Net Protections (“NP” or the “company”) is the pioneer in BNPL (Buy Now Pay Later) in Japan (started in 2002) and a leader with top market share of BtoC (Business to Consumers) BNPL markets*. NP also offers BNPL operations in Taiwan and has entered BtoB(Business to Business) BNPL market.

*Source: the company’s webpage which refers to the industry size of “Online Payment/settlement service providers 2022” by Yano Research Institute.

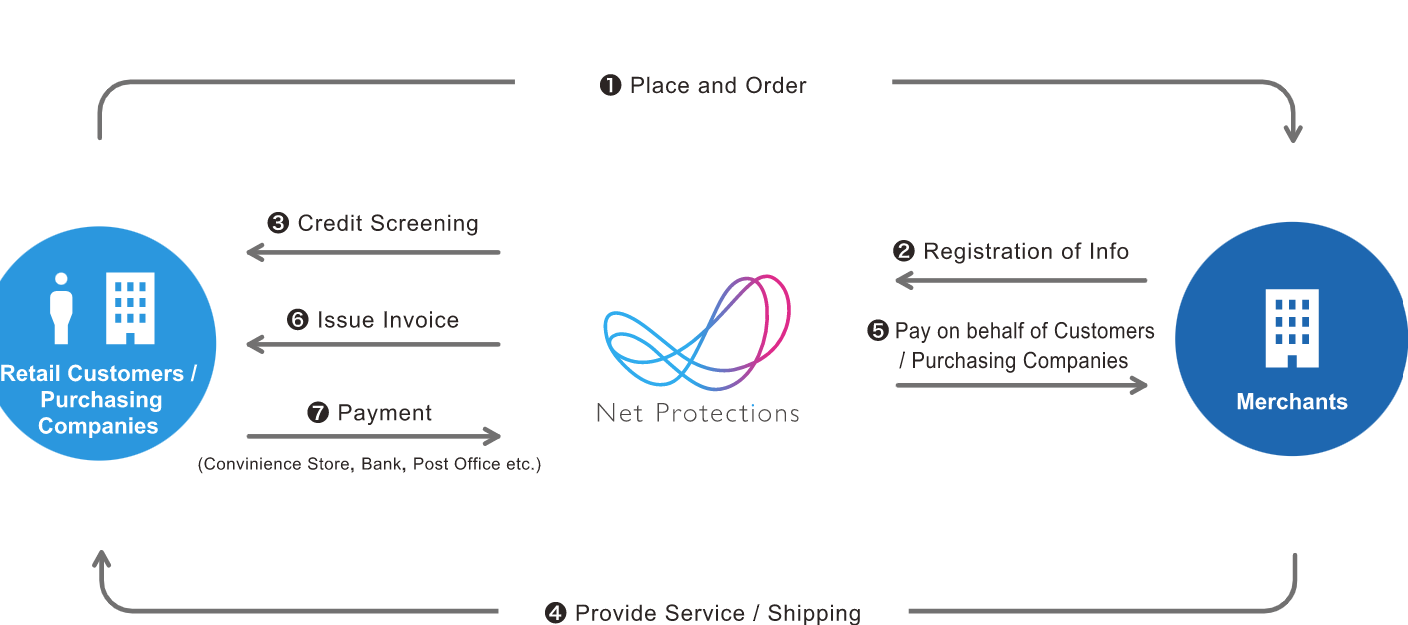

The company’s order flow:

(Financial Results Presentation for 6 months ending 3/23)

The above diagram describes the order flow of a transaction:

1) A customer places an order,

1) A merchant registers the order with NP,

3) NP conducts a credit screening of the customer in 1)

4) The merchant in 2) fulfills the order

5) NP pays the merchant in 4) on behalf of the customer in 1)

6) NP issues the invoice to the customer in 1)

7) The customer in 1) pays NP

1. Investment thesis

1) A nascent industry with ample growth ahead

FinTech in Japan

FinTech, derived from two words – finance and technology and describes the use of information technologies, such as blockchain, artificial intelligence (AI), and big data, to provide improved financial services.

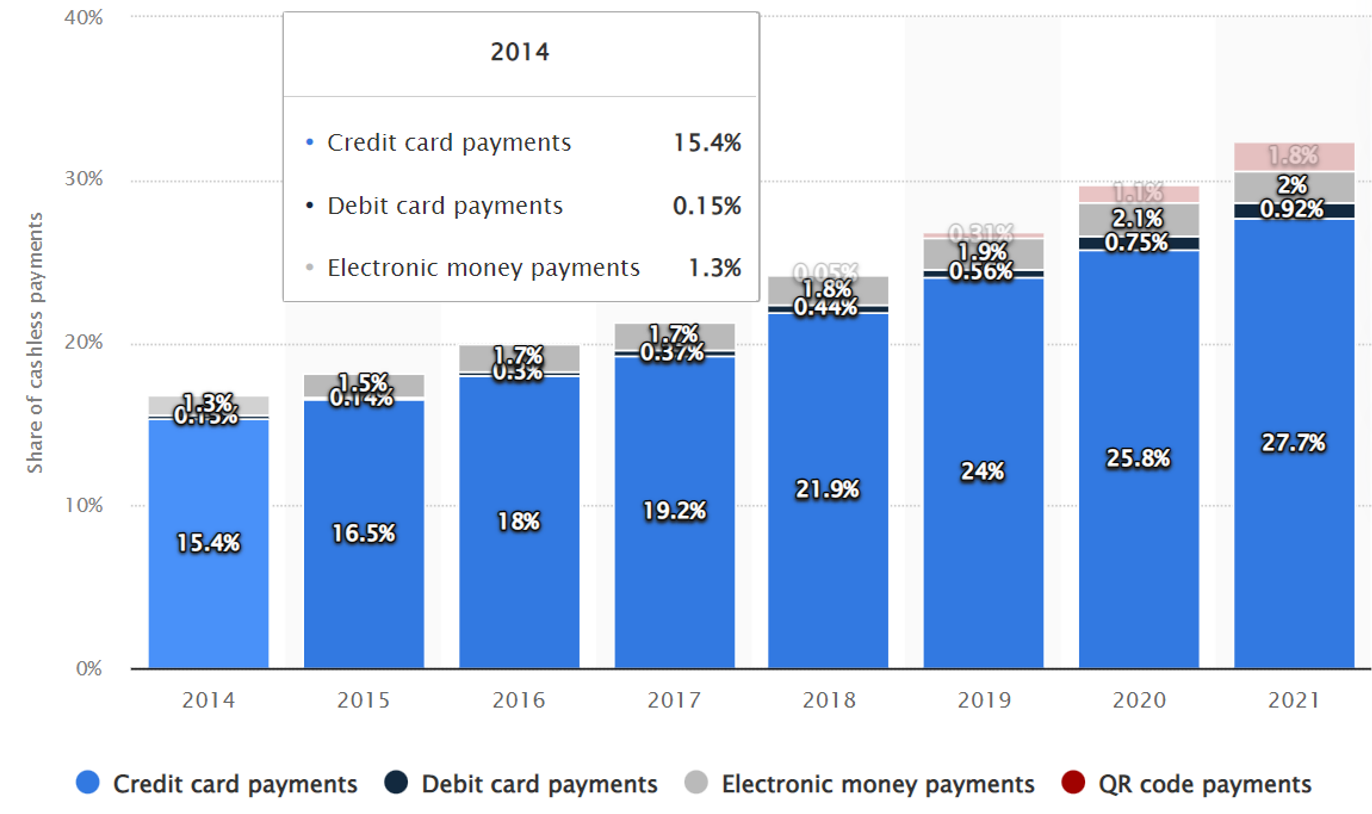

The FinTech sector encompasses a variety of segments, including digital payments, alternative finance, and digital investment. Digital payments and remittance services form the core of Japan’s FinTech market. Driven by the impact of Covid and government efforts to increase cashless payment usage, digital payments have recently gained popularity among Japan’s cash-oriented consumers. Cashless payments accounted for 29.7% of the final consumption expenditure in fiscal 2020.

(Source: Cashless payment ratio in Japan 2014-2021, Published by Statista, May 6, 2022)

The same ratio was already around 50% in US in 2018.

The value of money transfers via non-bank fund transfer providers doubled in the same year. The government has eased regulations in this segment, facilitating the entry of new players by lowering the capital requirements for market participants. The smart cashless payment market was forecast to grow significantly over the coming years. Likewise, the cryptocurrency market and alternative finance, including the lending service market have seen steady growth in recent years.

In 2016, the Japanese government made the creation of a FinTech ecosystem a key policy of its revitalization strategy. Since then, it has taken a series of measures and regulatory adjustments, to promote the growth of the FinTech sector, including improving the startup ecosystem, attracting FinTech companies, and promoting cashless payments in the city.

Major players involved in FinTech include Rakuten and Z Holdings with its smartphone-based payment services PayPay and Line, which boast a large customer base and offer a variety of online and mobile financial services, including banking, payments, securities trading, and insurance.

In 2021, big international players entered the Japanese FinTech market through acquisitions of startups. PayPal’s acquisition of Buy Now, Pay Later (BNPL) startup Paidy became the largest FinTech investment deal in the Asia region in 2021, while Google was reported to acquire payment and settlement startup Pring. Other major FinTech startups include cloud accounting service provider Freee, online asset management and robo-advisory provider WealthNavi, Money Forward, Kyash, Moneytree, and Zaim, among others.

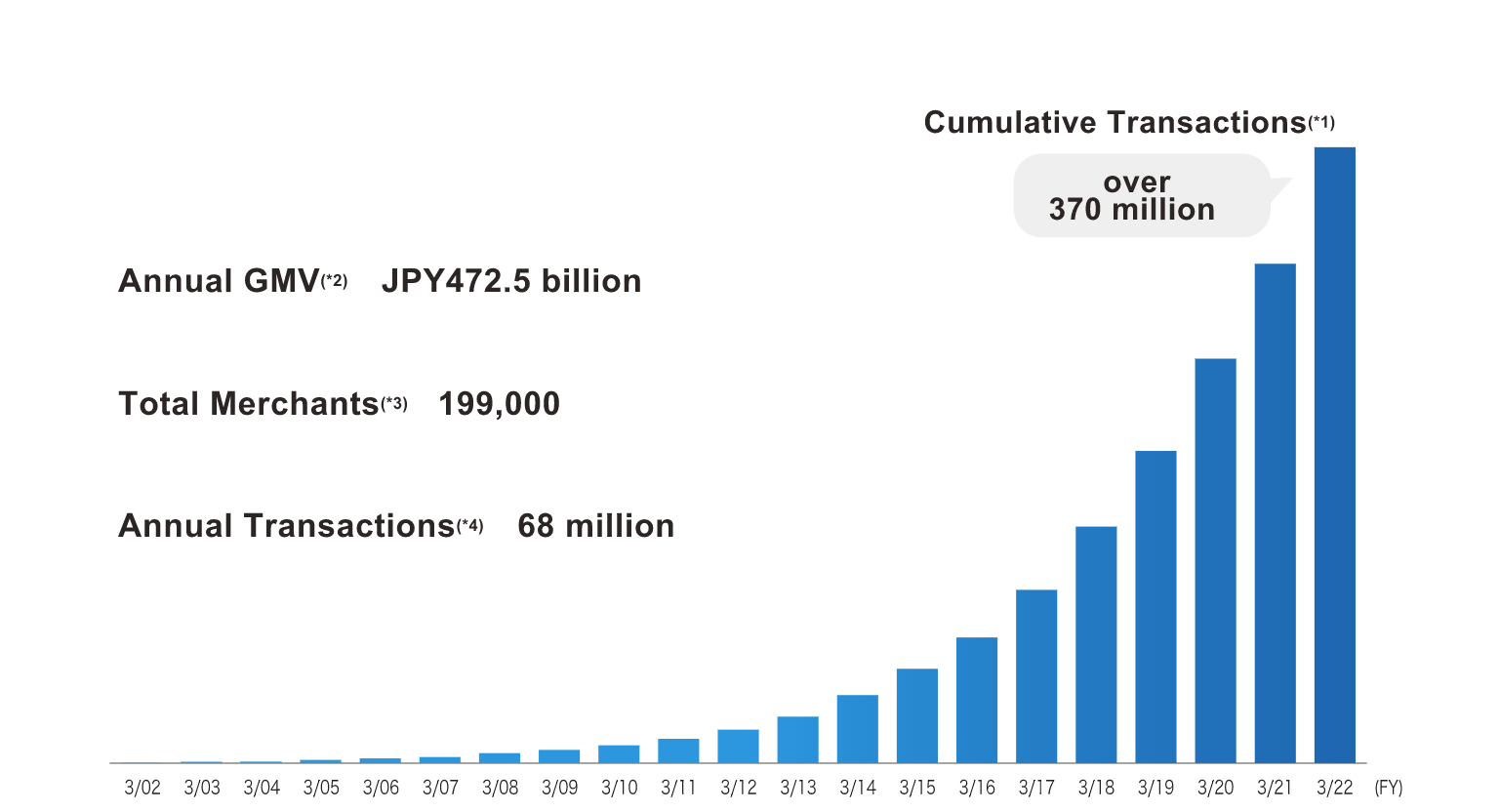

Supportive industry and NP’s own unique value propositions propels its growth as annual GMV (gross merchant value/gross transaction values) has reached JPY 472.5 Bn (approx. USD 3 Bn). One out of 7 Japanese and one out of 8 Japanese businesses have used NP.

(Source: company’s webpage)

2) Competitive Advantages

2-1: Great Value Prepositions

NP provides great values to both buyers and its merchants(NP’s direct clients):

Purchasers:

NP Atobarai, atone, and AFTEE offer a safe and secure means of payments because end buyers do not need a credit card, so there is no risk of information being divulged. The buyer has a peace of mind about the shipment, since payment is only made after confirming receipt of the product,

Merchants/Businesses:

NP Atobarai air and NP Kakebarai offer Business Process Outsourcing (BPO). Merchants can outsource the entire billing process, from credit screening to the issuance of invoices and payment reminders, cash collection and accounting. Thus, they can enjoy NP’s processing expertise and scale benefits. Furthermore, non-payment risks are born by NP, eliminating the need for credit screening costs in the merchants’ operations.

2-2: Differentiation vs. oversea competitors

The major business model differentiators of NP are:

1) The company requires lump sum payment from the buyers, while overseas BNPL players typically offer installment options. NP users do not have to provide the merchants credit card information and can wait till the receipt of products before sending payments.

2) NP’s user demographics include more mature individuals while overseas peers tend to attract younger generation who don’t have long credit history.

3) NP has accumulated massive data on consumers based on track records spanning 20 years and 320 MM unique transaction data. Using this knowledge base, NP can conduct an effacement credit screening with 97 approval rating and low delinquency, i.e, low bad debts.

3) Rising Backlog

As of 9/22, the company recorded the highest GMV*backlog in its history (JPY 40 Bn/month). This monthly GMV number is expected to grow by JPY 46 Bn given the signed new contracts.

GMV: The total amount of payments made through NP services, such as NP Atobarai and atone, etc.

4) Negative impacts of amendments to the Pharmaceuticals and Medical Devices, or PMD Act, will Abate

PMD Act was amended in 8/21, putting tighter restriction on ads by beauty and health care products. This tighter control suppressed sales in the category which in turn lowered NP’s transaction volume. However, the impacts are gradually abating as both consumers and merchants adjust to new regulatory environments.

5) The former Capitalist as CEO

Mr. Shibata, the current CEO, was an inventor with a private equity firm. But he saw a huge growth opportunity in NP and took a CEO role in 2004. Thus, NP’s management team knows how to talk to “investors”.

6) Well defined growth strategy

The company went public in 12/2021. The proceeds have been used to expand regional coverage (so far in Taiwan) and product offerings. The company entered into Taiwan markets in 2018 and slowly increasing its presence there. The new product areas of focus are home visit services (for installation/repair of home appliances) and payment services between small businesses (not between business and consumers).

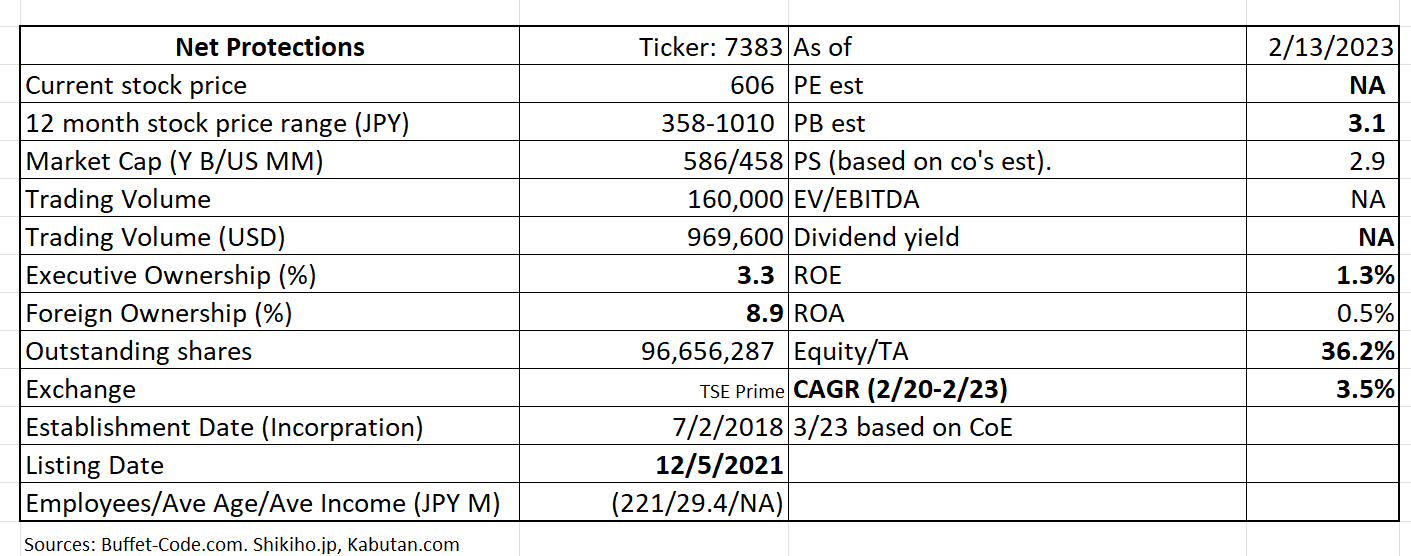

The company aims to grow its core BtoC operations by 20-25% and BtoC segments by 33-42% to reach total GMV of JPY 1.2 -1.6Tn from 3/21 to 3/26. This goal appears a bit aggressive since the last 3 year sales CAGR is around 3%. However, this goal is achievable, since:

1) In the post-Covid society, contactless/cashless payment are increasingly preferred,

2) Aforementioned negative impacts from tighter promotion restrictions are easing,

3) Cashless payment ratio is increasing and has doubled from 2014-2021,

4) The company has expanded its product offering and service areas in BtoC segment,

5) BtoB operations are new initiatives and quickly gaining traction.

PE is not available, since the company is expecting losses for 3/23 to reflect:

1) The company has ramped up marketing and hiring expenses to drive future growth and

2) Consumer segment has suffered a decline due to tighter regulations. The result is a rising share of business customer segment with lower profit margin. Consequently, all the profit lines would be lower for FYE 3/23.

2. Technically Speaking

(Source: kabutan.com)

The above chart shows that the shares are slowly rebounding from the lowered guidance in mid-Nov. of 2022. The stocks are currently trading at a higher end of trading range of JPY 350 – 600. The next resistance level is around JPY 700.

3. Business Model

Key Performance Indicator: GMV

Increase of GMV drives the sales volume, thus, the company focuses on the growth of GMV. Major growth initiatives are derived in investment thesis 6: Well defined Growth Strategy. These major growth plans are supported by marketing activities and an increase in alliance with platform operators.

GMV times commissions become NP’s sales. NP offers several service plans:

NP atobarai: 2.9%-5% transaction based commission + monthly fixed fees

NP Atone: 1.9% and above transaction based commission. Atone is Smart Phone based services

4. Financial Highlights

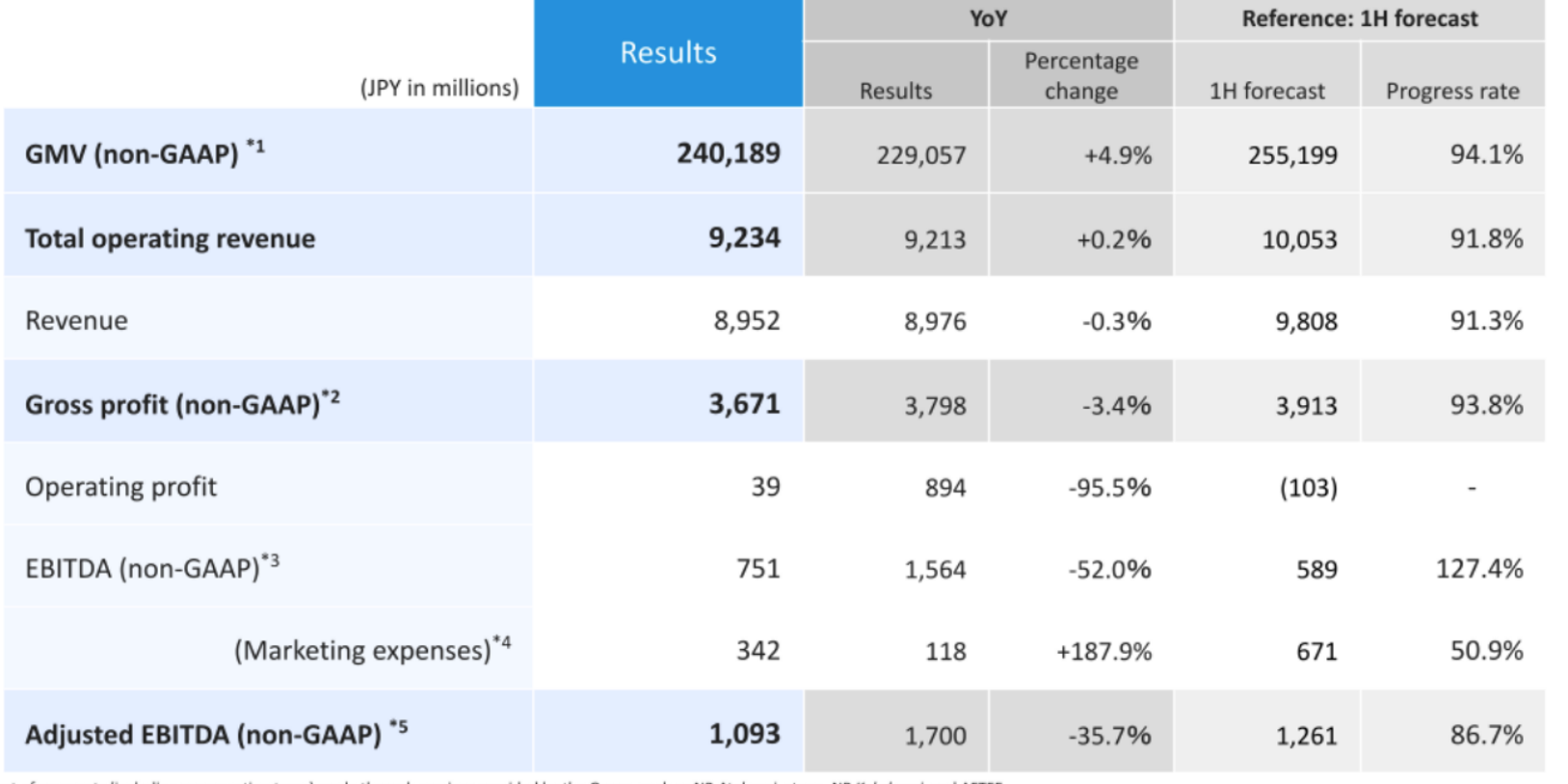

Financial Results for 6 months ending 9/30/22 vs. 9/30/21:

Total operating revenues were flat year over year, due to a decline in BtoC area which was offset by gains in BtoB.

In BtoC segments, the aforementioned tightened regulations on advertisement in beauty and heath sectors (60% of NP’s sales) pressured GMV.

Strength in BtoB segments are thanks to 1) post covid recovery in economic activities and 2) an increase in marketing efforts.

(Financial Results Presentation for 6 months ending 3/23)

However, operating expenses were up 25% by JPY 782 MM, causing operating profits to decline by 96%. Expanse rose driven by the company’s efforts to enhance marketing efforts and IT infrastructure.

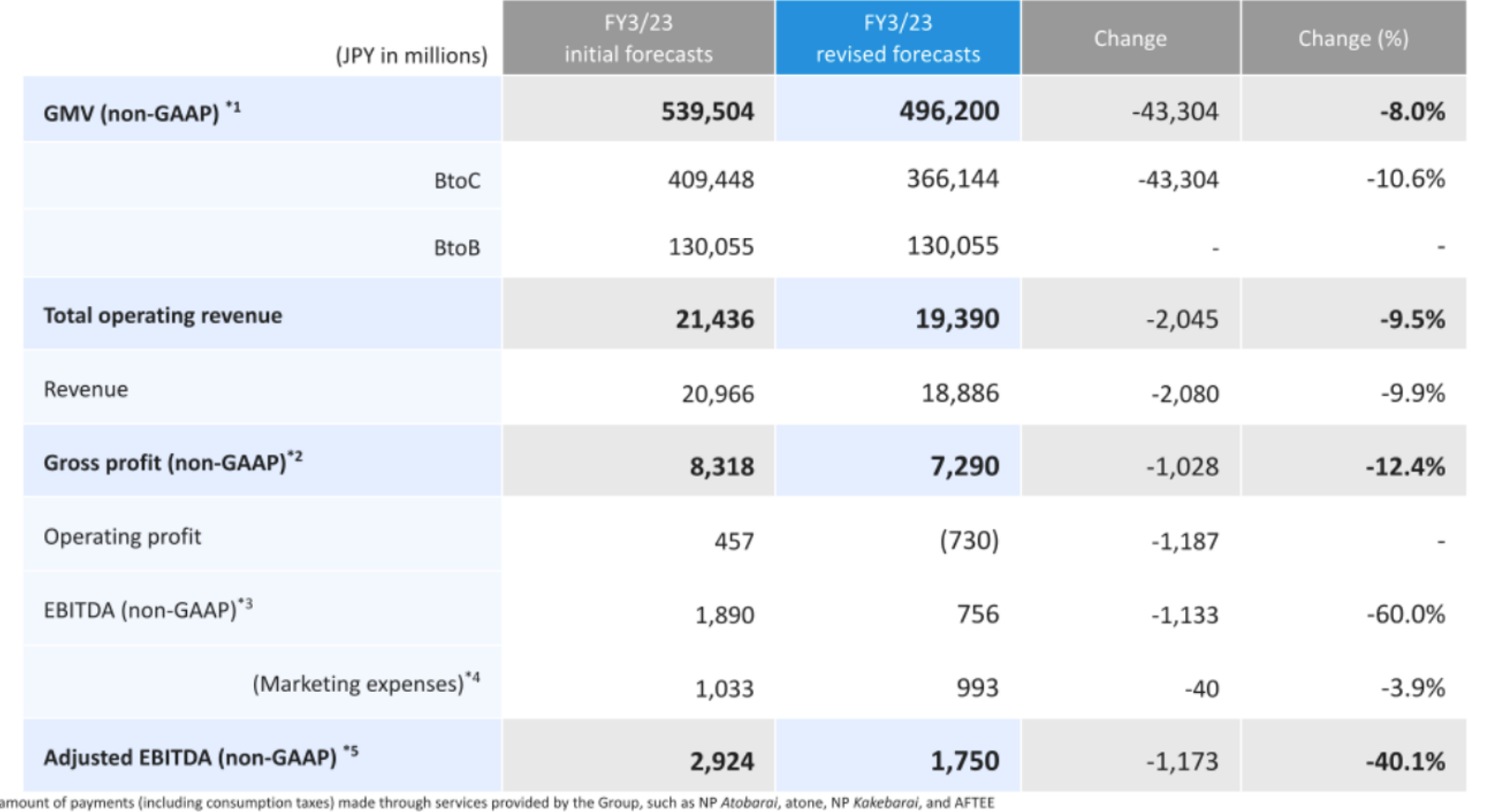

Downward revision to 3/23 results

(Financial Results Presentation for 6 months ending 3/23)

The act to limit promotional activities in beauty and health product segments have continued to put a downward pressure in GMV, albeit the magnitude of the decline is diminishing. Thus, the company has decided to lower its full year 3/23 guidance and a decline in operating profits is expected (shown in the above table).

However, given GMV back log is up 15% and reopening of the economy is picking up its force, management is confident in achieving its growth plan described in “Investment Thesis” above.

5. Total Addressable Markets (TAM)

The company’s target markets are sizable E-commerce. E-commerce market/TV home shopping size is estimated to be JPY 8.6 Tn, Home visit services (equipment installation/repair) market is around JPY 2.8 Tn. Taiwan is JPY 2 Tn, SMEs (small to med size enterprises/BtoB) is estimated to be JPY 140.4 Tn. The company’s estimates are based on reports by Yano Research Institute and Ministry of Economy, Trade and Industry. These company’s target markets exclude credit card payments.

6. Strengths and Weaknesses

Strength

As the Japanese BNPL pioneer, the company enjoyed the first mover advantage in the industry with a huge growth opportunity, as discussed in the preceding section.

Weaknesses

Competition from new and old

As discussed earlier, in Japan, the cashless payment industry is still at an early stage of its life cycle but the upside trend is clear. This growth has attracted and will attract new entrants in the forms of FinTech start-ups and the established banks expanding their service coverage. NP’s merchant customers don’t take buyers’ non-payment risks, thus, timely and accurate credit screening is a key component of NP’s service values. NP’s success in this area is based on the company’s 20 year operating history and a large knowledge base which is hard to replicate.

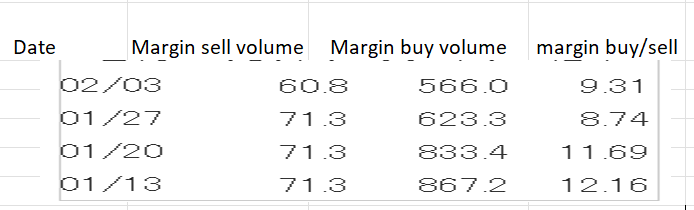

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For NP, margin buy sell ratio has been high but gradually declining (now 9.3x vs. 3x/acceptable level , but was 12x in the week of 12/13/22). Thus, the near term selling pressure is still there, needs to monitor but the trend is good.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance