rapidly along with anticipated release of major titles and the following success or failure of these titles. Investors’ expectations also move up and down based on weekly sale rankings of these games.

Many publishers (e.g. Kadokawa*) are involved with manga books and TV anime series but these stocks are heavily influenced by other factors such as general negative sentiments toward book publishing industry (i.e., a decrease in consumption of paper based media). Toho Anime is a pure play but its low trading volume makes it a hard stock to trade.

*Kadokawa has recently announced their collaboration with Tencent, a Chinese gaming juggernaut. Its access to huge Chinese consumer market should open up wide revenue opportunities for Kadokawa contents Kadokawa is an interesting stock in its own right. I may work on a blog on it.

As discussed later, the global anime market, including TV shows, movies and merchandise, hit $25 Bn in 2019. However, according to 2/24/21 New York Time article, salaries, even of a top animator, is low at $1,400 to $3,800 a month in Japan, even after working nearly every waking hour. In contrast, US animators earn $65,000 on average.

As per the same New York Time article, “studios can get away with the meager pay in part because there is a nearly limitless pool of young people passionate about anime and dreaming of making a name inf the industry”

But the willing young anime creators alone don’t depict a whole picture. The outdated production system designed to send majority of profits to ad hoc coalitions of toy makers, comic book publishers and other companies that are created to finance each project. They typically pay animation studios a set fee and reserve royalties for themselves.

My intent is not to discuss flaws of Japanese anime industry structure. I am hoping for the wider use of a software product such as “Clip Studio Paint” will ease some workloads of anime creators. Also, Clip Studio Paint may encourage illustrators to start their own freelance businesses, thus, being able to negotiate market- driven pays with the distribution companies.

I strongly believe that when anime creators’ pays are determined by the market forces, the health and sustained success of Japanese anime industry will be ensured.

3. Buy ArtSpark Now?

(Source: Trading View)

The above chart shows that the stock has been under pressure. The possible reasons for this underperformance are:

1) Business model change

The company is slowly transitioning into a subscription business model which reduces their company’s earnings initially. Investors may have been disappointed with these initial earnings drop. However, as time passes, the company will enjoy steady monthly cash flow which the company will report as ARR (Annual recurring revenues).

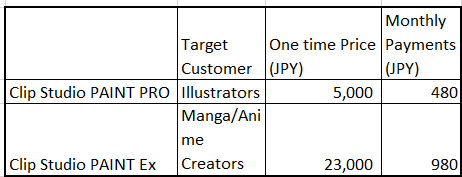

The below is pricing options for the company’s two main products:

(Source: prepared by www.JapaneseIPO.com based on the company report)

2) Guidance miss

For the 9 months/2021, the company’s sales reached 73% of its annual sales goal of JPY 7,077MM. This is a slight miss of 75% the company should reach after 9 months operations of a year. This miss was due to sluggish sales at the company’s second business – Candera. The company believes that the weakness in the automotive industry is transitory and the production will resume its high pace since the underlying consumer demand is strong (which we agree).

3) Strategic importance of Candera – questioned?

The above referenced challenge of Candera in the bullet 2) might have led to investor indigestion.

I myself could not understand synergistical or strategical benefits of having two groups, especially when I didn’t know there was still markets for feature phones. I was so wrong. There are healthy markets for feature phones and their sales accounted for 58% of global cell phone sales in Q2/2019 (per How-To-Geek). Nokia 225 4G seems to be the popular model and equipped with excellent battery life (once a week charging required), 4G voice quality and text receiving ability (limited text composing ability, though). It is easy to use and come with a $50 price tag.

Candera supplies 1) scalable human machine interface (HMI) not reliant on hardware and 2) CGI Studio, GUI (graphical user interface) design software. Technologies to display graphics are used for a wider range of portable internet devices, and the consumer electronics devices such as digital cameras, in-vehicle devices, electronic billboards and store information terminals.

The UI (user interface design) and UX (user experience design) concept is key. Candera’s UI/UX business provides comprehensive solutions for development and implementation by combining user interface (connecting users to devices and software), with user experience (pleasure, ease of use and other experience from devices and software). Since function-centered design has been dominant in Japan, human-centered design has not yet taken root. However, the need for user-friendly operations is likely to increase as functions increase.

In short, there is a market for Candera’s products.

4) Near term selling pressure.

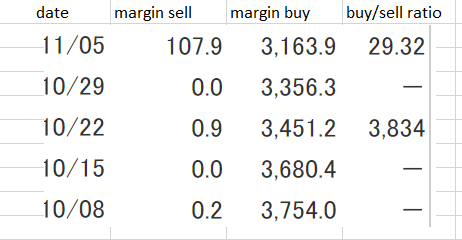

As noted in useful tips section in my www. JapaneseIPO.com blog, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For ArtSpark, as the below table indicates that there is large numbers of margin buy volume. Buy to sell ratio is high at 29.32x. 11/5 remaining margin buy volume is also high, compared to typical daily trading volume of 500,000 – 1MM. However, it is slowly coming down, i.e., buyers are slowing absorbing sellers who need to sell their margin buy positions before 6 month holding period expires. No need to rush to buying, but this stock is worth watching.

Margin trading (unit: 1000)

(Source: Kabutan)

Technically, the stock is at JPY 1000, a bit below last summer high, which can function as a support level.

Note: Shared Research publishes a detailed research report on ArtSpark in English (I feel that I am their promoter, although they don’t pay me a dime). Thus, I will focus on what Shared Research has not discussed which is a potential market size that ArtSpark can expand into.

(Source: the web site of Clip Studio Paint – the brand run by Celsys, Inc.)

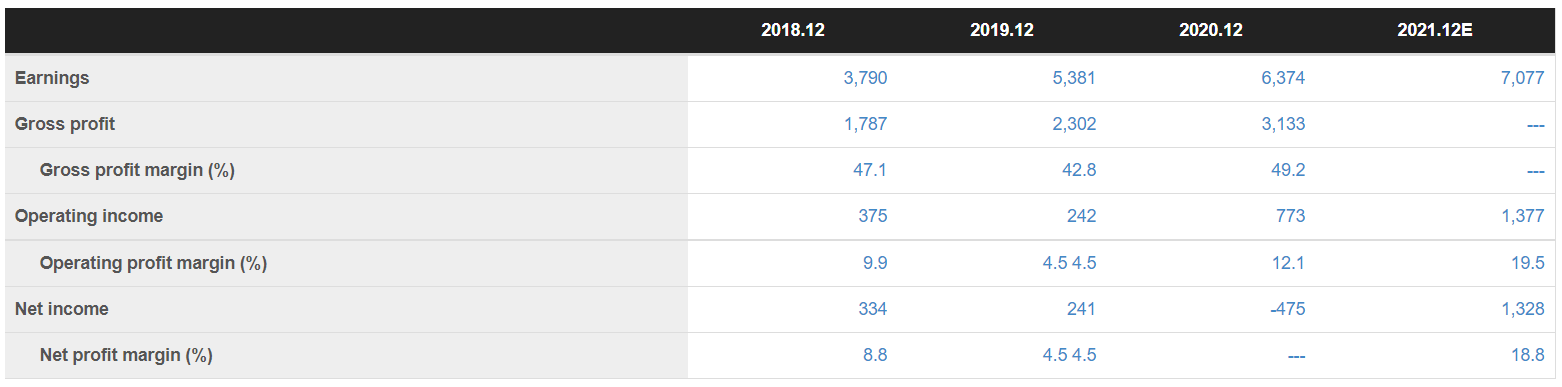

4. Financial Highlights

(Source: Buffet-Code.com)

(Source: ArtSpark Holdings Site)

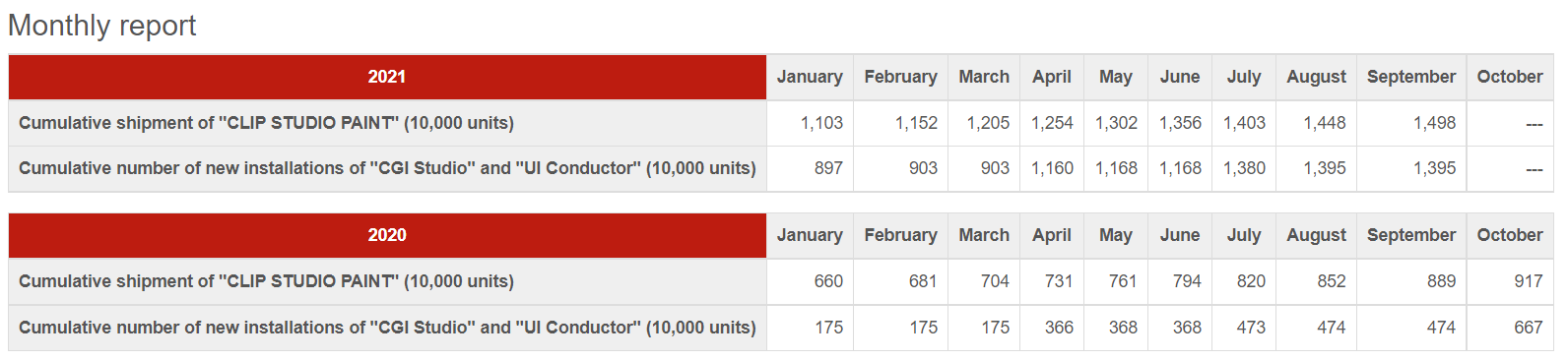

October numbers were just released as below:

Clip Studio Paint: Global shipment (cumulative) continued to be strong and exceeded 1,546,000

CQI Studio and UI conductors (cumulative numbers of newly installed) 1,598,000.

The company reported that, the install rate for automobiles for CQI and UI conductors continues to stall due to sustained shortage of semiconductors.

5. TAM (Total addressable Markets)

I couldn’t obtain the company’s total market estimate, thus, the below is from my own google search.

Animation/manga markets in Japan:

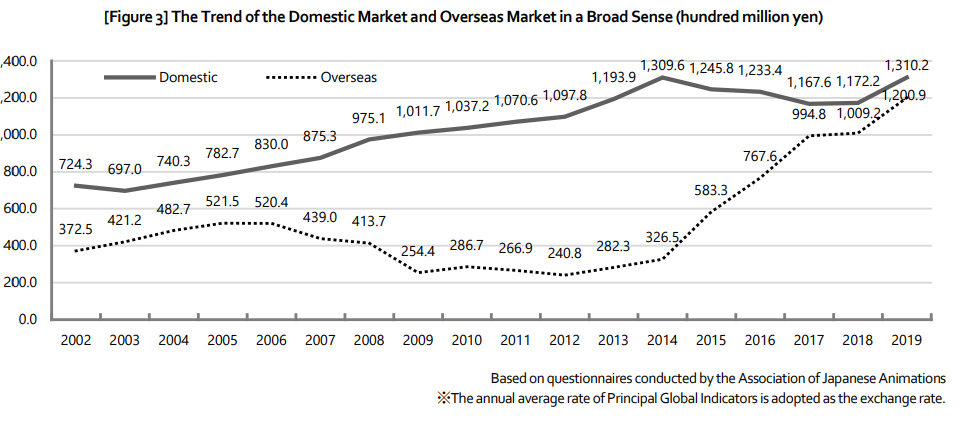

The below graph is from “Anime Industry Report 2020: published by The Association of Japanese Animations, in 3/21.

The domestic sales revenue of the animation industry in Japan amounted to approximately JPY 1.31 Tn in 2019. Combined with overseas sales, the Japanese animation industry sales reached a new record of about JPY 2.51 Tn ($25Bn). This domestic sales figure equates to 0.3% of total Japanese GDP in 2019, which is sizable, given Japanese defense spending typically accounts for 1% of GDP.

If Anime tourism is counted in, the importance of the animation industry on the Japanese economy seems to be even bigger, since 25% of US visitors to Japan was said to come to Japan for its pop culture.

Global Anime Market:

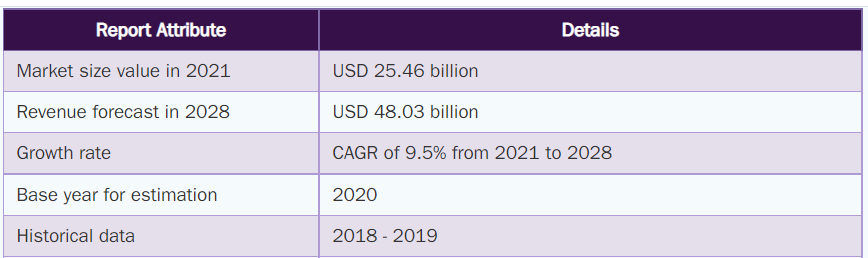

Grandview Research estimated that the global anime market value was $23.56 Bn in 2020 and was expected to expand at a compound annual growth rate (CAGR) of 9.5% from 2021 -2028. This 2020 size of $23.56 Bn is slightly lower than $25 Bn estimated by Association of Japanese Animators for 2019. Both groups might have defined the “animation industry” differently. The below table summarizes Grandview’s findings:

(Source: Anime Market Size & Share – Industry Report, 2021-2028)

Conclusion

We can safely assume that ArtSpark will enjoy a large and growing end user markets.

6. Strengths and Weaknesses

Strengths:

1. Celsys is the leader in the anime industry which is expected to show robust growth.

2. By supporting anime creators, not distributors, the company can do well regardless of any specific anime hit

3. Two groups – Celsys (anime creation software) and Candera (UI/UX IP) to augment each other. As mentioned earlier, Celsys’ user friendly products are supported by Candera group’s experience which was gained though graphic software for feature phones.

Weakness:

Candera division suffered from slow sales due largely to sluggish demand and a downturn in vehicle production volume in the automobile industry caused by the COVID-19 pandemic. Nontheless, the company wide sale was up 11% in first 9 months/2021 vs. 9 months/2020, propelled by Celsys (anime division)’s achieving the FY 2023 sales target in 12/21.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance