With GENDA trading at the lower end of its recent range, I took the opportunity to reassess its investment merits. During this review, I came across an intriguing report—Valuation Analysis by Capital Growth Strategies, a sponsored research firm. The report is attached for reference. Additionally, their initiation piece is available on GENDA’s IR page for those interested.

It took me a long time to grasp what this valuation report tried to accomplish. It appears that I am not the only one. I found Genda’s reply to the inquiry, “Please explain CGS’s valuation report,” in the FAQ section.

My take:

I concur with Genda in that its business model is in the early days in the domestic market, and there are a lot of different views on valuations. CGS asserts that consensus estimates and the resulting valuations are extremely low since the consensus is not taking into account future M&As other than announced.

Can we reasonably expect GENDA to continue identifying and integrating strong target companies?

Recently, few other M&A-driven growth companies have emerged and gone public—, F Cord (9211), and Next Gen (319A), to name a few. Japan Elevators and Yoshimura Foods have been around for a while.

Though they operate in different industries, they are securing valuable acquisitions and investor attention. Given this trend, is there certainty that attractive M&A opportunities will remain plentiful? GENDA’s strategy focuses on acquiring businesses that can be seamlessly integrated, but are these same high-quality targets also being pursued by private equity firms and other investment funds?

Since the “growth via M&A” model is still relatively new in Japan, even Japan Elevators and Yoshimura Foods have completed only 30–35 acquisitions to date—far fewer than Indutrade and Lifco in Sweden, which have executed 220–230 transactions. This disparity may suggest that Japan offers a sizable total addressable market (TAM). I’d like to think so, but the recent challenges faced by M&A advisory firms—such as M&A Research and Nihon M&A—raise some concerns. A decline in deal volume and lower advisory fees indicate potential headwinds that warrant closer attention.

Additionally, key valuation metrics do not indicate that GENDA is currently undervalued: a P/E ratio of 35x, a P/B ratio of 4.76x, an operating margin of 7.1%, an expected operating profit growth rate of 32%, and an ROE of 27%.

If you find CGS’s argument compelling and believe the market has not adequately priced GENDA’s valuation at ¥2,900, you may consider GENDA to be an attractive buy at the current stock price of ¥1,080.

Details of the report below.

CGS pointed out while a DCF analysis is the most corporate finance theory-based approach to calculate theoretical stock prices, it has a shortcoming of that that the theoretical stock price fluctuates greatly depending on the input value of the perpetuity growth rate.

To eliminate this drawback, CGS conducted a reverse DCF analysis, which helps reduce subjectivity by calculating the perpetuity growth rate implied by the current stock price. This approach eliminates arbitrariness and connects DCF-derived theoretical stock prices with market stock prices.

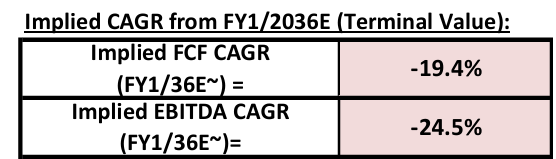

According to CGS, the perpetuity growth rate required to justify a Y 2,900 stock price in a DCF analysis would need to be -19.4%, which is excessively low and unrealistic. This means that if Genda’s FCF were to decline by -19.4% annually forever after CGS’ 10-year earnings forecast period, the DCF analysis would yield a stock price of Y2,900 .

Additionally, the EBITDA growth rate assumption would need to reflect a -24.5% annual decline indefinitely. These assumptions indicate that the current valuation is significantly undervalued.

(Source: CGS valuation report)

The CGS report concludes that, the perpetuity (constant long-term) growth rate implied in the consensus estimate cannot be justified without assuming an excessively low and unrealistic input of -19.4%, compared to the more commonly used assumption of ±1%. This suggests that the current consensus-based stock price is extremely undervalued.

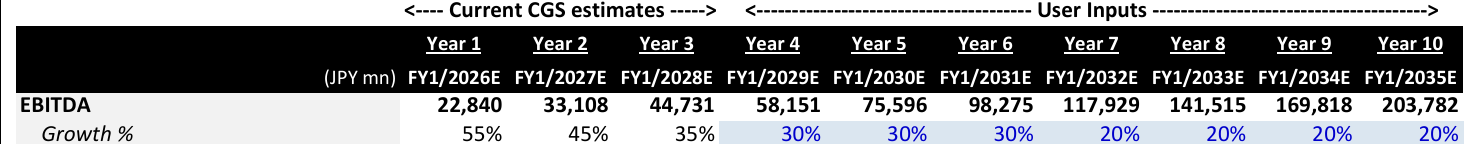

Regarding CGS’s 10-year earnings forecast:

The perpetuity growth rate mentioned above represents the growth rate after the forecast period. If the CGS’ 10-year earnings forecast was particularly aggressive, a steep decline—such as a perpetuity growth rate of -24.5%—would be expected to align with the current stock price after years of rapid growth.

Actual EBITDA growth of Genda:

Since its IPO in July 2023, Genda’s EBITDA has grown approximately 60% year-over-year for two consecutive fiscal years. It increased from ¥8.1 billion in FY1/24 to ¥14.2 billion in FY1/25, with a forecasted rise to ¥22 billion in FY1/26. The company has stated its commitment to ongoing M&A activities, which are expected to maintain a similar 60% growth rate as its benchmark.

CGS’s forecast is more conservative vs. historical Genda’s EBITA growth rate and goal:

- +45% growth projected for this fiscal year

- +35% growth for the next fiscal year

- Then gradually slowing to +30% and +20% in subsequent years

(CGS Report p2)

Thus, even under CGS’s conservative assumption, the only way to come up with Y 2900 current stock price is to assume perpetual growth rate of -19.4% as stated earlier.

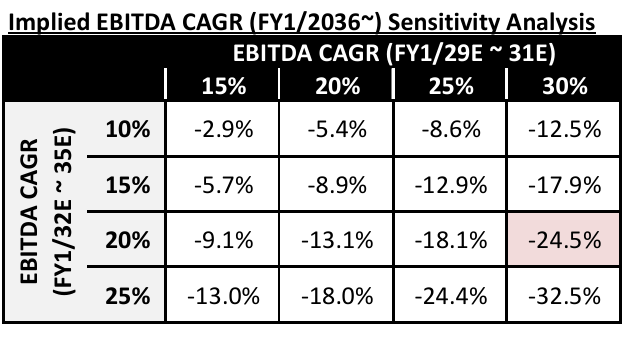

Some may argue that CGS’s EBITDA growth assumption is still too aggressive. To address these concerns, CGS has provided the following table, where the implied perpetuity growth rate is calculated retrospectively. This allows for an adjusted evaluation in case the forecasted

EBITDA growth rate is further revised downward.

Specifically, as you can see in the upper row of the chart below, if “the EBITDA growth rate from the 4th to the 6th year is 15%” and “the EBITDA growth rate from the 7th to the 10th years is 10%,” a perpetuity growth rate of -2.9% is implied (the upper left in the chart).

(CGS Report p3)

Even under the extreme assumption of EBITDA growth rate will decrease from the current 60% to 45%, 35%, 15% and 10% (this means that Genda execute no M&As for mid- and long-term and the growth comes from the existing businesses), the implied growth rate is still -2.9%, a conservative growth rate compared to +/-1%, which is used in a general DCF analysis.

Based on the above results, the conclusion is that the current stock price and valuation are highly undervalued. (CGS Report p2)

Genda maintained its M&A discipline by intentionally not issuing a medium-term management plan to prevent from selecting M&A targets just to meet the medium-term plan. However, internally, they set the EBITDA growth of 60% y/y.

CGS further believes that the consensus forecasts have largely not incorporated the company’s future M&A potential beyond those that have been publicly announced.“ (CGS Report p4).

In fact, another sign that consensus is excessively conservative is the EBITDA for FY2026/1. The market consensus is Y18.95 billion , but the company’s guidance is Y21.2 billion (in the presentation on December 24,2024) which is based on the assumption that there will be no M&A conducted in the future.

(CGS Report p4)

Based on them, the report ends with “a consensus forecast that largely excludes future M&A is not particularly useful given the GENDA’s growth strategy. Furthermore, it means that the trading multiples derived from consensus estimates do not account for the cash flow contribution from future M&A. For a valuation that incorporates the potential earnings contribution from future M&A as an estimated figure, please refer to the trading multiples based on CGS projections. (CGS report p4*).

*I could not find these trading multiples they referred to. Please let me know if you did?