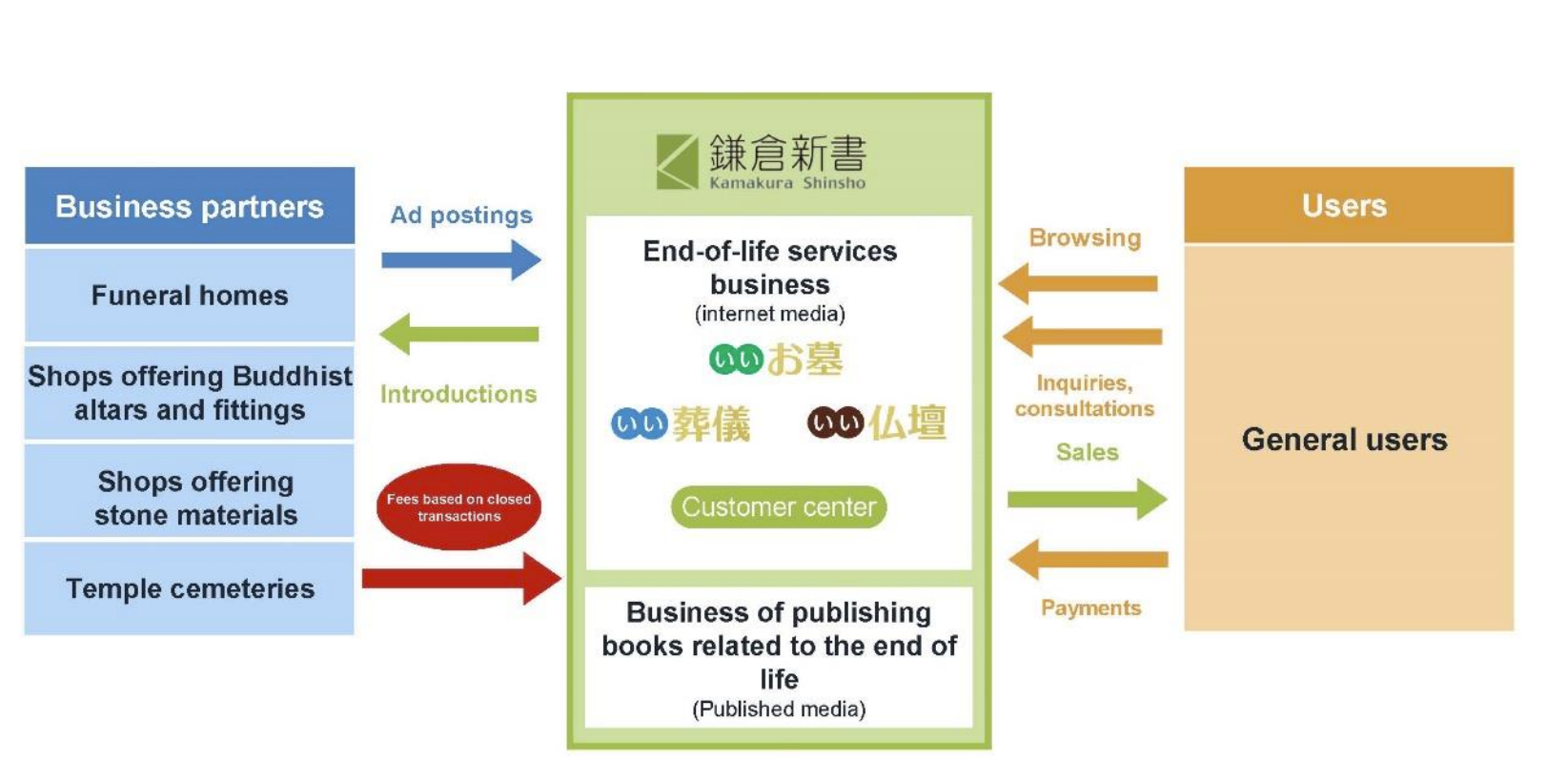

Kamakura Shinsho (“kamakura” or the “company”) runs two lines of businesses: end of life services (the main revenue source/98%) and the publication of books related to the end of life (the company’s original business). Kamakura’s core strengths lie in its three portal sites which are the platforms for matching target customers with service providers.

These service providers are Kamakura’s business partners who are funeral parlors, providers of Buddhist altars and fixtures, and shops offering graves and other stone materials. Kamakura Shinsho serves as their sales and marketing department and directs customer traffic to them. Its partner entities can focus on the actual negotiations and implementation, thus cutting customer acquisition costs substantially.

Kamakura’s main sites are “Ii Sougi (good funeral)“, “Ii Ohaka (good grave)” and “Ii Bututsudan (good Buddhist Altar).

1. Investment thesis

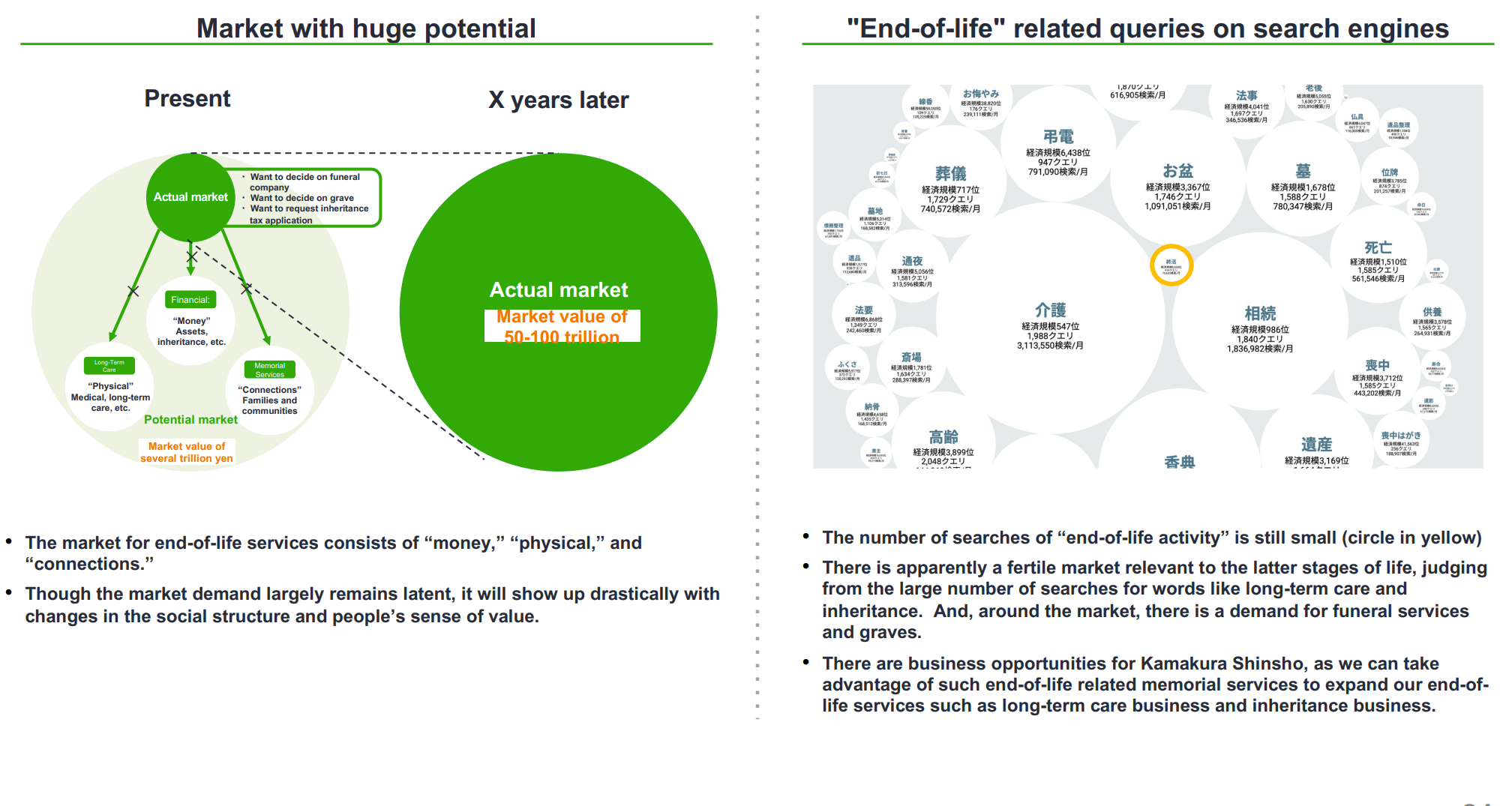

1) Huge unmet needs/growth potential

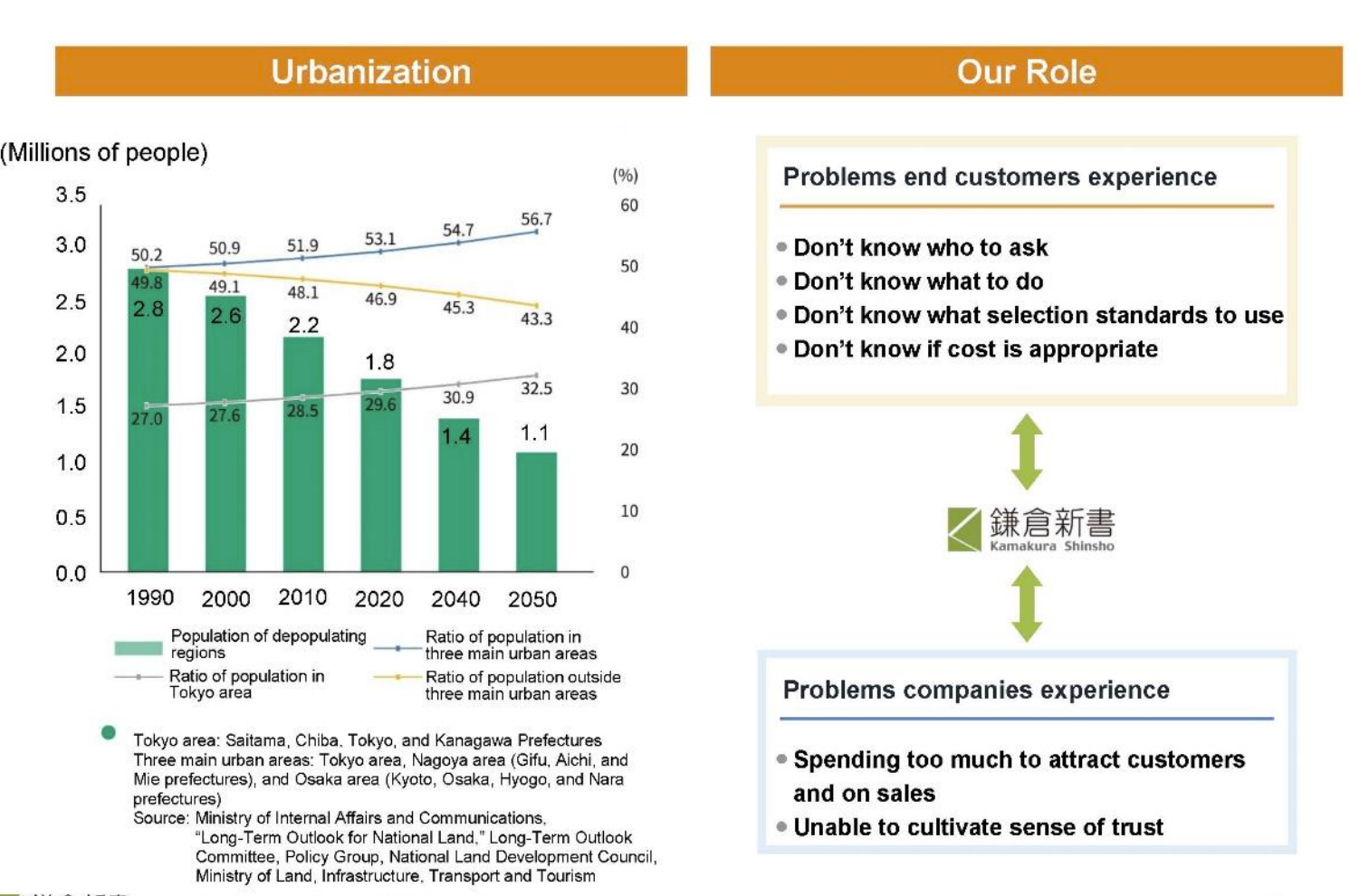

We all die, but the end of life planning is not something we tend to be well prepared for. When the need arises at the last minutes, say when one of your parents passes away, we tend to be at a loss: where should we begin in terms of a funeral preparation and dealing with the deceased’s financial affairs.

In 6/21, 12,322 people attended a three day “Ending Industry Conference”, where attendees could learn everything on how to prepare for the last phase of your life. The sheer number of attendance highlights a high level of interests of both consumers and service providers.

