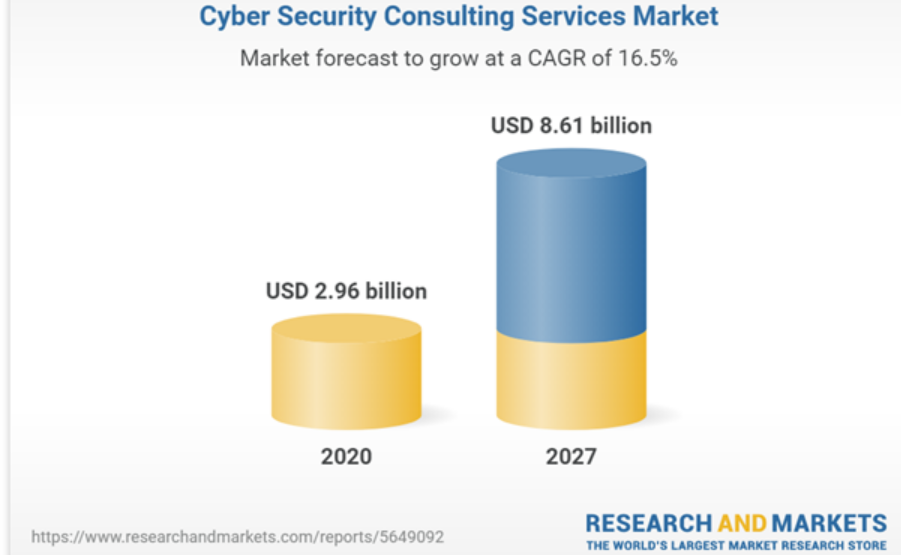

Global Security Experts (GSX) provides cyber security education business as its core with small and medium-sized companies as customers. The company’s 4 segments have contributed to its success over the 20 years with an annual client list of 3,000 with a 90% repeat rate.

4 segments:

1) The education business (18.5% of sales in Q3 for FYE 3/23)

The education business is classified into security training services for a) corporations and b) engineers:

a) The main product is Trap Mail which trains officers and employees against phishing mail attacks.

GSE has 11,000 companies as its clients and enjoys the leading share* in cyber-attack prevention training industry.

*According to ITR Market Review’s “Cyber Security Consulting Service Industry 2021” cited in the company’s financial briefing for Q3 of FYE 3/23.

Sample fee schedule:

One session for 1001-2000 mail addresses + training report: JPY 1,050,000 ( around $10,500)

Two sessions for 501-1000 mail addresses + training report: JPY 1,010,000 ($10,100)

b) An education service covers all aspects of cyber security and provides internationally acclaimed certification examinations.

Two core products:

Target: General IT engineers (so far 4004 attendants), Purpose: Educate/Train engineers to detect and correct system’s vulnerability against cyber attacks

Couse + Certificate fees: JPY 88,000 – 220,000

Target: Security-specialized IT engineers (so far 3492 attendants), Purpose: Educate/Train security engineers to improve their skill sets.

Couse + Certificate fees: JPY 320,000 – 540,000

2) The consulting business (27.4%):

In this group, the company provides a) consulting services and b) vulnerability evaluation services.

The company is one of the very few firms which offer cyber training services to SMEs (small to med sided entities. This ability to serve wide ranging needs of SMEs is rare and its competitive advantage.

a) Its consulting service proposes appropriate improvement measures after analyzing existing risks.

b) Its vulnerability evaluation service evaluates system vulnerability by conducting simulated attacks on the network system of customer companies.

3) The security solution business (27.1%)

This segment first accesses the existing security system at a firm and provides an improvement when/where necessary and trains engineers to maintain the enhanced system.

4) 0the IT solution business (27.0%).

For the IT solution business, the company provides the most suitable software selection and IT infrastructure construction.

(Source: Financial Results Briefing for the 3rd quarter of FYE 3/23)

The above bar chart highlights that all the four segment enjoyed year over year growth during Q3/23 (vs. Q3/22)

1. Investment thesis

1) Rising incidents/breach of securities cases

(Source: Financial Results Briefing for the 3rd quarter of FYE 3/23)

The above pie chart* illustrates that 79% of Japanese corporations suffered from cyber-attacks in the previous 12 months. Out of these victims, 35% was able to fend off offenders before the actual attacks, but 44% experienced actual damages such as system failures and data leakages.

*Prepared by Trend Micro’s research: Cyber security trends with Japanese corporations in Japan in 2020.

Unfortunately, there is no end to these disturbing trends in sight, leading to steady demand picture for GSE.

These security breach incidents have culminated an expulsive growth (20-fold) in the number of attendants to the company’s training classes from 122 in FYE 3/17 to 2,996 in FYE 3/22.

(Source: Financial Results Briefing for the 3rd quarter of FYE 3/23)

2) Technical excellence proven on the global stage

To prove the company’s superb ability to produce qualified security engineers, the company was awarded a top spot with EC-Council Training Center of The Year Award (Enterprise), hosted by EC EC-Council Global Awards. This is quite an achievement since the only 3 firms are awarded this top spot from a list of 2,380 training firms across 145 countries.

3) Guidance Upside Potential

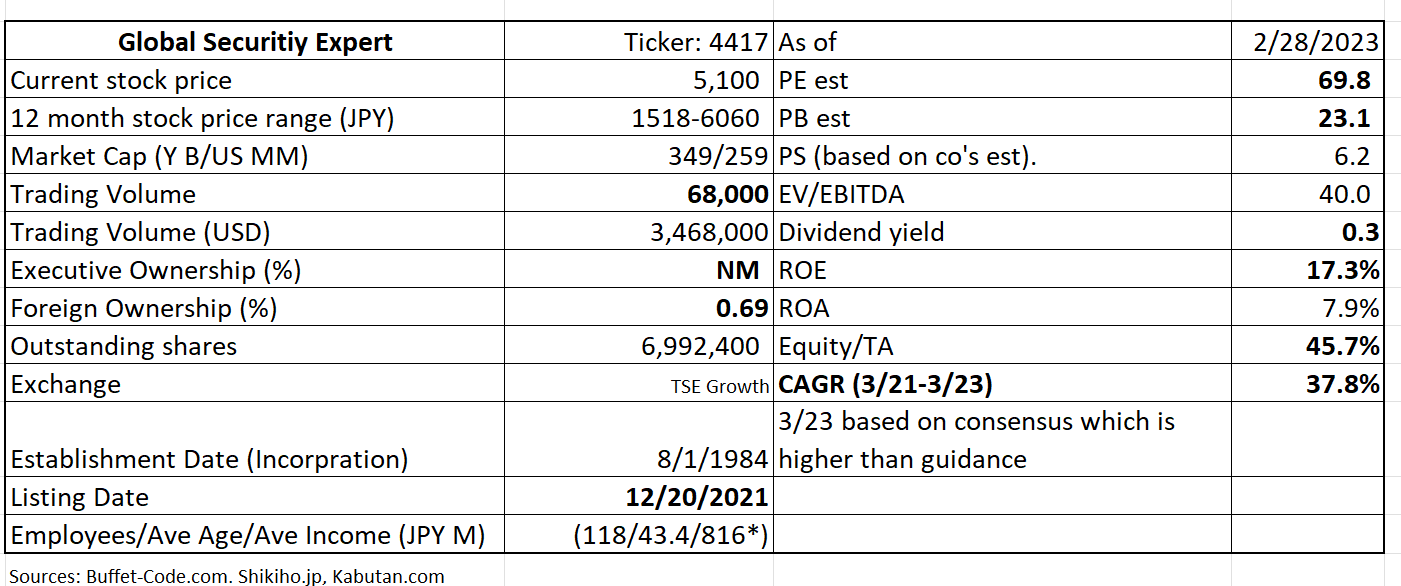

The company’s financial performance has progressed slightly better than planned. Higher security breach incidents have raised awareness among companies which has led to an increase in inquiry. As a result, the company recorded higher sales in Q3 (23%) for FYE 3/23 (vs. Q3 for FYE 3/22) and operating profits of +59%. Demand for GSX’s training sessions was robust, which improved operating margin since training segment carried higher than corporate average margins.

Thus, operating profits achieved 81% (vs. 75% required) toward a full year operating profits, even after setting aside employees’ benefit.

In the other business segments, the company plans to increase the number of partner/affiliate entities to improve efficiency in delivery of its products.

The company’s operations are relatively slow in Q1 and gradually gains traction, as a year progresses. Sales has achieved 74.5% of the full FY 3/23 numbers, thus, upside potential to the guidance is possible.

4) History of steady dividend payout

As shown below, the company has increased its dividend payout ratio (a slight decline in FY 3/20 under the Covid impacts) since FYE 3/19. JPY 13/share is planned for FYE 3/23 with payout ratio of 19.16%.

(Source: Financial Results Briefing for the 3rd quarter of FYE 3/23)

5) Competitive Advantage

The Company with training, consulting, implementation and maintenance capabilities can satisfy a wide range of security needs at SMEs and still generate profits. This can be accomplished via a full application of on line/remote resources, standardization/automation of certain products/services and collaboration with delivery/training partners throughout Japan.

The company’s growth strategy is to accelerate and expand the above initiatives.

* Notably, the company’s employees are well compensated vs. average in Japan. This may speak to high skill sets of their employees.

The company’s PEG is at a slightly elevated level at 1.85x, reflecting a high growth expectation for cyber security consultancy and training stocks. Trading volume needs to improve as well.

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that the shares have hit the support level of around JPY 4,770 and turned around. The stock can climb higher with an increased volume.

3. Business Model

1) One stop shop

The company’s competitive edge is its one stop shop model geared toward SMEs (employees 100-5000)

Typical IT training/consulting firms service large entities with a certain level of “IT/security literacy” and can provide a service provider with scale merits.

GSX can offer comprehensive services (personnel training, consulting, strategy implementation and maintenance) to SMEs whose needs are widely different from a firm to another.

2) GSX can satisfy the needs of Two customers

2-a) Entities/End user

The company offers a whole security platform, encompassing personnel training, vulnerability review, system installation & integration and emergency assistance.

2-b) System Integrators/IT solution companies

GSX provides engineers with technical training and certification.

4. Financial Highlights

Financial Results for the 3rd quarter ending 12/31/22 vs. 12/30/21:

(Financial Results Briefing for Q3 of FYE 3/23, translated by www.JapaneseIPO.com)

All the 4 segments have seen steady sales and profitability growth. Specifically:

1) Training

The company was able to take advantage of a demand increase in security IT engineers. Thus, sales and gross margin improved as planned.

2) Consulting

Incessant occurrence of security breach incidents at SMEs has increased consultation needs, after these incidents were dealt with. Major focus was placed on efficiency improvement to improve margins.

3) Security Solution

High demand level were seen, associated with frequent security breaches experienced at SMEs. Both sales and margin witnessed an improvement.

4) IT solution

Standalone performance was flat vs. the last Q3. The collaboration with consulting and security solution groups were cultivated leading to the efficient use of resources.

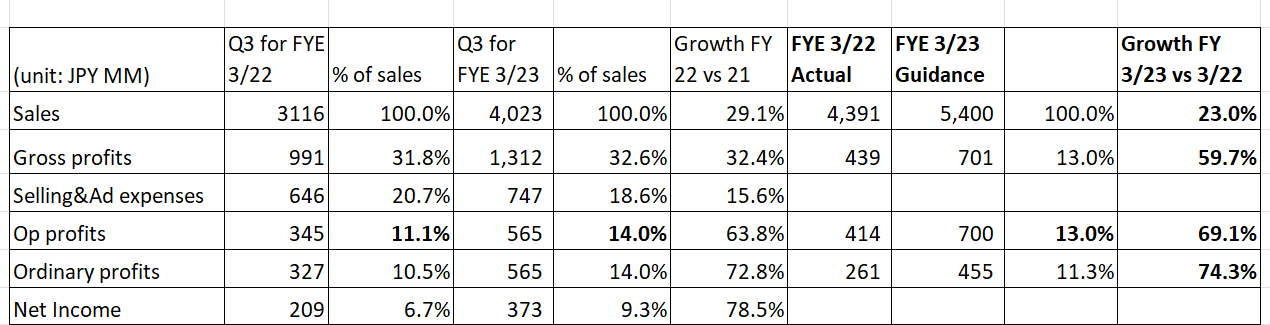

5. Total Addressable Markets (TAM)

(Source: Market and Research as of 8/22)

The cyber security consulting services market was valued at $2.955 Bn in 2020 and is expected to grow with a CAGR of 16.5% to reach market size of $8.6 Bn in 2027. The major growth drivers are an increase in cyberattacks and data breaches.

This trend does not show a sign of a reversal, thus, GSX will likely enjoy a growing customer base to tap into.

6. Strengths and Weaknesses

Strengths

1. One stop shop – competitive advantage

The company is unique in that it can meet a whole range of cyber security needs of SMEs which are not the main target customers of the large consulting firms. The 20 years of service experience has afforded GSX knowledge base to know unique security needs of SMEs.

2. Demand increase

The company expects that IT engineers with security credentials will garner more demand from hiring companies. This, in turn, should increase an demand for GSX’s training and certification program which has a high credibility and recognition in the industry.

Weaknesses

Business Brain Showa-Ota Inc. (Ticker: 9658) owns 66.7% of the company and may influence GSX’s strategic move. It is possible the parent’s business goals may stand in a way of GSX’s growth. However, GSX’s stock appreciation is a benefit to the parent’s P&L and its own stock performance. Thus, the parent will not likely impose adverse decisions to GSX’s growth paths.

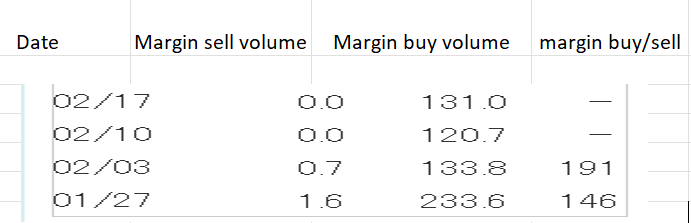

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For GSX, margin buy sell ratio has been high, but absolute level is decreasing. The near term selling pressure is still there, and needs monitoring.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance