Trial Holdings Inc. (141A): 2 huge drivers in stock: 1) A retailer with ability to sell Skip Cart (shopping carts with payment functionality), and 2) Topix overhaul

Trial presents investment merits from two perspectives: 1) as a beneficiary of the Tokyo Stock Exchange’s reform efforts, and 2) its growth potential.

TSE reform

Starting with the review of market segments in 2022, the TSE has been pressuring listed companies to manage with an awareness of capital costs and stock prices in 2023.

Recently in 6/24, as the second phase of the reform, the TSE announced a proposal to change the TOPIX, which previously targeted former first-section market stocks, to include all listed stocks in the Prime, Standard, and Growth markets.

According to the proposal:

1) The new TOPIX will consist of stocks with an annual turnover rate of 20% or more and a free-float market capitalization within the top 96%. Market estimates suggest that about 1,000 stocks out of the current approximately 2,100 will be excluded.

2) The new TOPIX will be phased in from October 2026 to October 2028 to avoid unnecessary volatility and confusion.

The benefits of the reform are many:

i) Until now, once a stock was included in the TOPIX, the passive assets linked to the TOPIX (about ¥80 Tn) would be held almost permanently. However, going forward, if stock prices continue to decline or trading remains sluggish, exclusion and sale will be enforced, increasing management awareness of their own stock performance among listed companies.

ii) The opening of the door to Standard and Growth market stocks is seen as an incentive for small and medium-sized enterprises aiming to diversify their shareholders. In the medium to long term, if companies become more conscious of being included in the TOPIX and work towards enhancing their corporate value, it could lead to the revitalization of the entire market.

Among the stocks expected to be newly included, the impact is particularly significant for candidates in both the Standard and Growth markets due to the influx of large TOPIX-linked money.

Although it will still be a few years before the new TOPIX members are determined, there is no doubt that the increased attention in the market will lead to more disciplined management.

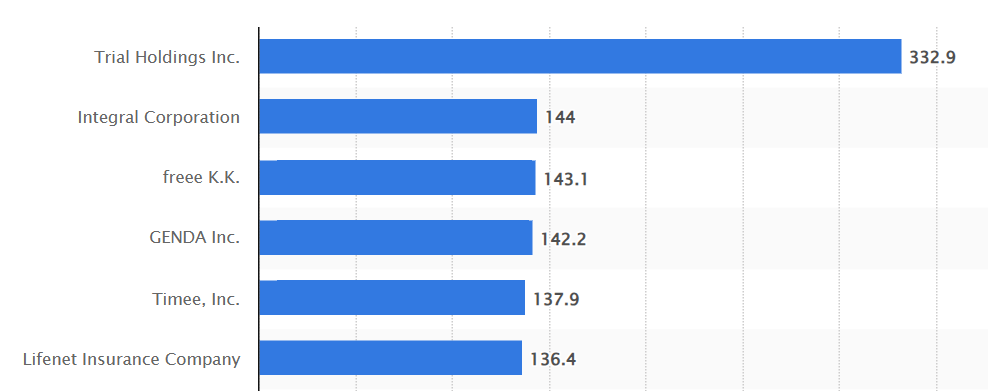

As the largest market cap stock in the Growth market, Trial has a good chance to be included in TOPIX. Notably, Timee which I wrote two weeks ago made the top 5 list of the largest stocks in the growth market as of 8/1/24.

(As of 8/1/24, source: Statista).

=====

TRIAL: A Discount Retail Industry Thriver.

Trial has grown by focusing on addressing the below two issues the Japanese retailers face.

1) Overall consumption decline

According to the Cabinet Office’s 2023 White Paper on the Aging Society, Japan’s domestic population is projected to decrease to about 100 MM by 2055 (currently 122.6 MM), with the working-age population ratio approaching 50%. Consequently, an overall expansion of consumption in Japan is not anticipated, necessitating the Japanese retailers to adjust to new market reality. Trial, equipped with Retail Tech and focused expansion strategy, is at the forefront of the necessary industry transformation.

2) Wasteful industry

There are many inefficiencies, inconsistencies, and unreasonable demands in the distribution and retail industry. The company estimates that the total costs associated with stockouts/losses*, R&D, inefficient store operations, advertising, and rebates amount to approximately ¥40 Tn, which is significant, vs. the domestic distribution and retail industry’s sales of about ¥154 Tn.

*The amount of food waste is estimated based on the Ministry of Economy, Trade and Industry’s “Commercial Statistics” (2022) and the “Supermarket Annual Statistical Survey Report” (October 2023) by the Japan Supermarket Association.

Trial in one paragraph

Trial Holdings Inc. (Trial or the company), originally founded as “Asahiya” in April 1974 in Hakata-ku, Fukuoka City, transitioned to its current name in October 1984, expanding its home appliance retail stores and promoting multi-store discount operations. In September 2015, it became a pure holding company, Trial Holdings Inc., to manage its group activities. By November 2018, it established Retail AI Inc. to develop smart shopping carts (now Skip Cart) and AI cameras, focusing on the retail AI business. The main stock drivers are 1) a multi-format store expansion plan and 2) improvement on the currently below-industry-average operating margin. I fully discuss these two points in my report which is available for purchase.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance