While Covid-19 caused significant human suffering, it also unexpectedly boosted certain industries. The medical testing sector, particularly for Covid test kits, experienced substantial market growth during the pandemic.

One of the key players in testing markets is Tauns with a market cap of Y63 Bn (yes, small but please read on), PE 10x, and ROE 44%. IPOed in 6/24, Tauns shared appreciated 47% YTD as investors positively reacted to a 62% y/y increase in operating profits for FY6/24 and a couple of important business partnership announcements. A 62% increase in OP is impressive since the government purchase of Covid test kits substantially decreased in FY6/24.

Tauns (“the company”) is a leading manufacturer of in vitro diagnostic reagents for rapid diagnosis in hospitals, particularly skilled in respiratory infections. The majority of sales are to Suzuken (a drug wholesaler) with reagent kits mainly sold to hospitals and general practitioners. Tuberculosis diagnostic reagents are provided to endemic countries like Africa, recommended by the WHO. Both domestic and international research institutions and biotech ventures are clients.

Although influenza test kits previously accounted for the majority of sales, since the launch of the new coronavirus antigen test kit in October 2020, coronavirus-related products with year-round demand have also become mainstays (50% of sales). The company is also developing cancer companion diagnostics and diagnostics for chronic diseases such as kidney diseases.

The company was formally established in April 2016 as part of a corporate reorganization supported by a private equity fund (HK-based CITIC Capital Partners) aimed at business restructuring and an IPO. However, the company’s practical establishment dates back to April 1987, when it was founded for the research and development of in vitro diagnostic pharmaceuticals, research reagents, and various analytical reagents.

Their main product is an antigen test kit that utilizes the immunochromatography method*, enabling rapid diagnosis beside the patient without the need for special equipment.

*Immunochromatography method: A typical example of a diagnostic reagent method is a pregnancy test, which is widely sold in pharmacies.

Although the breakdown of sales is not disclosed, the product lineup is classified by test target: ① COVID-19 (single test kits), ② COVID-19 and influenza (combo kits), ③ influenza (single test kits), and ④ other infectious diseases such as adenovirus and mycoplasma.

Overseas sales are still small at 3% in FY6/24.

I. Investment Thesis

1. Industry size – slowly expanding

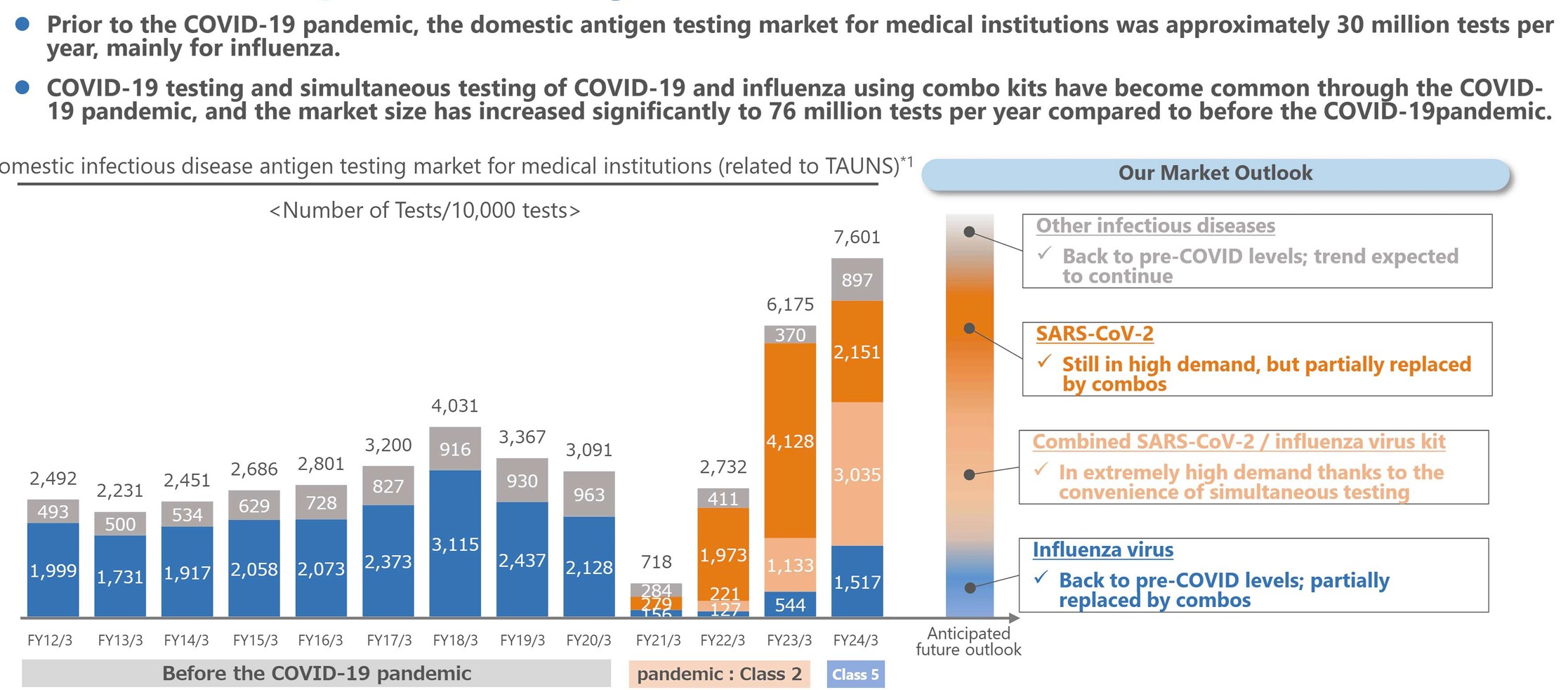

The below chart is the major investment thesis.

The bars are the market sizes that Tauns can address. Pre-covid, testing was mainly for flu (Blue section) and other infectious diseases (Gray). 30 MM tests were done per year. Post-covid, covid tests, and flu/covid combo tests pushed up the market size to 76 MM tests/year.

(source: company)

Since the classification of COVID-19 under the Infectious Disease Control Law shifted to Category 5 (the lowest) in May 2023, the purchases by municipalities have decreased. However, 1) COVID-19 remains highly infectious and lacks the seasonality of influenza, and 2) the Japanese citizens are cautious, so there is still a certain level of demand for testing in Japan.

2. Vertical Operations

The company manages everything in-house, from R&D to manufacturing and sales, enabling them to quickly convert customer needs into products. They utilize core technologies such as the immunochromatography method, antibody generation technology, and high-sensitivity detection technology. Combining these technologies is a significant strength in the development of diagnostic reagents.

3. Technical excellence

In 2024, Tauns launched the new COVID-19 test kit “ImmunoAce® SARS-CoV-2 III,” utilizing the independently developed rabbit-derived antibodies instead of the commonly used mouse-derived antibodies in antigen test kits, achieving higher sensitivity.

Their independently developed black platinum-gold colloid offers higher visibility than the conventional red-gold colloid. This technology is applied to the Immuno series and is recognized as the “Black Line” for its black indication lines and control lines.

4. High Market Share with Potential to grow

In the market for influenza, adenovirus, and COVID-19 antigen test kits, the company holds top domestic market shares.

Flu: #1 among 21 companies. Share: 42%

Adenovirus (a type of virus that can cause a variety of infections): #1 among 15 companies. Share: 34%

Covid #1 among 28 companies. Share: 25%

Covid/Flu combo kit: #2 among 20 companies. Share: 17%

- For the COVID-19/influenza combo kit, which saw a surge in demand, supply constraints held Tauns the 2nd place in FY6/24.

- By strengthening the kit supply system, and collaborating with Shionogi & Co., Ltd. for sales, the company aims to expand the market share of COVID-19-related kits

5. Valuation

Despite this high market share, Tauns’ valuation is comparable to its infectious disease testing peer, Mizuho Medy. (source: shikiho)

6. Many ways to grow

In addition to the stable overall market demand for its test kits, Tauns aims to increase its market shares by

1) collaborating with technical and business partners and 2) developing new products.

6-1) Partnerships

Since its IPO in 6/24, the stock tends to positively react to the announcements of technical and business alliances.

At the end of 2021, the company entered a joint sales agreement with Shionogi (4507) for COVID-19 antigen test kits. Sales are initiated through Shionogi’s medical representatives (MRs). The company pays Shionogi promotional fees.

On 10/25/24, the license agreement with First Screening Co., a major player in the field of infectious disease diagnostics was announced. This agreement is expected to accelerate product development, expanding the company’s business domain from antigen test kits to various infection tests, including cardiovascular and kidney disease diagnostics.

On 12/25/24, Tauns entered a purchase agreement with Roche Diagnostics. Starting in 1/25, the company will start selling new coronavirus antigen test kit products to Roche.

6-2) New products

Next-generation testing technologies

The company is developing D-IA, a system that features the same ease of operation as antigen test kits while allowing for high-accuracy testing using compact and affordable devices. This system can simultaneously test up to eight specimens, enabling either multiple tests on a single specimen or multiple specimens on a single test, improving testing efficiency and speed. The goal is to enhance POCT (point-of-care testing) and enable laboratory-level testing in clinical settings.

Chronic diseases

The company is developing various products, including a diagnostic kit for zinc deficiency by measuring blood zinc concentration, a companion diagnostic for cancer using blood samples with immune profiling*, liquid biopsy tests for cancer using POCT, kidney disease tests with a simple urine testing system, and periodontal disease test kits using the immunochromatography method.

*They have introduced a patent license for immune status biomarkers to predict the effectiveness of immune checkpoint inhibitors.

- By using whole blood for immune cell analysis, it is possible to reduce the labor (and cost) of preparing test specimens, which can potentially increase the number of tests conducted.

- By utilizing various immune cell analysis data, Tauns aims to expand the use of these technologies in the future, potentially establishing preventive techniques for various diseases and other extended applications.

7. New factory to ensure ample product suppliers

The company’s production facility is currently limited to the Kamishima Factory at its headquarters in Izunokuni City, Shizuoka Prefecture. However, to accommodate future business expansion and ensure stable business continuity, the company has acquired land in Mishima City, Shizuoka Prefecture, and is constructing a new factory. The investment exceeds Y10 bn which was funded mainly with cash, bank loans, and supply chain subsidies (Y4 bn), with operations expected to commence in 12/25.

8. IPO which pays dividends

The payout ratio target is 30%. The current dividend yield is 4.5%.

II. Risks and mitigants

1. The biggest risk: competitors coming up with new and better testing technologies.

Mitigants: Stay on top of technical and regulatory developments.

The company ensures close collaboration between the R&D and sales departments to share challenges effectively. They proactively and continuously gather information on regulatory authorities’ trends and relevant academic societies. Additionally, Tauns works on joint research with universities, public research institutions, and medical institutions to stay updated on industry and market changes and customer needs promptly.

Furthermore, since the developed products require pharmaceutical approval, it conducts clinical evaluation tests in medical institutions while coordinating with the production and quality control departments.

2. Severity of an Infectious Disease Season

Tauns’ sales are highly dependent on severity of an infectious disease during a particular season.

To lessen the volatility of the sales, the company aims to strengthen its competitiveness by developing new products to respond to emerging infectious diseases and creating new products within existing infectious disease areas. Additionally, they are working to enhance their presence in non-infectious disease areas.

3. Low liquidity

The company has received investment from CITIC Capital Japan Partners III, L.P. and CCJP III Co-Investment, L.P., which are part of the global private equity firm CITIC (now Trustar) Group. Pre-IPO, they held a total of 60.0% of the issued shares. At IPO, they sold their shares down to 41.7%. Also, President Nonaka owns 28.9%, down from 30.47% at IPO.

Financial Highlights

(source: company)

FY 6/22

Sales were Y 17,456 mm, and ordinary profit was Y 11,210 mm, which was 3.0 times and 9.6 times higher vs. FY 6/21. This significant increase was due to the Ministry of Health, Labour, and Welfare purchasing COVID-19 antigen test kits. Sales to the Ministry in FY 6/22 amounted to Y 8,411 mm, accounting for 48.2% of total sales.

Why was 6/23 weaker

Sales: Y 15,673 mm (a 10.2% decrease from the previous fiscal year)

Operating profits: Y 4,967 mm (a 55.6% decrease)

Ordinary profit: Y 4,953 mm (a 55.8% decrease)

Net profit: Y3,034 mm (a 32.3% decrease).

During FY 6/23, the spread of the Omicron variant and the first influenza outbreak since the start of the COVID-19 pandemic were observed. From February 2023 onwards, the spread of COVID-19 subsided, and in May, the classification of COVID-19 was downgraded from Category 2 to Category 5, leading to a decline in testing demand. Despite the cessation of sales to the government, the 4/22 launch of “ImmunoAce® SARS-CoV-2 Saliva,” a new product using saliva as a sample type, along with sales to municipalities, helped mitigate the significant impact on performance.

The profit decline was also due to a sales decrease and a rise in material, production, and transportation expenses.

FY6/24

Sales: Y18.434bn +17.6%

Reasons for the increase:

- The continued demand for testing existing infectious diseases, such as influenza and adenovirus, even after the transition of COVID-19 to Category 5.

- The summer outbreak of COVID-19 started slightly earlier than expected

Operating profit: Y8.03 billion + 61.7%

Net profit: Y5.774 bn +90.3%

- the increase in sales of high-margin combo kits, the EBITDA margin significantly improved to 47.2% from 35.8% vs. 6/23.

FY6/25 Guidance Sales +4.6% OP +1%: assumptions

- Based on the enhancement of production capacity for combo kits and the accelerated partnership with Shionogi & Co., Ltd., the market share and the proportion of combo kits in sales are expected to increase.

- There is a certain downward pressure on prices due to price competition in COVID-19-related products.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment-related service or product. Information provided, whether charts or any other statements regarding market, real estate, or other financial information, is obtained from sources that we and our suppliers believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.