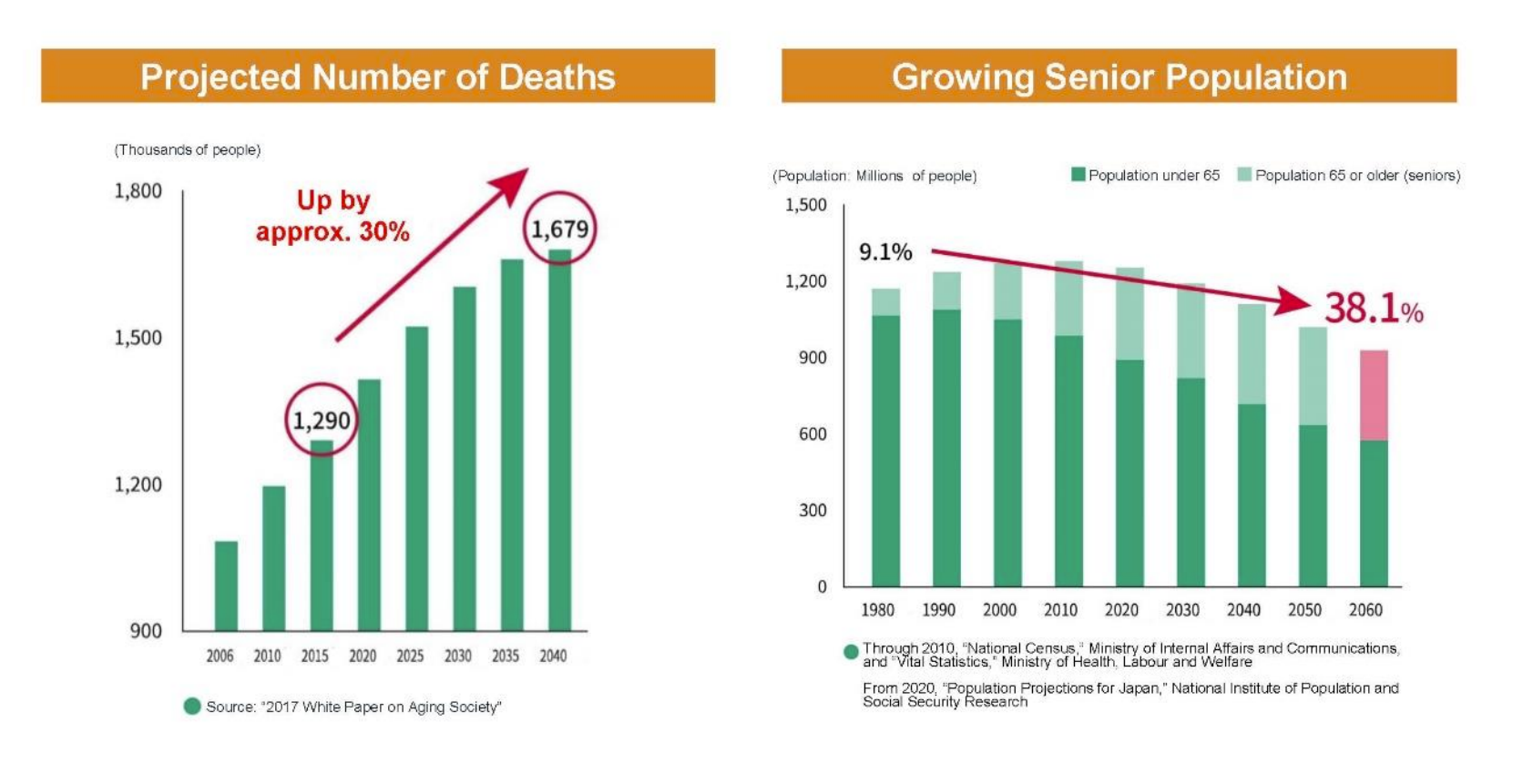

This rising interest in this area is a reflection of aging population (38% of Japanese population will be 65 years old or older by 2060) which leads to a constant rise in the number of deaths. Kamakura has played an important role in connecting service providers with clients who need solutions.

(Source: Corporate Profile Memo as of 3/26/19)

2. Transformation into an end of life infrastructure company

Kamakura has its root in funeral book publishing. Then they shifted from book publishing to on-line matching service between funeral service providers and mourners.

They are currently in the phase of expanding their service offering from information on funeral parlor and grave sites to the entire phases of end of life planning. Pre-death issues are complicated as a death can invoke phycological and financial ramifications to the people surrounding the death. To ease these pains,

Kamakura offers matching services in such areas as long term care insurance selection, will preparation and asset distribution. In another words, Kamakura is aiming to be an end of life infrastructure company.

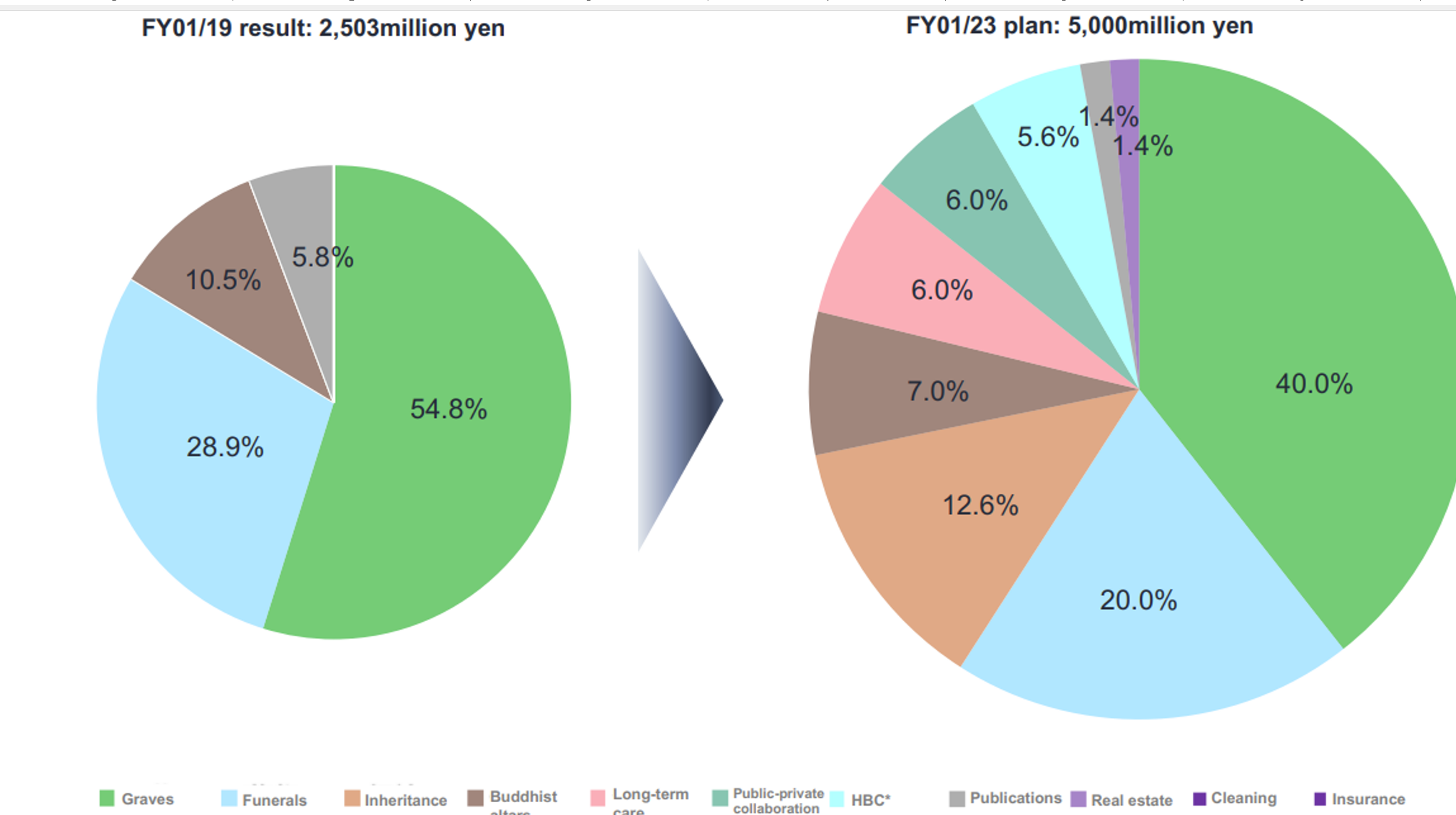

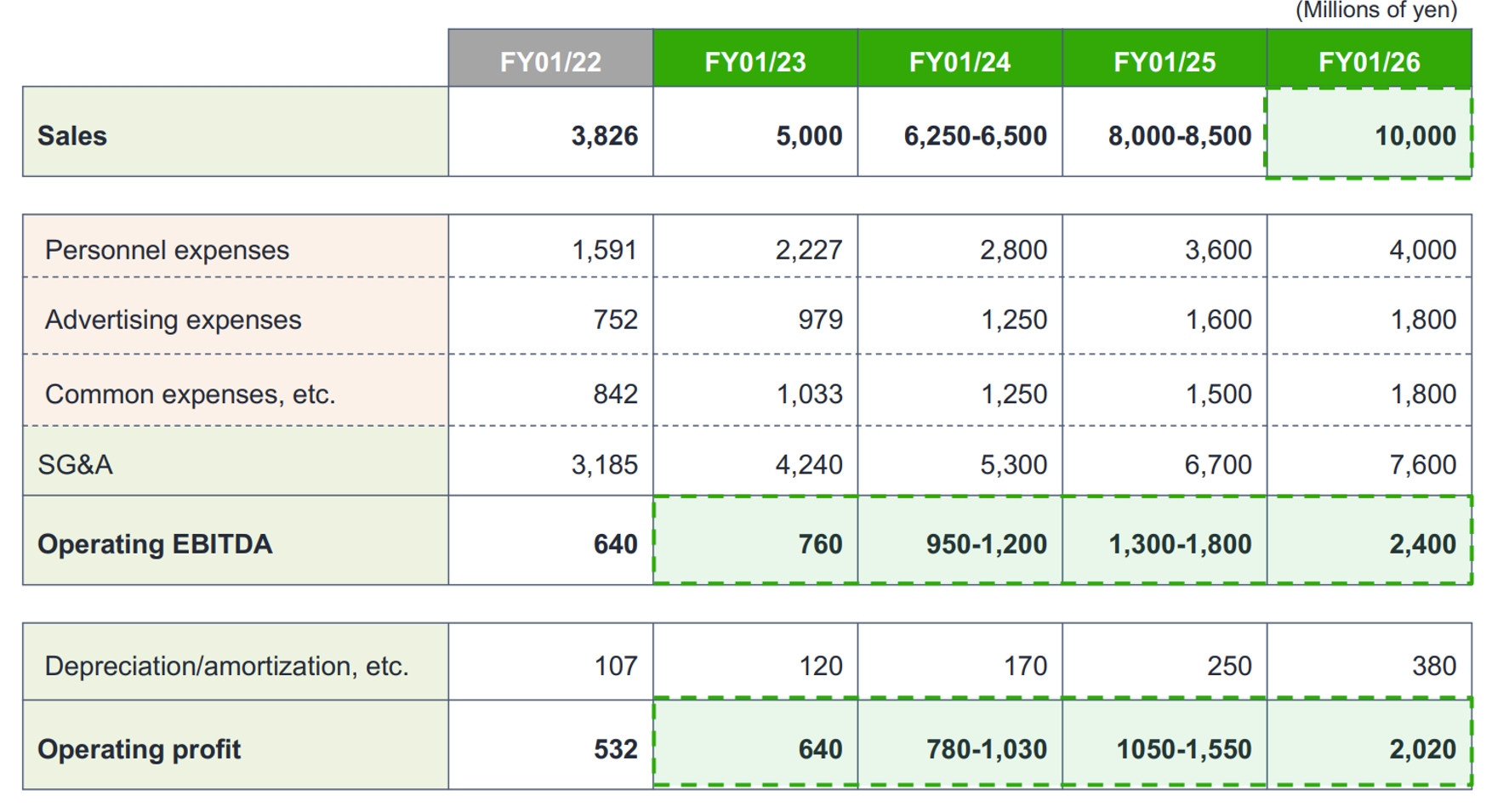

This transformation can in turn provide the company with sales volume increase (from JPY 2.5 Bn in 1/19 to JPY 5 Bn in 1/23 planned) and diversification as shown in the two pie charts below:

(Source: Business Results Briefing for the first 9 months for fiscal year ending 1/23)

3) Changing industry dynamics

The majority of Japanese people espouse Buddhist religious beliefs, and its culture and custom dictate process of funerals. Funeral size and costs are falling, due to a shrinking family size and a rising share of population choosing to live in urban area (i.e., limitation of space), as shown in the below left graph. Also, the Buddhist altars, fittings, and graves are all becoming smaller and cheaper, as customers adopt more frugal spending habits and due to increasingly diverse lifestyles and personal values. Against this industry backdrop – an increase in the number of funerals but a decrease in spending per a funeral the service providers are forced to work harder to reach customers. This trend enhances value of Kamakura’s products.

(Source: Corporate Profile Memo as of 3/26/19)

4. Expansion through partners

Kamakura has entered an alliance with Japan Post Co., Ltd., and begun an end of life service to Japan Post customers via its 1,466 post office branches. Japan Post is 32.4% owned by government , well known and trusted by the Japanese citizens. Japan Post alliance is important, since it targets seniors who don’t have Internet access.

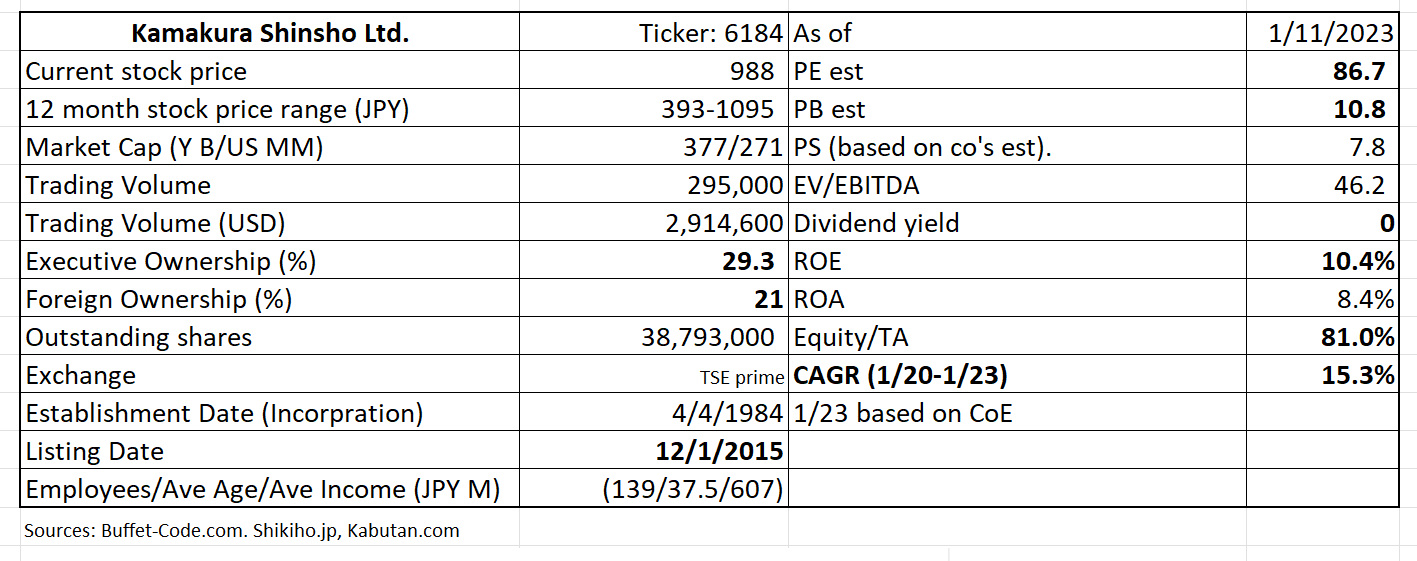

PE of 87 is toppy but can be partially explained by the fact that the company is at an early stage of transformation within a high growth industry. Many product segments are still in deficits.

2. Technically Speaking

(Source: kabutan.com)

The above chart shows Kamakura shares react nicely to good quarterly results. The stocks are currently at a resistant level of JPY 1,030 which it needs to push through with a large volume to notch higher.

3. Business Model

The company’s revenue streams are two-fold – success fees + ad listing fees.

The company’s core function is to connect its business partners with their clients. Kamakura runs an advertisement on behalf of its business clients and when end users purchase its business clients’ products/services, Kamakura get paid predetermined “success fees”.

(Source: Business Results Briefing for the first 9 months for fiscal year ending 1/23)

4. Financial Highlights

(Source: Business Results Briefing for the first 9 months for fiscal year ending 1/23)

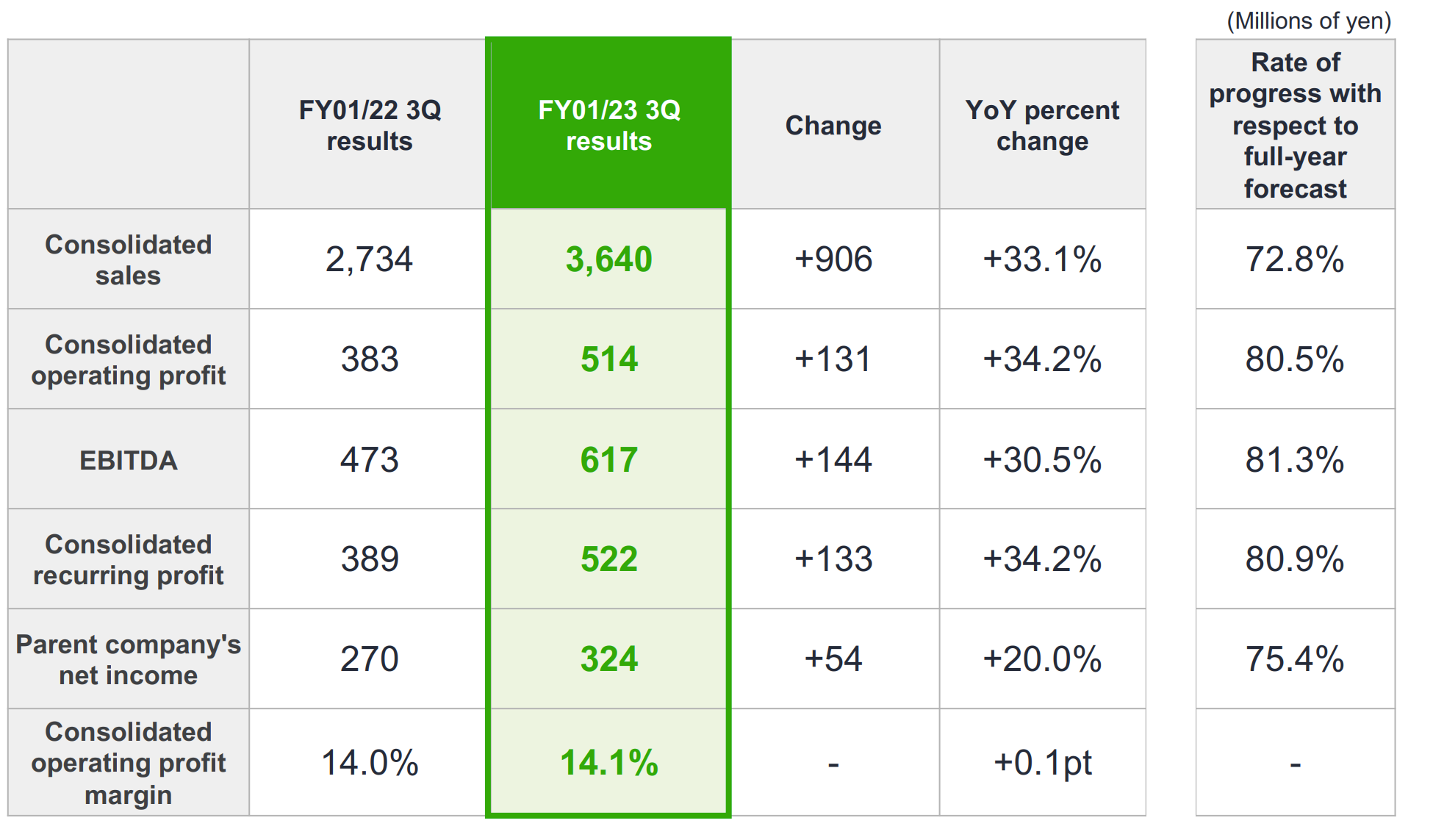

Financial results for the first 9 months ending 1/23 vs 1/22

Sales were up 33% driven by solid performance of both original businesses (three portal sites) and new initiatives.

Original businesses have benefitted from lifting of covid restrictions against funeral gathering. Sales have reached 73% of the company’s annual goal, shy of 75% it should have achieved during 3 quarters. However, as social lives further recovers from Covid restrictions, the company expects to reach its sales goal in FY 1/23.

New initiatives:

The below are notable successes in the new businesses:

Long term care insurance: the company was able to team up with many insurance companies. Also many experienced professionals are brought in, to assist in educating new customers.

Public-private collaboration (Kamakura’s collaboration with local governments):

The company is gaining awareness as a provider of “end of life services” among local governments. As of the end of Q3, the company have partnered with 237 local governments in 43 prefectures.

Financial Plan:

The company has been actively building its professional teams to propel new partner acquisitions. Amidst Covid induced-restrictions on social gatherings, the company was able to maintain flat sales level over the last three years. As people’s lives slowly return to normal, so will economic activities. Thus, guidance appears not to be too aggressive.

(Source: Business Results Briefing for the first 9 months for fiscal year ending 1/23)

5. Total Addressable Markets (TAM)

The company’s main investment merit is a potential growth of its target market and its ability to expand into the numerous auxiliary segments. The right pie chart illustrates a high volume of death related online searches, i.e., huge unmet demand exists.

(Source: Corporate Profile Memo as of 3/26/19)

6. Strengths and Weaknesses

Strengths

1) The industry with a huge growth opportunity, as discussed in the preceding section.

2) Name recognition as a Competitive advantage

Kamakura is well known as a company with deep knowledge base on death/ritual related customs. This should help it winning a new mandate from partners, public or otherwise.

Weaknesses

Shrinking funeral sizes and spending budgets

The above recent trends have led to the industry wide sales decline. This, in turn, intensifies competitive pressure among players, and cost cutting pressures have ensured. Kamakura’s services can be more valuable to partners who need to locate ideal clients at lower costs.

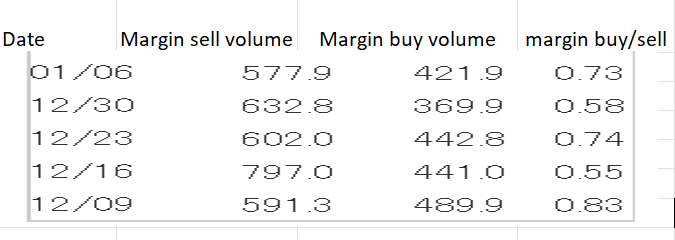

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Kamakura, margin buy sell ratio has been low at below 1x. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance