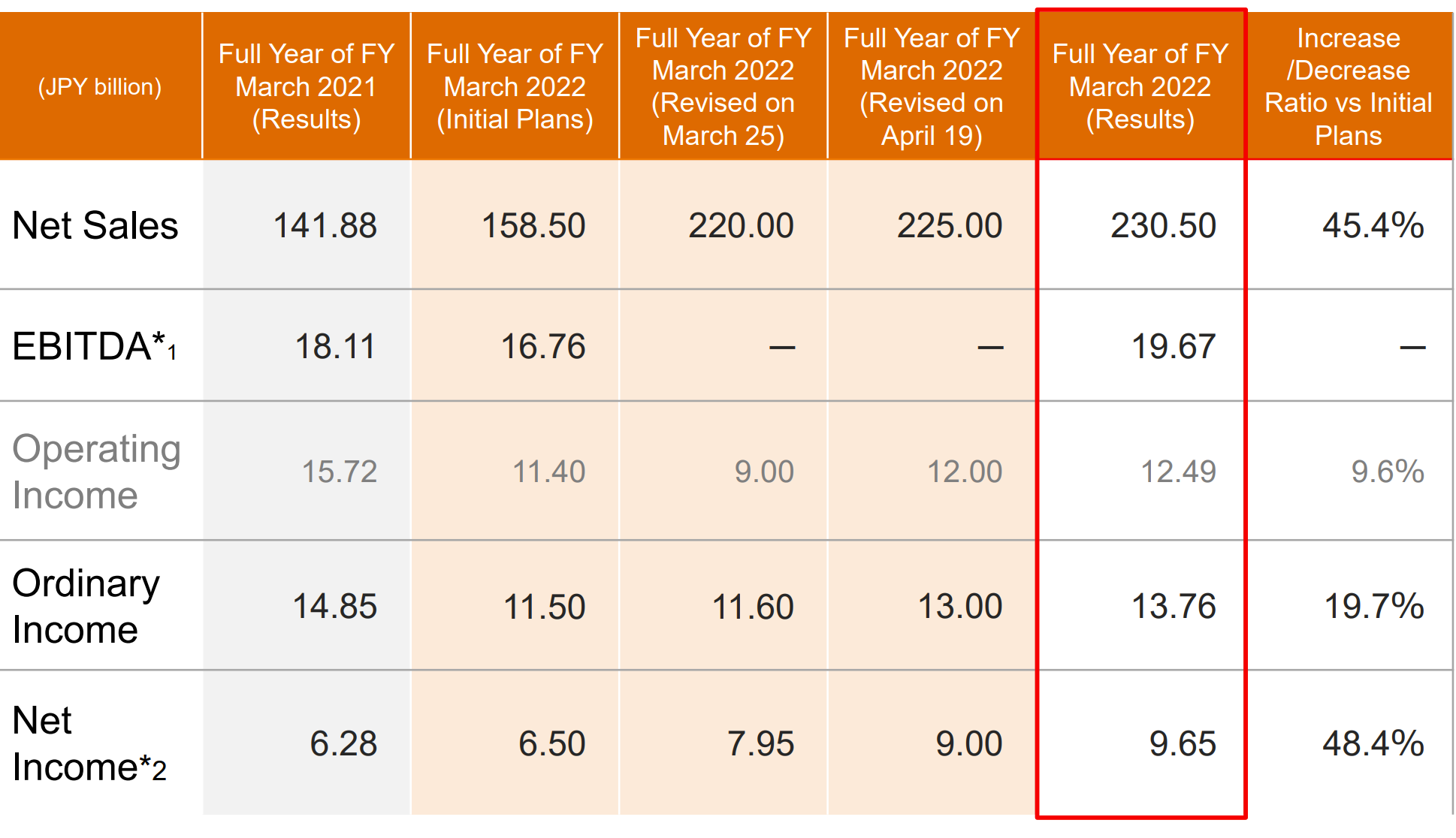

erex (“erex” and the “Company”) is a electricity retailer. It has entered into electricity sales for households after power retail market was liberalized in 4/2016 in Japan. The company has also expanded power procurement sources from other power generation companies to biomass power plants. Furthermore, it has entered into a joint venture with TEPCO Energy Partner* to expand sales of renewable energy.

*TEPCO Energy Partner – Electricity retailer operating under “TEPCO” brand throughout Japan, except Okinawa. It is a subsidiary of Tokyo Electric Power Company Holdings, Inc. (TEPCO) is Japan’s largest power company group.

1. Investment thesis

1) A rising presence in biomass power generation

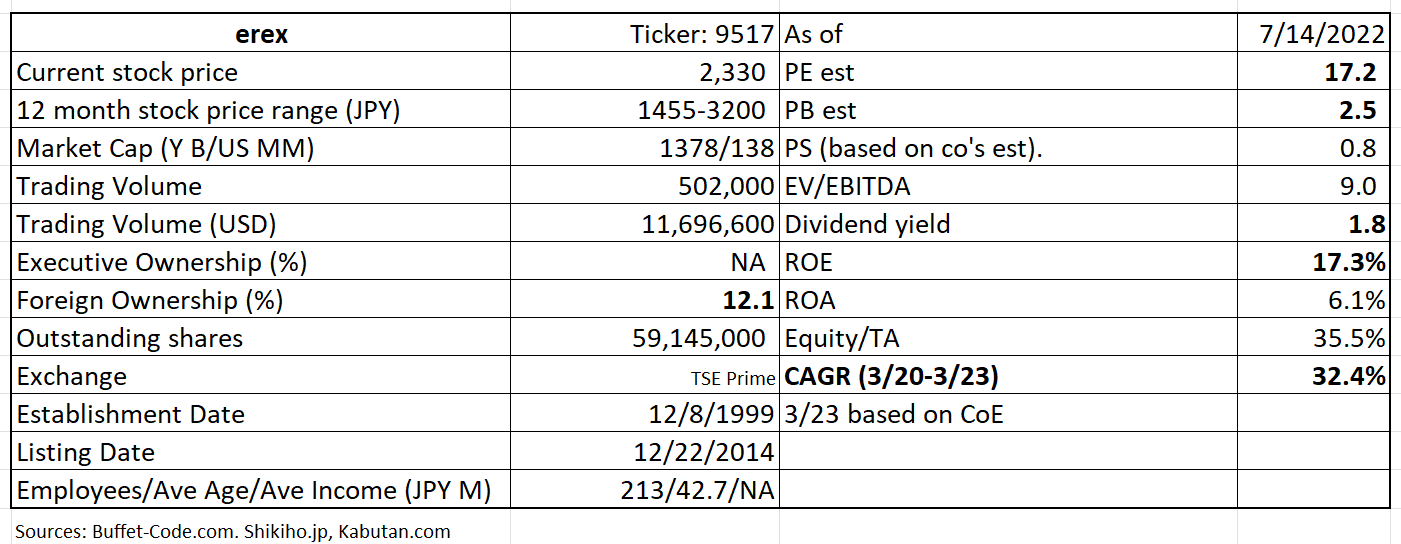

Current 5 biomass power generation plants are in operations. Two more will be opened by 2026.

(Source: Financial Briefing for FYE 3/22)

2) Two pronged business model itself is a differentiation factor

The company has built its comprehensive business model in which 1) each 4 group helps the other group making the profits for the entire company. Furthermore, 2) each group can independently be profitable by selling their products to un-related customers. This sets them apart from its peers.

Each group’s strengths are highlighted below:

1) Fuel Business – Sourcing

erex is the first in Japan to operate a biomass power plant, using PKS* as a main fuel. “erex Singapore Pte Ltd.” in Singapore is its overseas outlets regarding fuel procurement. By diversifying “sourcing”, such as setting up its subsidiaries and working with partner companies in countries like Malaysia and Indonesia which is well known for a palm oil production and manufacturing PKS will consequently help erex’s stable fuel procurement.

*PKS stands for Palm Kernel Shell. PKS is the remaining coconut shell after palm oil has been extracted from palm seed.

2) Electric Power Business – Generation

erex is continuously constructing and operating biomass power plants throughout Japan by valuing a harmonious relationship with the local community. The company currently have 5 biomass stations which makes it the leading biomass power generation company in Japan with output of 350 megawatts.

3) Trading Business

Presently, erex handles three types of powers: 1) power from its own power plant, 2) power from other power companies, and 3)power traded on JEPX*. They adjust these procurement ratios according to market conditions to optimize the power supply configuration and achieve economic efficiency at the same time.

*JEPX: Japan Electric Power Exchange – Established in 2003, JEPX is the only electric power exchange in Japan.

4) Retail Business

erex was the 3rd to be registered as a power producer and supplier when the deregulation of electric power took place in 2000 and now has over 20 years of experience. In 2019, it created its subsidiary Evergreen Marketing jointly with TEPCO Energy Partner to serve high voltage/extra high voltage customers. In 2020, it founded Evergreen Retailing to enter low voltage customer market.

Note: Difference between Low and How Voltage power

Low Voltage Customers (individual households): In homes, the power used to run appliances and lighting uses low voltage. Low voltage electricity flows through a wire as a direct current, or DC for short. Direct current means that it’s constantly flowing in one direction, because this electricity can only flow in one direction, it does not create an electromagnetic field surrounding the wire.

High Voltage Customers (Corporate customers): High voltage electricity is created in a very different way than low voltage electricity. Instead of using batteries, high voltage electricity uses generators that rotate quickly to create electricity. These generators are most often powered by steam or gas, and they produce alternating current electricity that is very high voltage.

3) Overseas expansion

The near term focus and profit driver is development of sorghum plant*in Vietnam

*Sorghum is an important crop that serve multiple purposes as human food, animal feed, and bioenergy production. There are opportunities to produce different types of biofuels from sorghum-based biomass. Sorghum with its vast genetic resources can serve as bioenergy crop and not compete against the value of it as food and nutritional security crop. Bioenergy crops provides an opportunity for agriculture to be part of solution for energy and mitigation to climate change (from “ScienceDirect”)

In Vietnam, erex aims to develop 4.3GW of biomass power plants by 2035. The significance of Biomass instruction in Vietnam is 3-fold: stable power source to Vietnamese, contribution to employment, and de-carbonization.

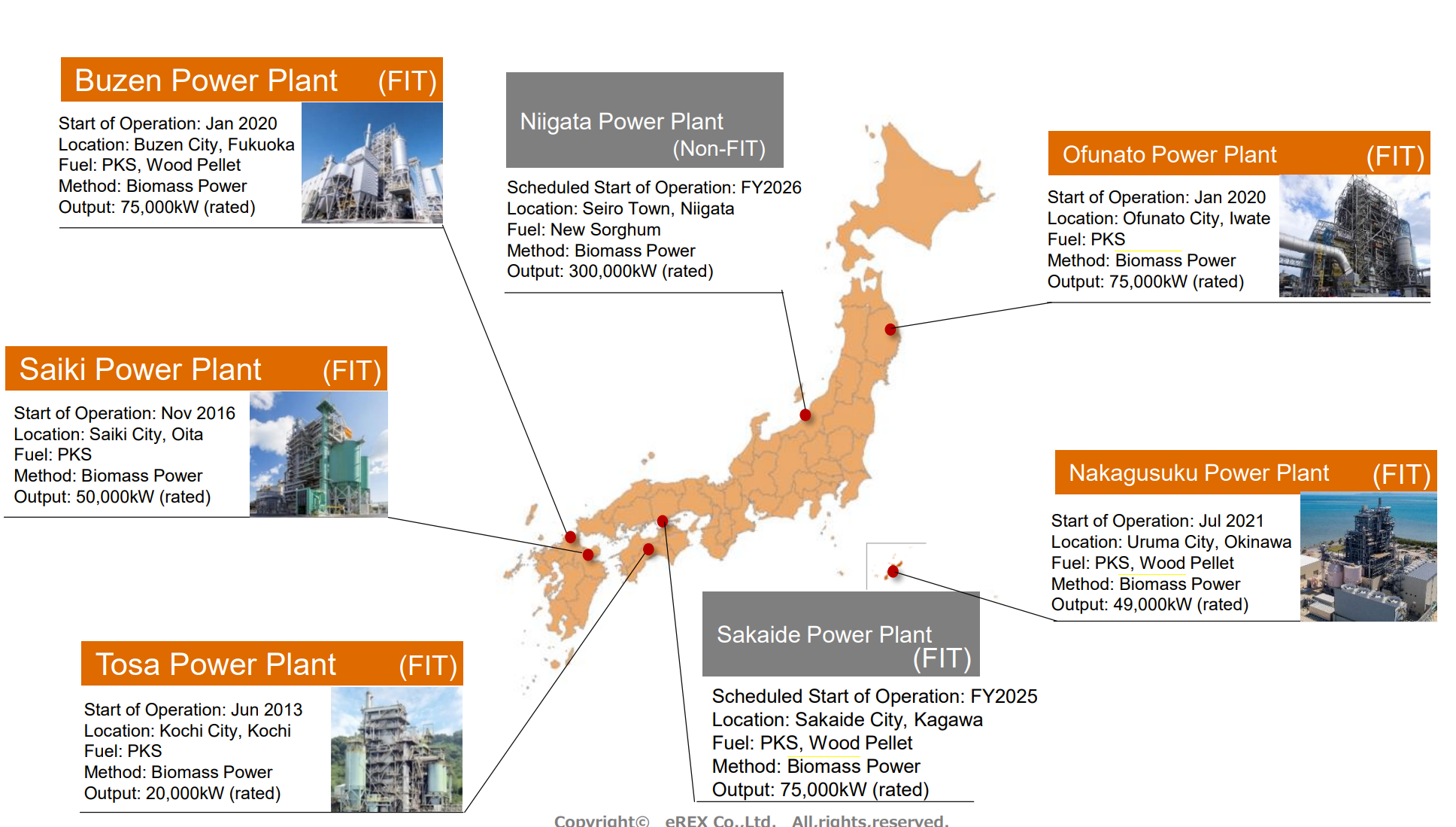

4) Rising dividends

Despite being a growth company, erex has balanced its funding requirements with dividends payout.

(Source: Financial Briefing for FYE 3/22)

2. Technically Speaking

(Source: buffet-code.com)

The stock is on a gradual uptrend year to date. There is a volume cluster at JPY 2,540 which the stock needs to push through, with a heavy volume to continue to move higher.

3. Business Model

Discussed in investment thesis section above.

4. Financial Highlights

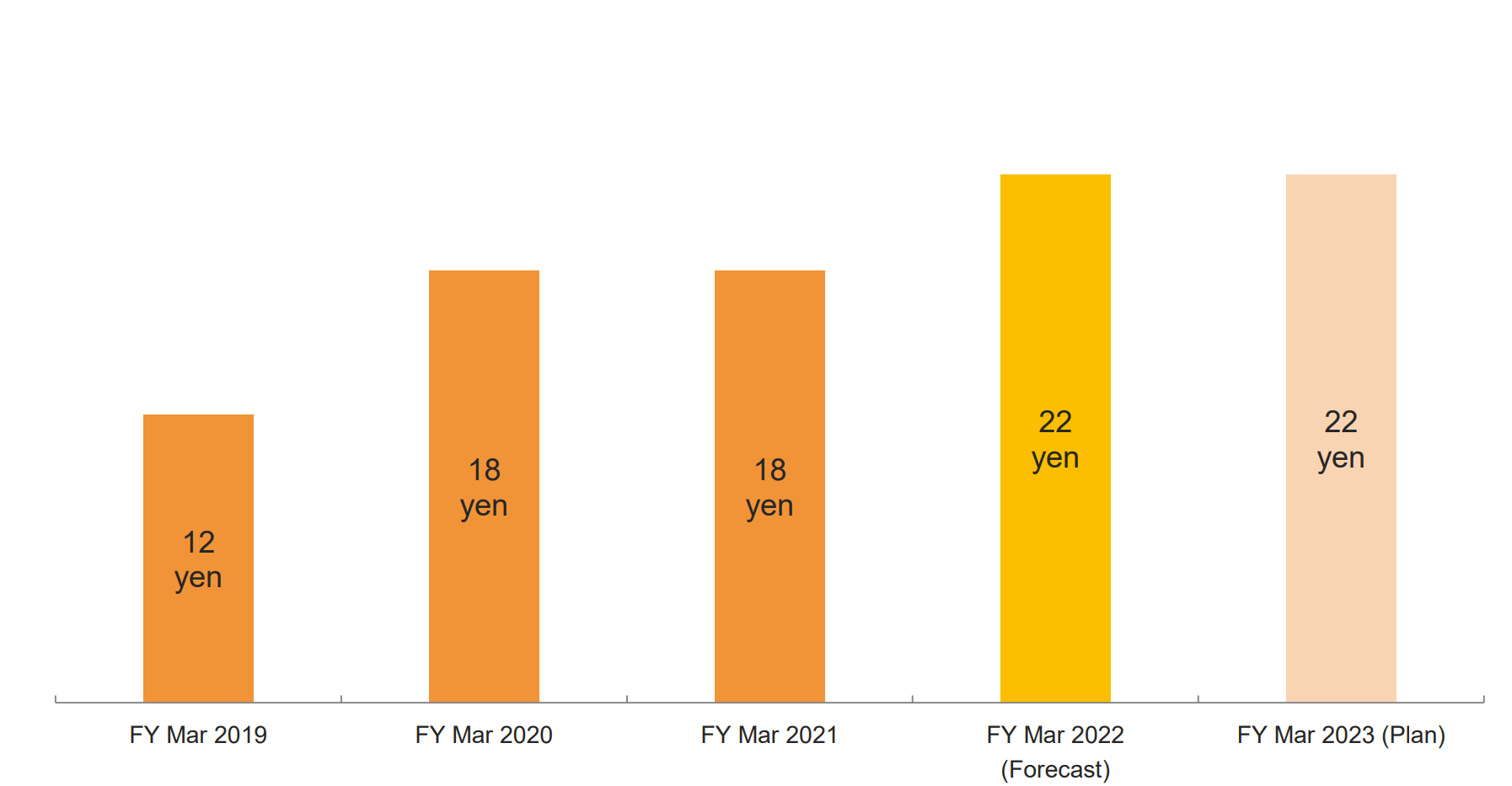

Consolidated results for full fiscal year for FYE 3/22

FYE 3/22 sales beat the twice-upped guidance* slightly. The drivers of the higher guidance was thanks to strong performance of Evergreen Marketing Co., Ltd (corporate customers) and Evergreen Retailing Co., Ltd (individual households). In addition, reinforced sales activities at sales partners and alliance partners drove the upside.

The high-voltage sector saw a strong growth as the power sales volume increased to about 4,614 million kWh (up 97.3% year-over-year) due to acquisition of large projects and an increase in CO2-free plans.

In the low-voltage sector, power sales volume was about 1,212 million kWh (up 18.2% year-over-year) and the number of customers was about 289,000 (up 56,000 year-over-year) as a result of reinforced sales activities at existing sales partners and new alliance partners.

On the other hand, the cost of power procurement rose due to soaring prices of LNG, coal, and other resources. This has resulted in operating income missing the initial guidance, although it met the 2nd and updated guidance.

* Reasons for 2 guidance hike

erex raised its sales guidance twice for FYE 3/22, as the power sales got increasingly robust cold winter increased heating demand.

(Source: Financial Briefing for FYE 3/22)

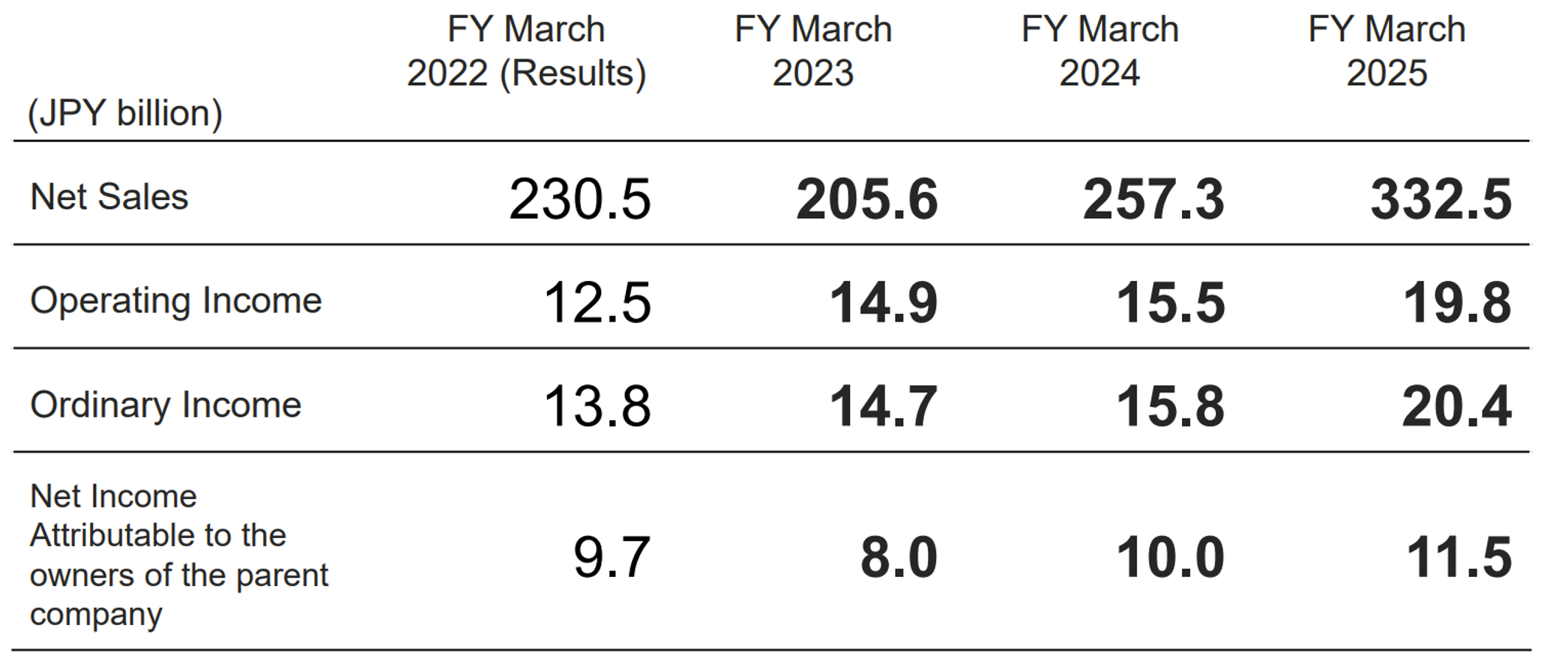

Mid-term plan

The company has set a conservative 3 year growth plan. Sales is expected to decline a bit from the level of FYE 3/22 level which had enjoyed strong seasonal demand. This demand surge may not be repeated. From FYE 2024 forward, Vietnam and other overseas investments will slowly contribute to the group wide sales. In Vietnam, full-scale cultivation of Sorghum is scheduled to start in stages, starting with candidate sites where trial cultivation has been completed.

(Source: Financial Briefing for FYE 3/22)

5. Total Addressable Markets (TAM)

The overall power usage is dependent on the economic activities which are cyclical. However, global Biomass market will likely steadily grow under the current renewable energy cultivation policies and movements.

The global Biomass market size was valued at USD 53.5 Bn in 2021 and is anticipated to grow at a CAGR of 6.3% during the forecast period (from 2021 through 2030) according to a recent market study by Quince Market Insights. Biomass is a renewable organic material that comes from animals and plants. It can be converted to renewable liquid and gaseous fuels or burned directly for the heating process.

Biomass serves as a sustainable and low-carbon alternative to fossil fuels. New developments are aiming at using more biomass fuels which are set to drive the global biomass market growth. Also, rising needs to regulate the emission of greenhouse gases (GHG) are also a factor rising the demands for global biomass market. (Source: Quince Market Insights, cited by Global Newswire on 1/24/22).

6. Strengths and Weaknesses

Strengths

Growing industry backdrop.

The Sixth Basic Energy Plan was approved by the Cabinet in October 2021, and the target for the introduction of renewable energies in the power supply mix for FY2030 was raised significantly from 22-24% to about 36- 38%. Asian countries have also set policy targets to increase the introduction of renewable energies. In sum, the interests and needs of customers in Japan and overseas for renewable energy have been increasing.

Weaknesses

Rising costs

The cost of procuring biomass fuels and other fuel sources has been rising, due to the high cost of materials and marine transportation and the weak Japanese yen. However, erex Group has secured stable fuel procurement through an appropriate combination of long-term contracts and spot contracts, utilization of stockpiles, and expansion of suppliers. In the trading business, although the cost of procuring power rose due to soaring resource prices, erex Group has been working to balance supply and demand by combining trading in the wholesale power trading market and power derivatives trading, while focusing on its in-house and PPA (power purchase agreement)* power sources.

*An Energy PPA is a long-term power purchase agreement between a renewable energy developer and a corporate consumer or seller who will then resell the energy. The main benefits of PPAs for consumers are: access to competitive, stable and predictable price.

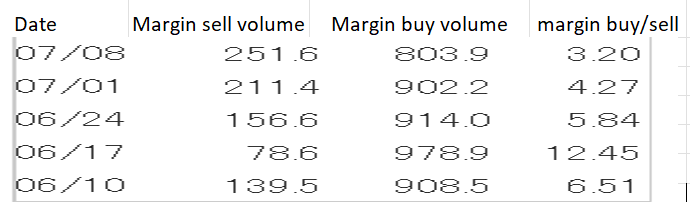

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For erex, margin buy/sell ratios has been declining and coming down to an acceptable level of around 3x. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance