Vector Inc. (Ticker – 6058): Asia’s top PR firm, eying the global stage!

Vector (the company or “Vector”), with the market share of +40%, is the #1 PR firm in Japan (market size: $9Bn). The company has gained significant customer acceptance by being “Uniqlo/MacDonald” of the PR industry. It is now ready to enter much bigger Japanese advertising market and global PR market.

Vector is not only a great stock but is a booster to Japanese economy. By introducing good products and services to wide range of consumers, Vector is lifting consumption which accounts for 55% of Japanese GDP in 9/21.

1. Investment thesis

1) Advertising market disrupter

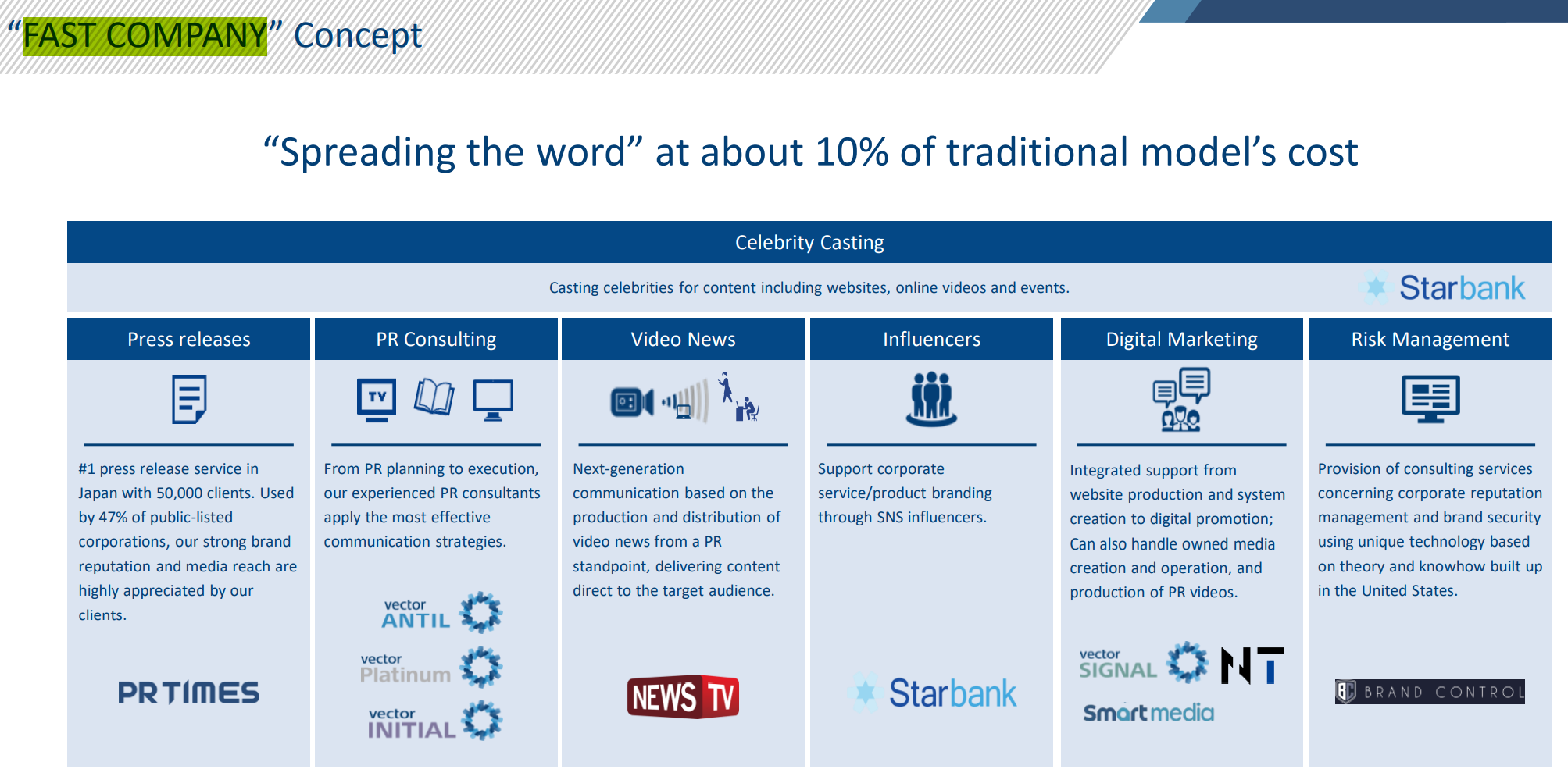

The company claims that it is offering the PR services at 10% of traditional advertisement costs. The company’s high cost-performance is supported by its unique “FAST COMPANY” strategy.

The 3 key phrases symbolize the FAST Company mission: Low Cost, Middle Quality and Speedy, that is,

Tha Company aims to inform the target customers of new products/services via the most effective digital means. The company’s utmost strength lies in its ability to offer every step of PR process: 1) Press Releases 2) ad creation. They also offer risk management (brand protection), as shown in the chart below.

(Source: Interim Results for FYE 2022 as of 10/15/21)

1) Press Releases (Service name: PR Times)

Vector, through its listed subsidiary PR Times, is the #1 Press Releases service provider, used by 65,000 clients and 47% of listed companies.

2) PR Consulting (Service name: Antil)

Vector’s PR consulting teams can provide the most effective communication strategies from the initial PR planning to the final execution.

Vector’s 3 men team reduces advertising costs since the client does not need to keep internal Ad/PR teams.

Vector further reduces the costs of their services since their services are standardized, thus scalable, based on their vast library of past successful services.

3) The diverse digital media venue offerings (Service names: NewsTV, StarBank, SmartMedia)

Vector can create and deliver (NewsTV & SmartMedia) video contents which are best suited to the target audience, using the carefully selected spokesperson from their large talent pool (StarBank).

2)Ability to reach consumers from many angles

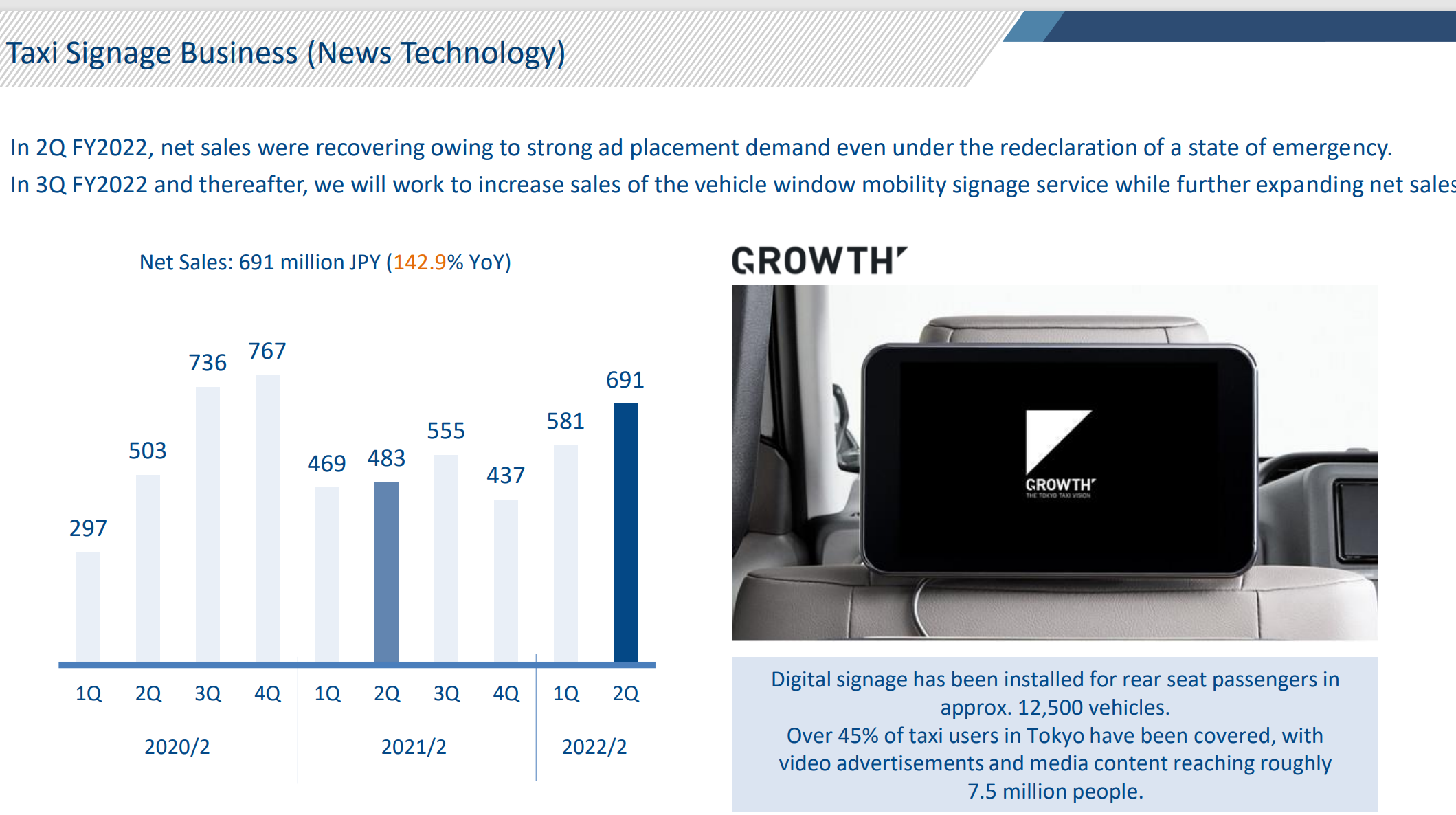

The company can offer its clients many PR venues to best suited for the client markets. The three examples of these venues are 1) digital signage installed on a taxi’s rare seat, 2) Canvas – a service to provide PR signage on car windows and 3) Break – PR video clips on the screen can get undivided attention of smokers in breakroom.

(Source: Interim Results for FYE 2022 as of 10/15/21)

3) Asia’s largest PR Company

By size of 2019 annual sales, Vector ranked at the top among its Asian peers. A next leg of growth can come from many businesses which Vector has invested in. Please refer to 3) “Investment” item in “Business Model” section for the list of the company’s involvement in wide range of growth industries.

(Source: Interim Results for FYE 2022 as of 10/15/21)

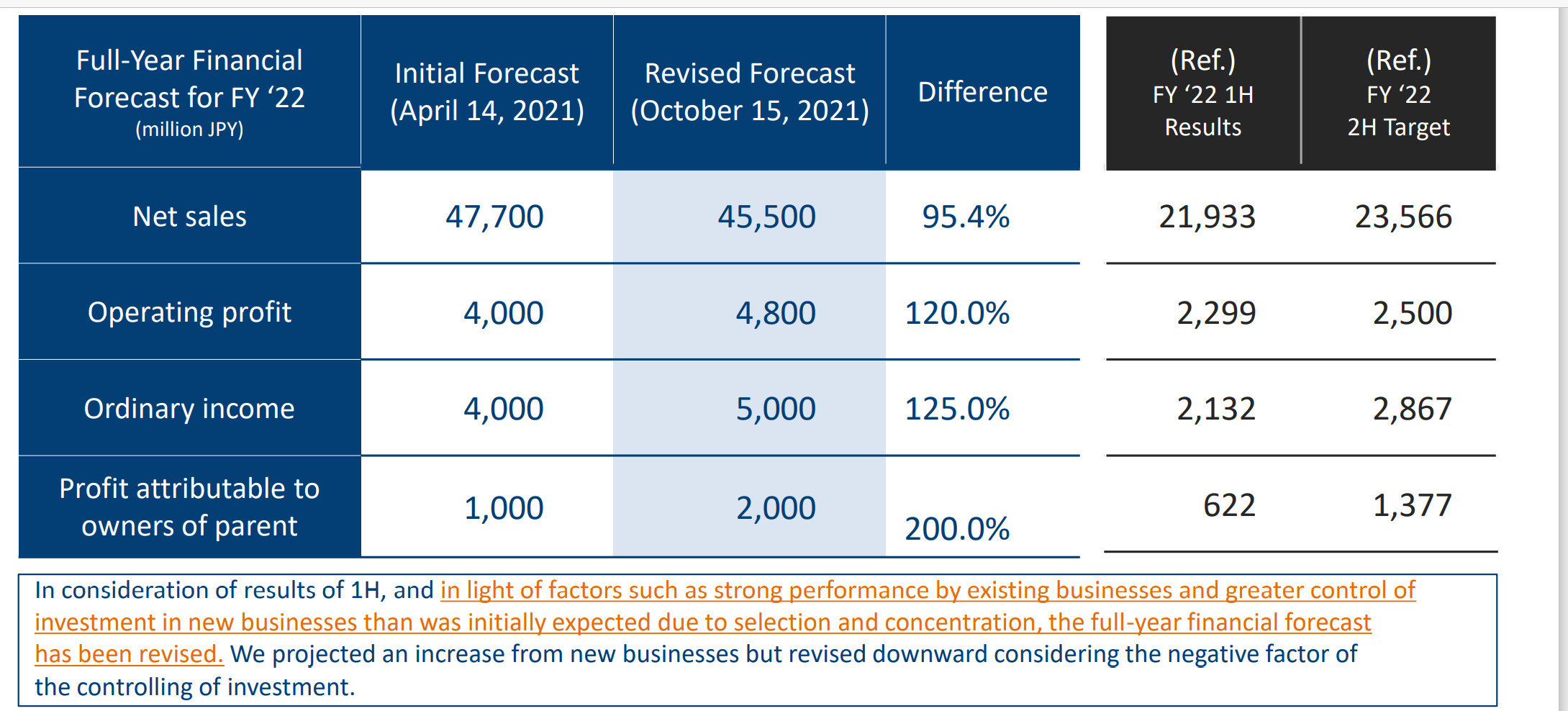

4) Full year guidance raised for FYE 2/22

Based on the solid first 6 months of FYE 2/22, the company raised guidance for all the profit lines by 120-200%. Sales projection was slightly (about 5%) reduced since unprofitable new initiatives were pruned out. This streamlining of projects has led to the higher profitability estimates.

(Source: Interim Results for FYE 2022 as of 10/15/21)

9 months results for FYE 2/22 released on 1/14/22 shows a good progress toward this upped guidance. Sales has reached 75% of the new guidance and operating and net income reached 80%.

| Vector Inc. | Ticker: 6058 | As of | 12/31/2021 |

| Current stock price | 1,161 | PE est | 27.7 |

| 12-month stock price range (JPY) | 881-1395 | PB est | 4.4 |

| Market Cap (Y B/US M) | 553/6 Bn | PS (based on co’s est). | 1.2 |

| Trading Volume | 1,683,000 | EV/EBITDA | 18.4 |

| Trading Volume (USD) | 19,539,630 | Dividend yield | 0.7 |

| Executive Ownership (%) | 39.1 | ROE for 12/20* | 3.9% |

| Foreign Ownership (%) | 4 | ROA for 12/20* | 1.5% |

| Outstanding shares | 47,936,000 | Equity/TA | 40% |

| Exchange | Mothers | CAGR (2/19-2/22E) | 15.3% |

| Establishment Date | 3/30/1993 | 2/22 E company forecast as of 12/21 | |

| Listing Date | 3/27/2012 | ||

| Employees/Ave Age/Ave Income (JPY M) | 89/37.3/765 | ||

| Sources: Buffet-Code.com. Shikiho.jp, Kabutan.com |

2. Technically Speaking

(Source: TradingView.com)

The stock shot up on 10/15/21 on a large volume, reacting to the company’s increased guidance for FY 2/22. The stock has come down after that, due partly to the general market weakness and profit taking. The above chart shows that the stock is currently trading at JPY 1,165 which is the largest volume cluster. If the daily trading volume stays at a current elevated level, it has a good chance of pushing through this ceiling.

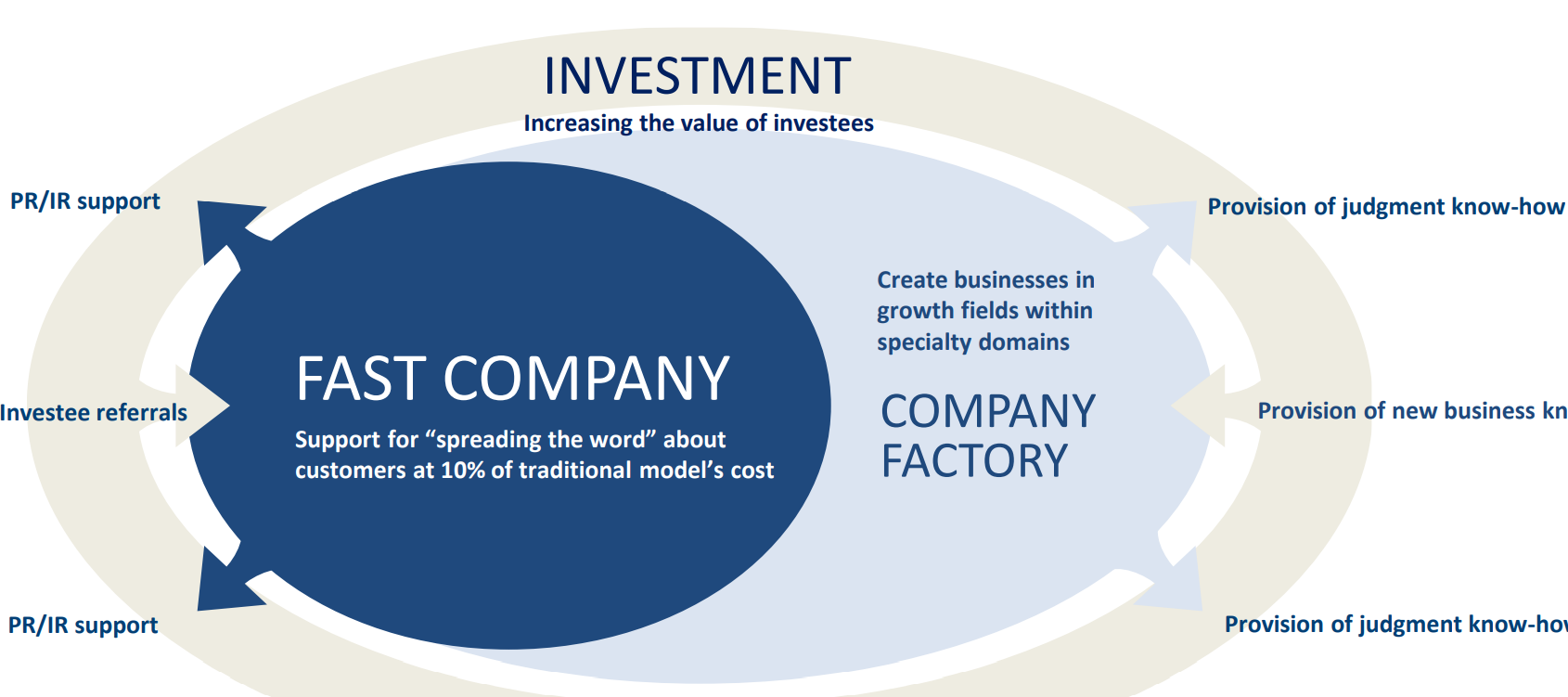

3. Business Model

(Source: Interim Results for FYE 2022 as of 10/15/21)

As shown in the above graph, Vector groups are broken into three distinct groups:

1) FAST Company

This group support company’s PR initiatives which are discussed in the “Ad industry’s disruptor” section.

2) COMPANY Factory

Vector is engaged in several new initiatives which will lead the company forward.

Ashita Cloud – The Personnel Evaluation Cloud service (Ashita Cloud) is an example of the new initiatives to fuel the company’s further growth.

Ashita (tomorrow in Japan) was acquired by Vector in 2018. It uses AI and is offered on SaaS/subscription base and just turned profitable in Q2 for FYE 2/22.

Hiromeru (means “spread the words/concepts” in Japanese)

Hiromeru is ad industry e-commerce site. It aims to increase efficiency in sales processes by creating a platform enabling online shopping of Vector Group’s PR menu. Hiromeru provides wide success case studies, invoking the PR demands which the clients did not even know that they had.

JOBTV – Another new service which was just launched on 11/18/21. JOBTV is a Netflix of a recruiting site. A candidate can search and watch an organization’s recruiting video as one watches a show in Netflix (see below for the screen shot of hiring companies). Similarly, a hiring company can search and watch PR videos of candidates.

3) INVESTMENT (and M&As)

The company invests in the areas which can enhance the company’s services offering in the future. Chairman/founder Mr. Nishie has noted that the company’s goal is to acquire a business at 5x EBITDA. However, even when Vector needs to pay up to 6-7x EBITDA, the acquired businesses tend to grow their EBITDA 2-3 times in a year by being part of Vector’s digital infrastructure.

The below table highlights Vector’s track record of its investments in wide range of growth industries. 24 firms have IPOed so far and 4 companies went public in 2021, including Robot Payment (the blog is available in www.JapaneseIPO.com) and Livero.

(Source: Interim Results for FYE 2022 as of 10/15/21)

4. Financial Highlights

The company reported stellar first 9 months results for FYE 2/22 on 1/14/22. Both sales and operating income have reached their historical highs, thanks to the strength of two core groups: PR and Press Releases. Most notably, PR Times (press releases segment)’ customer base now stands at 65,000 entities and tie-ups with regional banks has further expanded PR Times’ reach into a wide customer base. PR times strength is critical since PR Times account for 10.5% of group wide sales but generates 39.5% of operating profits. Vector owns 58.32% of PR Times whose results are consolidated into Vector’s financials.

Unit: JPY MM

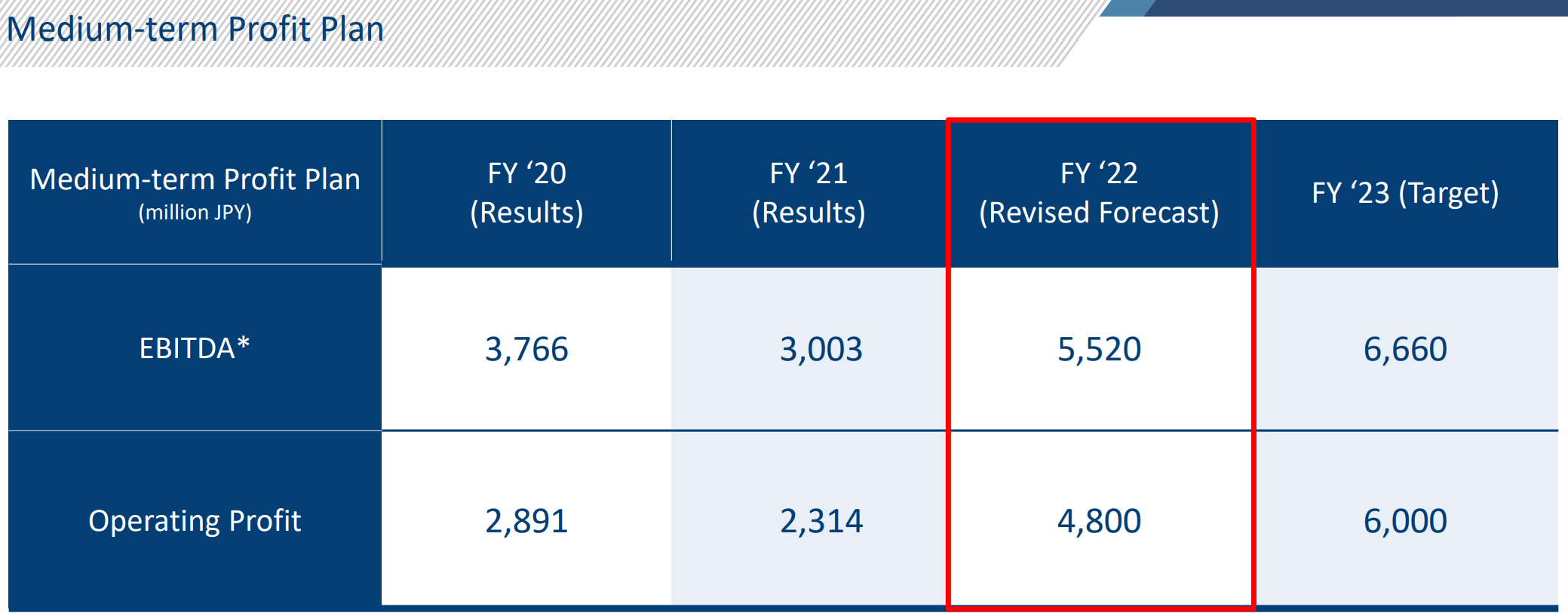

Three year plan (FY 2020-2023)

The company has kept EBITDA and Operating profits estimate for FY 3/23 with growth rate at 20% and 25%, respectively.

5. TAM (Total accessible markets)

The company estimates that Japanese PR market at JPY 100 Bn ($875 MM) and advertising market to be JPY 6 TN ($53 Bn). Thus, Vector’s current market share can be calculated at 45.5% in Japanese PR market and 0.8% for advertising market.

Globally, Statista estimates PR market was worth $88 Bn 2020 (according to its 11/8/2021 report). The same report expects that the worldwide PR market will grow to $125 Bn in 2025 at 7.4% of CAGR (compound annual growth rate).

Therefore, we can conclude that there is ample room for growth for the company in Japanese advertising market. The global PR market can be more challenging for the company, due to language and cultural differences. However, the company’s willingness to invest in all walks of economy should have given management an ability to quickly learn the best course of “attacks” in new markets.

6. Strengths and Weaknesses

Strengths

1. Management

The Company’s competitive strength is very vocal founder, Mr. Nishie. He has created the leading PR company by steadfastly focusing on good products at low costs. Now he has a mission of growing company by 1) addressing much bigger advertisement market and 2) investing in auxiliary business areas which can further grow, once it is incorporated into Vector eco system.

2. Industry Tailwind

As seen in the TAM section above, the addressable market for the company is wide open. The market can actually be even bigger since Mr. Nishie has an uncanny ability to approach a business which Vector can buy or invest in and incorporate it to broaden Vector’s addressable market.

Weakness

Ad/PR spending is viewed as “highly sensitive” to economy. However, the company is rather insulated from this cyclicality of ad spending, since its service package is well known for its high-cost performance with visible and trackable success rates.

8. Near-term Selling Pressure

As noted in” useful” tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Vector, margin sell is larger than margin buy balance. Therefore, when the stock resumes an upward trend, we can assume that there may be increasing short-covering activities which further push the stock upward.

Margin trading unit (1,000):

| date | margin sell | margin buy | buy/sell ratio |

| 1/14/2022 | 1576.3 | 1040.9 | 0.66 |

| 1/7/2022 | 1420.8 | 956.1 | 0.67 |

| 12/30/2021 | 735.4 | 936.4 | 1.27 |

| 12/24/2021 | 209.9 | 894.8 | 4.26 |

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance